Chesapeake Energy 1998 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1998 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

utility markets demonstrated that electrical generating capacity has not kept up

with rising demand for electricity. As a result, an estimated 45,000 megawatts

of new gas-fired electrical generating units are scheduled to come on line by

2001. This alone could increase natural gas demand by an additional 2-4% per

year, just as production declines should begin accelerating from the severe con-

traction in drilling activity.

In addition, increasingly stringent environmental standards will create an

even greater reliance on gas-fired generation. The Environmental Protection

Agency has recently issued a rule that requires 22 states east of the Mississippi

River to lower their emissions by 28% before the year 2007. This rule strongly

favors gas-fired generation over coal-fired facilities. Though nuclear power

plants still provide 20% of the nation's electricity, during the next 20 years up to

75% of these facilities will likely be decommissioned and replaced by natural gas-

fired power plants. Rising electricity usage, decreasing nuclear power capability

and the significant environmental benefits of natural gas should make natural

gas America's fuel of choice in the 21st century.

Favorable supply and demand trends

In the face of these impressive demand trends, the oil and gas industry will

have to generate significant supply increases. If present growth trends continue,

natural gas demand increases of 2-4% per year will require a supply increase

from approximately 22 tcf in 1998 to 30 tcf in 2010. To satisfy this demand,

the U.S. natural gas industry will be required to discover over 200 tcf of new

natural gas reserves in the next 10 years, a task we believe the industry can-

not accomplish without significantly higher natural gas prices. Our conclusion

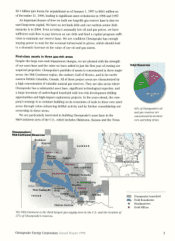

that gas demand will greatly outstrip supply in the next decade was the moti-

vating factor behind Chesapeake's natural gas-focused acquisitions in 1997

and 1998, and our willingness to increase Chesapeake's debt in funding the

acquisitions.

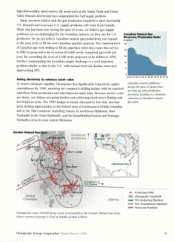

During the past two years, energy companies invested an estimated $50 bil-

lion in drilling new U.S. wells, increasing the active rig count by over 40% to more

than 1,000 rigs in February 1998. Despite these record expenditures, the nation's

gas production level increased by only 1% per year. Today's rig count of around

500, barely half of last year's, is the lowest level since industry record keeping

began in 1944. By way of comparison, an all-time high of 4,530 rigs were drilling

in December 1981, which represents an 88% reduction in drilling activity during

the past 18 years.

Several factors have contributed to the lack of production growth. In the Gulf

of Mexico, the most important gas supply basin in the U.S., a huge increase in

drilling activity in 1995-98 resulted in no net supply increase. Finding costs were

much higher than projected, and annual depletion rates approaching 30-40% in

the high-deliverability, short-reserve life, shallow-water region overwhelmed the

increased drilling activity, leaving the area with an average reserve life of less

than five years. Further deepening the expected supply declines in the years

ahead is the large reduction in rigs working the Gulf, from 140 in February 1998

to 100 today. The heavy concentration of drilling during the past few years in other

Electrical generation

will increase from fourth

on the gas consumption

list today to first by

2020 as 1,100 gas-tired

electrical generating

plants are built.

Energy In formation Agency

January 1999

Today's rig count is 50% less

than last year's and 88% below

1981's record levels.

Chesapeake Energy Corporation Annual Report 1998 7

10/97 6/98 1/99