Chesapeake Energy 1998 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1998 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

high-deliverability, short-reserve life areas such as the Austin Chalk and Cotton

Valley Pinnacle Reef trends has compounded the Gulf supply problem.

Many investors believe that the gas production required to meet increasing

U.S. demand and overcome U.S. supply problems will come from Canada.

While this has been true during the past 10 years, we believe gas supply

problems are as challenging for the Canadian industry as they are for U.S.

producers. We do not believe Canadian natural gas productivity can expand

in the near term to fill the new Canadian pipeline projects. The required level

of Canadian gas well drilling to fill the pipelines when they come into service

in 2001 is projected to be in excess of 8,000 newly completed gas wells per

year, far exceeding the level of 4,500 wells projected to be drilled in 1999.

Further compounding the Canadian supply challenge is a well depletion

problem similar to that in the U.S., with annual reservoir decline rates now

approaching 20%.

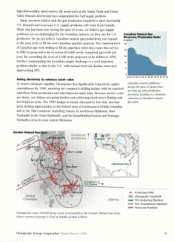

Acting decisively to enhance asset value

To ensure adequate liquidity, Chesapeake has significantly reduced its capital

expenditures for 1999, matching the company's drilling budget with its expected

cash flows from production and miscellaneous asset sales. Because service costs

are down, our dollars are going further and achieving much lower finding and

development costs. The 1999 budget is mostly allocated to low-risk, develop-

ment drilling opportunities in the Helmet area of northeastern British Colombia

and in the Mid-Continent, including Sahara in northwest Oklahoma, West

Panhandle in the Texas Panhandle, and the Knox/Bradley/Cement and Watonga-

Chickasha areas in west central Oklahoma.

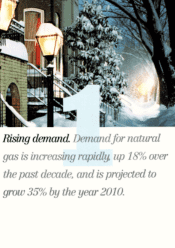

Greater Helmet Gas Area Northwest

IqWINT Territories

kS S I T L

British

Columbia

JULY LAKE

I

HELMET

to Eastern us.

Gas Markets -*

Alberta

Chesapeake owns 700,000 gross acres of leasehold in the Greater Helmet Gas Area,

where reserves average 6.0 bcf at depths of only 4,500 ft.

Canadian Natural Gas

Reserves/Production Ratio

in years

40

32

24

16

8

085 86 87 88 89 90 91 9293 9495 96 97 98

Canadian reserve additions

during the past 15 years have

not kept up with production

increases, leading to a dramatic

reduction in Canada's reserve

life index.

Producing Wells

T1 Chesapeake Leasehold

NCL Gathering Pipelines

NCL Transmission Pipelines

Westcoast Pipelines

Chesapeake Energy Corporation Annual Report 1998 9