Chesapeake Energy 1998 Annual Report Download

Download and view the complete annual report

Please find the complete 1998 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

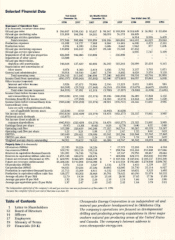

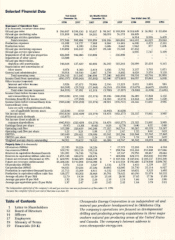

Table of contents

-

Page 1

-

Page 2

... 18 19

Letter to Shareholders Board of Directors

Officers Employees Glossary of Terms Financials (10-K)

Chesapeake Energy Corporation is an independent oil and natural gas producer headquartered in Oklahoma City. The company's operations are focused on developmental drilling and producing property...

-

Page 3

... is well positioned to benefit when natural gas prices recover.

Building long-term natural gas reserves Prior to our transformation, Chesapeake was known primarily as an innovative exploration company that grew rapidly during 1994-96 through the application of advanced-technology horizontal drilling...

-

Page 4

Rising demand Demand for natural

gas is inca easing rapidly, up 18% over

the past decade, and is projected to

grow 35% by the year 2010.

-

Page 5

...

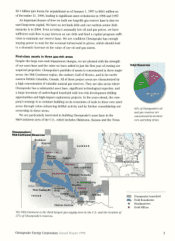

_Golden Trend

Arkoma

/ Caddo-Springer

Sholem-Alechem

*

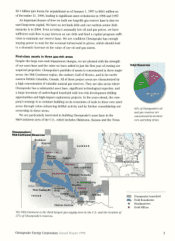

Chesapeake Leasehold Field Boundaries Headquarters

Field Offices

The Mid-Continent is the third largest gas supply area in the U.S. and the location of 57% of Chesapeake's reserves.

Chesapeake Energy Corporation Annual Report 1998

3

-

Page 6

Clean energy.

N ural gas is the

0

lt

coal and

producing

'han

than fuel oil.

-

Page 7

... the projected strong demand growth for natural gas. This past summer's extremely volatile electric

10/97

6/98

1/99

After peaking in the winter of 7996-97, natural gas prices have fallen significantly because of two record warm winters in a row.

Chesapeake Energy Corporation Annual Report 1998...

-

Page 8

Home grown.

A

atural gc is

onsum ed

n North America, keeping it free

m worldwide political and

citions.

-

Page 9

... factor behind Chesapeake's natural gas-focused acquisitions in 1997 and 1998, and our willingness to increase Chesapeake's debt in funding the acquisitions. During the past two years, energy companies invested an estimated $50 billion in drilling new U.S. wells, increasing the active rig count by...

-

Page 10

Chesapeake's strategic position.

are well positioned to capitalize on the strengthening natural gas market,

We

with significant reserves, land inventory

and drillbit expertise in three key

gas-rich areas in North America.

-

Page 11

...a well depletion 16 problem similar to that in the U.S., with annual reservoir decline rates now 8 approaching 20%.

0

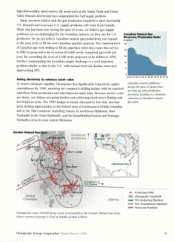

Acting decisively to enhance asset value To ensure adequate liquidity, Chesapeake has significantly reduced its capital expenditures for 1999, matching the company's drilling budget...

-

Page 12

A brighter future. The future is

brightj ur natural gas companies.

7 he Chesapeake team is committed

to surviving these challenging times

and prospering in the years ahead

-

Page 13

...

Peer Group

In spite of higher interest costs, Chesapeake's operating cost structure is nearly 15% below that of its peers because of our exceptionally low lease operating and G&A

expenses.

Aubrey K. McClendon

Tom L. Ward

March 15, 1999

Chesapeake Energy Corporation Annual Report 1998...

-

Page 14

...gas in affiliation with Tom L. Ward, the company's President and Chief Operating Officer. Mr. McClendon is a member of the Board of Visitors of the Fuqua School of Business at Duke University, an Executive Committee member of the Texas Independent Producers and Royalty Owners Association, a director...

