Chesapeake Energy 1998 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1998 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$2.1 billion (pro forma for acquisitions) as of January 1, 1997 to $661 million as

of December 31, 1998, leading to significant asset writedowns in 1998 and 1997.

An important feature of how we built our long-life gas reserve base is that we

used long-term capital. We have no net bank debt and our earliest senior debt

maturity is in 2004. Even at today's unusually low oil and gas prices, we have

sufficient cash flow to pay interest on our debt and fund a capital program suffi-

cient to maintain our reserve base. We are confident Chesapeake has enough

staying power to wait for the eventual turnaround in prices, which should lead

to a dramatic increase in the value of our oil and gas assets.

First-class assets in three gas-rich areas

Despite the large non-cash impairment charges, we are pleased with the strength

of our asset base and the value we have added in just the first year of owning our

acquired properties. Chesapeake's portfolio of assets is concentrated in three major

areas: the Mid-Continent region, the onshore Gulf of Mexico, and in far north-

eastern British Columbia, Canada. AJ1 of these project areas are characterized by

a high concentration of valuable natural gas reserves. They are also areas where

Chesapeake has a substantial asset base, significant technological expertise, and

a large inventory of undeveloped leasehold with low-risk development drilling

opportunities and high-impact exploratory projects. In the years ahead, the com-

pany's strategy is to continue building on its economies of scale in these core asset

areas through value-enhancing drillbit activity and by further consolidating our

ownership in these areas.

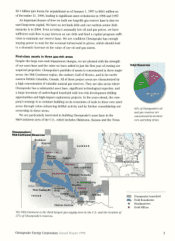

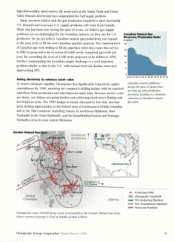

We are particularly interested in building Chesapeake's asset base in the

Mid-Continent area of the U.S., which includes Oklahoma, Kansas and the Texas

Chesapeake's

Mid-Continent Reserves

Bradshaw

Hugoton

Mocane-

Laverne

/,

Fritch /

West Panhandle

TEXAS

KANSAS

Sahara

OKLAHOMA

Watonga/Chickasha

* Okiar City

Bradley

Anadarko Lleds

Deep /_Golden

Cement /Trend

Knox

Sholem-Alechem

/

Caddo-Springer

Arkoma

The Mid-Continent is the third largest gas supply area in the U.S. and the location of

57% of Chesapeake's reserves.

Total Reserves

92% of Chesapeake's oil

and gas reserves are

concentrated in its three

core operating areas.

Chesapeake Leasehold

Field Boundaries

*Headquarters

Field Offices

Chesapeake Energy Corporation Annual Report 1998 3