Chesapeake Energy 1998 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1998 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

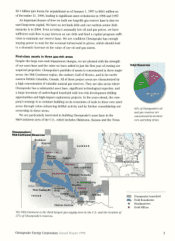

Panhandle. The Mid-Continent is the third largest gas supply area in the U.S.,

exceeded only by the offshore and onshore Gulf of Mexico regions. Characterized

by long reserve lives, attractive lifting costs, excellent gas markets and abun-

dant consolidation opportunities, the Mid-Continent is Chesapeake's operating

backyard and the location of 57% of its reserves. The wisdom of increasing our

assets in the Mid-Continent is particularly apparent during this time of histori-

cally low prices. Many of Chesapeake's Mid-Continent properties will continue

producing for decades, and we believe these long-lived assets will enable the

company to outlast what we anticipate will be a relatively brief period of low

natural gas prices. Afterwards, we expect to prosper as natural gas prices

increase substantially as a result of declining supply and rising demand.

Lessons from past cycles

Over the past 20 years, Chesapeake's management team has witnessed a

number of down cycles in the energy industry: 1982-83, 1985-86, 1991-92

and 1994-9 5 come to mind. Although the current cycle has been unusually

severe, history reinforces the wisdom of contrarians who understand that pow-

erful self-correcting market forces generate strong price recoveries following

cyclical downturns like the current one. While some investors may be reluctant

to invest in this sector during tough times, Chesapeake's management knows that

price collapses provide the foundation for improved valuations in the future.

Simply put, low prices cure low prices as consumers are motivated to consume

more and producers are compelled to produce less. Furthermore, his-tory tells

us that the depth of this cycle assures a coming recovery in natural gas prices

that is likely to be faster and more powerful than most observers realize.

Based upon an expected 50% reduction in drilling levels for new reserves

in 1999 and the depletion of existing wells accelerating to annual rates of

15-20%, we anticipate that U.S. gas production may fall 5-10% in the next

18-24 months. With overall demand projected to increase by as much as 10%

during the same period, Chesapeake believes a substantial increase in nat-

ural gas prices may be just ahead, possibly as soon as in the second half of

1999. With our 1.1 tcfe of natural gas reserves, low operating cost structure,

substantial inventory of low-risk drilling projects, operational expertise to

rejuvenate acquired properties and a high-potential 3-D seismic exploration

program, Chesapeake is poised to benefit fi'om the strong market forces

shaping the future of the natural gas industry.

The long-term case for natural gas

Every day more residential, commercial and industrial consumers select

natural gas as their fuel of choice. Natural gas is America's best energy value

at an average cost of 25% less than electricity and 15% less than fuel oil. It is

also the most environmentally sensitive fuel the same level of energy derived

from burning natural gas generates 50% less carbon emissions than coal and

30% less than fuel oil.

The electricity generation sector is a major component of the projected strong

demand growth for natural gas. This past summer's extremely volatile electric

60

48

24

12

Two Years of Declining

Natural Gas Prices

$3.00

36

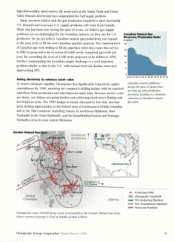

Anadarko

Deep

2.00

1.00

Chesapeake's Mid-Continent

reserves are projected to

continue producing for an

average of 40 years.

Hugoton

Northwest

Oklahoma

Southern

Oklahoma

Misc.

Mid-

Continent I

Chesapeake Energy Corporation Annual Report 1998 5

10/97 6/98 1/99

After peaking in the winter of

7996-97, natural gas prices

have fallen significantly

because of two record warm

winters in a row.

Texas

Panhandle

Chesapeake's Key Fields'

Reserve Lives

In years