-

Page 15

...was a managing director of Morgan Stanley & Co. from 1970 to 1989. He was Vice Chairman of the American Stock Exchange from 1982 to 1984. Mr. Whittemore is a director of Ecofin Limited, London; Partner Reinsurance Company, Bermuda; Maxcor Financial Group Inc.,

New York; SunLife of New York, New York...

-

Page 16

... oil and gas company and prior to that was Chief Financial Officer of a private exploration company in Oklahoma City from 1981 to 1985. Mr. Rowland is a Certified Public Accountant and graduated from Wichita State University in 1975.

Steven C. Dixon

Senior Vice PresidentLand and Legal

Senior Vice...

-

Page 17

... Vice President Human Resources since June 1998. She was the company's Human Resources Manager from 1996 to 1998. From 1994 to 1995, she served in various accounting positions with the company including Assistant Controller Operations. From 1989 to 1993, Ms. Burger was employed by Hadson Corporation...

-

Page 18

... Certified Public Accountant and graduated from the University of Texas in 1987.

Janice A. Dobbs has served as Corporate Secretary and Compliance Manager since 1993. From 1975 until her association with the company, Ms. Dobbs was the corporate/securities legal assistant with the law firm of Andrews...

-

Page 19

...Chesapeake...Cumings, Ken Davidson, Cheryl Davis..., Mark Lester, Carrie...Aubrey McClendon, Joe McClendon...Lisa Owens, Donald Pannell, Michael Park, Carol Passick, Amy Patel, Gary Payne, Armando Pena, Robert Perkins II, Linda Peterburs, Dale Petty, Barbie Phelps..., Rose Sales, Tony ... Ronnie Ward, Tom Ward, Julie...

-

Page 20

... previously found to be productive of oil or gas in another reservoir, or to extend a known reservoir.

all costs associated with property acquisition, exploration, and development activities for a company using the full-cost method of accounting. Additionally, any internal costs that can be directly...

-

Page 21

... City, Oklahoma (Address of principal executive offices)

73-1395733

(I.R.S. Employer Identification No.)

73118

(Zip Code)

(405) 848-8000 Registrant's telephone number, including area code Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Common Stock, par value...

-

Page 22

... the United States and Canada. Chesapeake began operations in 1989, completed an initial public offering in 1993, and trades on the New York Stock Exchange under the symbol CHK. The Company's principal offices are located at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118 (telephone 405/848...

-

Page 23

... table for 1998, the Company drilled 11(3.6 net) productive development wells and one (0.4 net) non-productive development wells in Canada. Also during 1998, the Company drilled one (0.3 net) productive exploratory wells and seven (2.1 net) non-productive exploratory wells in Canada. Well Data

At...

-

Page 24

...in natural gas salçs. During 1998, the following two customers individually accounted for 10% or more of the Company's total oil and gas sales:

Amount ($ in thousands) $ 30,564 $ 28,946 Percent of Oil and Gas Sales l2%

11%

Koch Oil Company Aquila Southwest Pipeline Corporation

Management believes...

-

Page 25

Chesapeake Energy Marketing, Inc. ("CEMI"), a wholly-owned subsidiary, provides oil and natural gas

marketing services, including commodity price structuring, contract administration and nomination services for the Company, its partners and other oil and natural gas producers in geographical areas ...

-

Page 26

... oil and gas

marketing sales in the consolidated statements of operations and are not considered by management to be material.

The Company also utilizes hedging strategies to manage fixed-interest rate exposure. Through the use of a swap arrangement, the Company believes it can benefit from stable...

-

Page 27

...core assets. From time to time, we have used short-term bank debt, generally as a working capital facility. Future cash flows are subject to a number of variables, such as the level of production from existing wells, prices of oil and gas, and our success in developing and producing new reserves and...

-

Page 28

... liens, paying dividends and making other restricted payments, merging or consolidating with any other entity, selling, assigning, transferring, leasing or otherwise disposing of all or substantially all Of our assets, and guaranteeing any indebtedness.

At December 31, 1998, the Company did not...

-

Page 29

... upon our Chief Executive Officer, Aubrey K. McClendon, and our Chief Operating Officer, Tom L. Ward. The unexpected loss of the services of either of these executive officers could have a detrimental effect on our operations. The Company maintains $20 million key man life insurance policies on the...

