Citibank 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

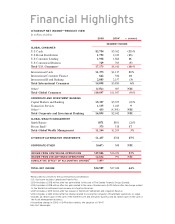

CITIGROUP NET INCOME——PRODUCT VIEW

In millions of dollars

2005 20041 % CHANGE

SEGMENT INCOME

GLOBAL CONSUMER

U.S. Cards $2,754 $3,562 (23)%

U.S. Retail Distribution 1,752 2,019 (13)

U.S. Consumer Lending 1,938 1,664 16

U.S. Commercial Business 729 765 (5)

Total U.S. Consumer2 $7,173 $8,010 (10)%

International Cards $1,373 $1,137 21%

International Consumer Finance 642 586 10

International Retail Banking 2,083 2,157 (3)

Total International Consumer $4,098 $3,880 6%

Other3 $(374) $97 NM

Total Global Consumer $10,897 $11,987 (9)%

CORPORATE AND INVESTMENT BANKING

Capital Markets and Banking $5,327 $5,395 (1)%

Transaction Services 1,135 1,045 9

Other4, 5 433 (4,398) NM

Total Corporate and Investment Banking $6,895 $2,042 NM

GLOBAL WEALTH MANAGEMENT

Smith Barney $871 $891 (2)%

Private Bank6 373 318 17

Total Global Wealth Management $1,244 $1,209 3%

CITIGROUP ALTERNATIVE INVESTMENTS $1,437 $768 87%

CORPORATE OTHER $(667) $48 NM

INCOME FROM CONTINUING OPERATIONS $19,806 $16,054 23%

INCOME FROM DISCONTINUED OPERATIONS7 $4,832 992 NM

CUMULATIVE EFFECT OF ACCOUNTING CHANGE8 $(49) - -

TOTAL NET INCOME $24,589 $17,046 44%

Financial Highlights

1

Reclassified to conform to the current period’s presentation.

2 U.S. disclosure includes Canada and Puerto Rico.

3

2004 includes a $378 million after-tax gain related to the sale of The Samba Financial Group (Samba).

4

2004 includes a $378 million after-tax gain related to the sale of Samba and a $4.95 billion after-tax charge related

to the WorldCom settlement and increase in Litigation Reserves.

5 2005 includes a $375 million after-tax release of WorldCom Settlement and Litigation Reserve.

6

2004 includes a $244 million after-tax charge related to closing the company’s Private Bank operations in Japan.

7

Includes $2.1 billion gain on the sale of the Travelers Life and Annuities business and $2.1 billion gain on the sale of

the Asset Management business.

8

Accounting change in 2005 of ($49) million reflects the adoption of FIN 47.

NM——Not Meaningful