Chesapeake Energy 1998 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 1998 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letter to Shareholders

During 1998, a very difficult and challenging year for the oil and gas industry,

Chesapeake completed the strategic repositioning effort it began in late 1997.

Our goal was to reduce the company's risk profile, generate more attractive

drilling results and build an inventory of long-lived natural gas reserves the

fuel of choice for the 21st century. Completely transformed, Chesapeake now

owns 1.1 trillion cubic feet equivalent (tcfe) of proved oil and gas reserves, one

of the 20 largest inventories of onshore U.S. natural gas, and is well positioned

to benefit when natural gas prices recover.

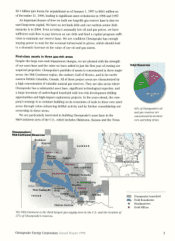

Building long-term natural gas reserves

Prior to our transformation, Chesapeake was known primarily as an innovative

exploration company that grew rapidly during 1994-96 through the application

of advanced-technology horizontal drilling on its large leasehold inventory in the

Texas Austin Chalk area. Despite high expectations in the industry and on Wall

Street for the vast potential of extending the Austin Chalk Trend into Louisiana,

falling oil prices and significant geological and engineering challenges generated

disappointing returns for all operators involved.

To recover from this major setback and to better position the company for the

coming growth in the natural gas industry, Chesapeake successfully transformed

itself during the second half of 1997 and the first half of 1998. Unfortunately,

during the process, we incurred substantial debt at the same time that oil and

natural gas prices began to fall precipitously. To date, these factors have resulted

in a market valuation that does not reflect the true value of Chesapeake's long-

lived natural gas assets.

Chesapeake is confident that natural gas is the long-term, environmentally sen-

sitive answer to the nation's energy needs. Based on this belief and on our exper-

tise hi increasing value from natural gas assets, Chesapeake completed eight major

property acquisitions in 1998. The 750 billion cubic feet of natural gas equivalent

(bcfe) of acquired properties significantly strengthened the company, preparing it

for a brighter future with higher natural gas prices. Acquired for a $700 million

combination of cash and Chesapeake common stock, these properties:

nearly tripled Chesapeake's oil and gas reserves to 1,091 bcfe;

doubled the company's reserves-to-production index from five years to 10 years;

increased the percentage of natural gas reserves from 70% to 87%;

raised the percentage of proved developed reserves by value from 66% to 78%;

increased 1998's oil and gas production by 62%.

We are confident that our acquisitions will add substantial value in the long-

term. However, full-cost accounting standards have resulted in a series of asset

writedowns reflecting exceptionally low oil and gas prices ($10.48 per barrel and

$1.68 per mcf) as of December 31, 1998. These prices are the lowest inflation-

adjusted prices in the past 50 years and yield unrealistic values for Chesapeake's

reserves. Factoring in the two-year decline in oil and gas prices, the present value

(discounted at 10%) of Chesapeake's reserves has decreased from approximately

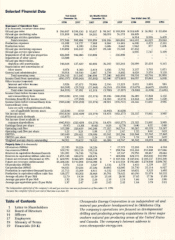

Reserve Growth

In bfr

1,200

960

720

480

240

SEC PV-1O Reserve

Value Sensitivity

$ in ,nillwns

93 94 95 96 97 98

Chesapeake's oil and gas

reserves increased by a

compounded annual rate

of 51% from 1993 to 1998.

Chesapeake Energy Corporation Annual Report 1998 1

96 97 98

Dramatically lower oil and

gas prices have caused the

discounted present value

of Chesapeake's reserve

base of 1.1 tcfe (pro forma

for acquisitions) to fall

by more than $1.4 billion

during the past two years.

$2,000

1,600

1,200

800

400