-

Page 30

...cost of planning, designing, drilling, operating and in some instances, abandoning wells. In most instances, the regulatory requirements relate to the handling and disposal of drilling and production waste products and waste created by water and air pollution control procedures. Although the Company...

-

Page 31

.... The Company provides safety training and personal protective equipment to its employees.

OPA and Clean Water Act. Federal regulations require certain owners or operators of facilities that store or otherwise handle oil, such as the Company, to prepare and implement spill prevention control plans...

-

Page 32

plans and facilities response plans relating to the possible discharge of oil into surface waters. The Oil Pollution Act of 1990 ("(WA") amends certain provisions of the federal Water Pollution Control Act of 1972, commonly referred to as the Clean Water Act ("CWA"), and other statutes as they ...

-

Page 33

... The Company considers its employee relations to be good.

Facilities

The Company owns 13 buildings totaling approximately 86,500 square feet and nine acres of land in an office complex in Oklahoma City that comprise its headquarters' offices. The Company also owns field offices in Lindsay,

Waynoka...

-

Page 34

..., exploration, and development activities for a company using the full-cost method of accounting. Additionally, any internal costs that can be directly identified with acquisition, exploration and development activities are included. Any costs related to production, general corporate overhead or...

-

Page 35

... Acreage. Lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and gas regardless of whether such acreage contains proved reserves.

Working Interest. The operating interest which gives the owner the right to drill...

-

Page 36

..., New Mexico. In this project, the Company is utilizing 3-D seismic technology to search for prospects that management believes have been overlooked in this portion of the Permian Basin because of inconclusive results provided by traditional 2-D seismic technology. During 1998, the Company drilled...

-

Page 37

...the WillistonBasin. The Company does not plan to drill any wells during 1999 in the Williston Basin unless oil prices increase significantly. Oil and Gas Reserves

The tables below set forth information as of December 31, 1998 with respect to the Company's estimated net proved reserves, the estimated...

-

Page 38

... Company and the following officers and directors: Aubrey K. McClendon, Tom L. Ward, Marcus C. Rowland. Shannon T. Self, Walter C. Wilson Henry J. Hood, Steven C. Dixon, J. Mark Lester and Ronald A. Lefaive. The complaint alleges violations of Sections 10(b) and 20(a) of the Securities Exchange Act...

-

Page 39

... issues remaining in the case involve the validity, potential inflingement and value, if any, of UPRCs patent.

UPRC's claims against the Company in UPRC v. Chesapeake Energy Corporation, et al. are based on services provided to the Company by a third party vendor controlled by former UPRC employees...

-

Page 40

... declare and pay dividends. Under these indentures, the Company may not pay any cash dividends on its common or preferred stock if (i) a default or an event of default has occurred and is continuing at the time of or immediately after giving effect to the dividend payment, (ii) the Company would not...

-

Page 41

... was accounted for using the purchase method. The table should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated

fmancial statements, including the notes thereto, appearing in Items 7 and 8 of this report.

21

-

Page 42

...Cash Flow Data: Cash provided by operating

activities before changes in working capital Cash provided by operating activities Cash used in investing activities Cash provided by (used in) financing activities Effect of exchange rate changes on cash Balance Sheet Data (at end of period): Total assets...

-

Page 43

... and joint ventures.

Further, the Company reduced its capital expenditure budget for

exploration and development to more closely match anticipated cash flow from operations.

As part of this revised strategy, the Company acquired various proved oil and gas reserves through merger or through...

-

Page 44

The Company's strategy for 1999 is to continue developing its natural gas assets by drilling, but at a

significantly reduced pace. The Company has reduced its capital expenditure budget (before any acquisitions) to approximately $90 million and has reduced the Gulf Coast drilling component ...

-

Page 45

... to develop proved

undeveloped reserves, are depleted and charged to operations using the unit-of-production method based on the ratio of current production to proved oil and gas reserves as estimated by the Company's independent engineering consultants and Company engineers. Costs directly...

-

Page 46

... expenses required by the Company's growth and industry wage inflation. The Company capitalized $5.3 million and $5 3 million of internal costs in the Current Year and Prior Year, respectively, directly related to the Company's oil and gas exploration and development efforts. The Company anticipates...

-

Page 47

... Period. Higher costs caused the Company's capital spending to exceed budgeted amounts during the Transition Period and also increased the estimated future capital expenditures to be incurred to develop the Company's proved undeveloped reserves. The Company's results from wells completed during the...

-

Page 48

...results primarily from increased personnel expenses required by the Company's growth and industry wage inflation. The Company capitalized $2.4 million of internal costs in the Transition Period directly related to the Company's oil and gas exploration and development efforts, compared to $11 million...

-

Page 49

... in fiscal 1997. The Company sold its partnership interest in Peak in June

1998.

Revenues from oil and gas service operations were $6.3 million in fiscal 1996. The related costs and expenses of these operations were $4.9 million for the year ended June 30, 1996. The gross profit margin was 22% in...

-

Page 50

...rigs, thus increasing the estimated future capital expenditures to be incurred to develop the Company's proved undeveloped reserves. The oil and gas price declines and the increased costs to drill and equip wells caused the Company to eliminate 35 gross proved undeveloped locations in the Knox Field...

-

Page 51

... tax benefit related to the exercise of employee stock options of approximately $4.8 million was allocated directly to additional paid-in capital in 1997, compared to $7 9 million in 1996.

Liquidity and Capital Resources

For the Years Ended December 31, 1998 and 1997

Cash Flows from Operating...

-

Page 52

... million in preferred stock. During the Prior Year, the Company issued $300

million of senior notes.

For the Six Months Ended December 31, 1997 and 1996

Cash Flows from Operating Activities. Cash provided by operating activities (inclusive of changes in components of working capital) increased to...

-

Page 53

... to make restricted payments (as defmed), including the payment of preferred stock dividends, unless certain tests are met. As of December 31, 1998, the Company was unable to meet the requirements to incur additional unsecured indebtedness, and consequently was not able to pay cash dividends on...

-

Page 54

... approach to mitigating risks associated with the Year 2000 readiness of material

business partners (vendors, suppliers, customers, etc.). The project will also identify contingency plans to cope with unexpected events resulting from Year 2000 issues.

Beginning in mid-1997, the Company began an...

-

Page 55

...business partners do not achieve Year 2000 compliance on a timely basis. The Company currently intends to complete its contingency planning by September 30, 1999, with testing and training to take place early in the fourth quarter. Recently Issued Accounting Standards

On June 15, 1998, the Financial...

-

Page 56

... sale commitments. Gains or losses on crude oil and natural gas hedging transactions are recognized as price adjustments in the months of related production.

As of December 31, 1998, the Company had the following natural gas swap arrangements designed to hedge a portion of the Company's domestic gas...

-

Page 57

... Gas Marketing Sales in the consolidated statements of operations and are not considered by management to be material.

Interest Rate Risk

The Company also utilizes hedging strategies to manage fixed-interest rate exposure. Through the use of a swap arrangement, the Company believes it can benefit...

-

Page 58

... Income (Loss) for the Year Ended December 31, 1998, for the Six Months Ended December 31, 1997 and for the Years Ended June 30, 1997 and 1996 Notes to Consolidated Financial Statements Financial Statement Schedules: Schedule II - Valuation and Qualifying Accounts

39 40

41

42

44 45

77

38

-

Page 59

... financial statements listed in the accompanying index present fairly, in all material respects, the fmancial position of Chesapeake Energy Corporation and its subsidiaries (the "Company") at December 31, 1998 and 1997, and at June 30, 1997, and the results of their operations and their cash flows...

-

Page 60

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS

ASSETS

December 31,

1998 1997

June30

1997

CURRENT ASSETS: Cash and cash equivalents Restricted cash Short-term investments Accounts receivable: Oil and gas sales Oil and gas marketing sales Joint interest and other, net of ...

-

Page 61

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS

Year Ended December 31,

1998

Six Months Ended December 31,

1997

Year Ended June 30,

1997

1996

($ in thousands, except per share data)

REVENUES: Oil and gas sales Oil and gas marketing sales Oil and gas service ...

-

Page 62

... Changes in assets and liabilities Cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Exploration and development of oil and gas properties Acquisitions of oil and gas companies and properties, net of cash acquired Investment in preferred stock of Gothic Energy Corporation...

-

Page 63

... ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS - (Continued)

Year Ended December 31,

1998

Six Months Ended December 31,

1997

Year Ended June 30.

1997

1996

(5 in thousands) SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

CASH PAYMENTS FOR: Interest, net of capitalized...

-

Page 64

... expenses and other Stock options issued in Hugoton purchase Tax benefit from exercise of stock options Change in par value Balance, end of period ACCUMULATED EARNINGS (DEFICIT): Balance, beginning of period Net income (loss) Dividends on common stock Dividends on preferred stock Balance, end of...

-

Page 65

... reservoirs. The

Company's properties are located in Oklahoma, Texas, Louisiana, Kansas, Montana, Colorado, North Dakota, New Mexico and British Columbia, Canada.

The Company changed its fiscal year end from June 30 to December 31 in 1997. The Company's results of operations and cash flows...

-

Page 66

... any costs related to production, general corporate overhead or similar activities (see Note 11). Capitalized costs are amortized on a composite unit-of-production method based on proved oil and gas reserves. As of December 31, 1998, approximately 76% of the Company's proved reserve value (based...

-

Page 67

... the sale of service company assets of $0.9 million was amortized to income over the estimated useful lives of the Peak assets. The Company sold its partnership interest in Peak in June 1998.

Income Taxes

The Company has adopted Statement of Financial Accounting Standards No. 109, Accounting for...

-

Page 68

... in oil and gas sales to the extent

related to the Company's oil and gas production, in oil and gas marketing sales to the extent related to the

Company's marketing activities, and in interest expense to the extent so related.

Debt Issue Costs

Included in other assets are costs associated with the...

-

Page 69

... change of control or

certain asset sales.

The senior note indentures also limit the Company's ability to make restricted payments (as defined), including the payment of preferred stock dividends, unless certain tests are met. As of December 31, 1998, the Company was unable to meet the requirements...

-

Page 70

...BALANCE SHEET As of December 31, 1998 (S in thousands)

ASSETS

Non-

Guarantor

Subsidiaries

CURRENT ASSETS: Cash and cash equivalents Short-term investments Accounts receivable Inventory Other Total Current Assets PROPERTY AND EQUIPMENT: Oil and gas properties Unevaluated leasehold Other property and...

-

Page 71

... As of December 31, 1997 ($ in thousands)

ASSETS

Non-

Guarantor

Subsidiaries

CURRENT ASSETS: Cashandcashequivalents Short-term investments Accounts receivable Inventory Other Total Current Assets PROPERTY AND EQUIPMENT: Oil and gas properties Unevaluated leasehold Other property and equipment Less...

-

Page 72

... As of June 30, 1.997 ($ in thousands)

ASSETS

Non-

Guarantor

Subsidiaries

CURRENT ASSETS: Cash and cash equivalents Short-term investments Accounts receivable Inventory Other Total Current Assets PROPERTY AND EQUIPMENT: Oil and gas properties Unevaluated leasehold Other property and equipment Less...

-

Page 73

... the Year Ended December 31, 1998:

REVENUES: Oil and gas sales Oil and gas marketing sales Total Revenues OPERATING COSTS: Production expenses and taxes Oil and gas marketing expenses Impairment of oil and gas properties Impairment of other assets Oil and gas depreciation, depletion and amortization...

-

Page 74

...in thousands)

Non-

Guarantor

Subsidiaries

Guarantor

Subsidiaries

Company

Eliminations

Consolidated

For the Year Ended June 30, 1997:

REVENUES: Oil and gas sales Oil and gas marketing sales Total Revenues OPERATING COSTS: Production expenses and taxes Oil and gas marketing expenses Impairment of...

-

Page 75

..., 1998:

CASH FLOWS FROM OPERATING ACTIVITIES CASH FLOWS FROM INVESTING ACTIVITIES: Oil and gas properties Proceeds from sale of assets Investment in preferred stock of Gothic Energy Corporation Repayment of long-term loan Proceeds from sale of PanEast Petroleum Corporation Other additions CASH FLOWS...

-

Page 76

...Non-Guarantor Subsidiaries

$ (11,008)

57

Company

$

Eliminations

$

Consolidated

$

For the Year Ended June 30, 1997: CASHFLOWSFROMOPERATINGACTIVITIES

CASH FLOWS FROM INVESTING ACTIVITIES: Oil and gas properties Proceeds from sale of assets Investment in service operations Long-term loans to third...

-

Page 77

... at this time.

Another purported class action alleging violations of the Securities Act of 1933 and the Oklahoma Securities Act is pending against the Company and others on behalf of investors who purchased common stock of Bayard Drilling Technologies, Inc. ("Bayard") in its initial public offering...

-

Page 78

... termination of employment without cause. These agreements expire at various times from June 30, 2000 through June 30, 2003.

Due to the nature of the oil and gas business, the Company and its subsidiaries are exposed to possible environmental risks. The Company has implemented various policies and...

-

Page 79

..., related to the impairment of oil and gas properties. The writedowns and significant tax net operating loss carryforwards (caused primarily by expensing intangible drilling costs for tax purposes) resulted in a net deferred tax asset at December 31, 1998 and 1997 and June 30, 1997. Management...

-

Page 80

...,000, respectively, for legal services provided by a law firm of which a director is a member.

Employee Benefit Plans

The Company maintains the Chesapeake Energy Corporation Savings and Incentive Stock Bonus Plan, a 40 1(k) profit sharing plan. Eligible employees may make voluntary contributions to...

-

Page 81

...Gas, Inc. ("DLB") for $17.5 million in cash, 5 million shares of the Company's common stock, and the assumption of $90 million in outstanding debt and working capital obligations. On April 22, 1998, the Company issued $230 million (4.6 million shares) of its 7% Cumulative Convertible

Preferred Stock...

-

Page 82

...Pro forma information regarding net income and earnings per share is required by SFAS No. 123 and has been determined as if the Company had accounted for its employee stock options under the fair value method of the statement. The fair value for these options was estimated at the date of grant using...

-

Page 83

...375

3,535,126

The exercise of certain stock options results in state and federal income tax benefits to the Company related to the difference between the market price of the common stock at the date of disposition (or sale) and the option price.

During 1998, the six months ended December 31, 1997...

-

Page 84

... sale commitments. Gains or losses on crude oil and natural gas hedging transactions are recognized as price adjustments in the months of related production.

As of December 31, 1998, the Company had the following natural gas swap arrangements designed to hedge a portion of the Company's domestic gas...

-

Page 85

... oil and gas

marketing sales in the consolidated statements of operations and are not considered by management to be material.

The Company also utilizes hedging strategies to manage fixed-interest rate exposure. Through the use of a swap arrangement, the Company believes it can benefit from stable...

-

Page 86

11. Disclosures About Oil And Gas Producing Activities

Net Capitalized Costs

Evaluated and unevaluated capitalized costs related to the Company's oil and gas producing activities are

summarized as follows:

December 31, 1998

U.S. Oil and gas properties: Proved Unproved Total Less accumulated ...

-

Page 87

Year Ended December 31, 1998

U.S.

Canada (S in thousands)

$

Combined

Development costs Exploration costs Acquisition costs: Unproved properties Proved properties Sales of oil and gas properties Capitalized internal costs Proceeds from sale of leasehold, equipment and other

Total

$

145,953 63,...

-

Page 88

... to be incurred in developing and producing the proved reserves, less any related income tax effects. During 1998, capitalized costs of oil and gas properties exceeded the estimated present value of future net revenues from the Company's proved reserves, net of related income tax considerations...

-

Page 89

.... Proved developed oil and gas reserves are

those expected to be recovered through existing wells with existing equipment and operating methods. As of

December 31, 1997, all of the Company's oil and gas reserves were located in the United States.

Presented below is a summary of changes in...

-

Page 90

...77,764

144,721

During 1998, the Company acquired approximately 750 Bcfe of proved reserves through merger or through purchases of oil and gas properties. The total consideration given for the acquisitions was 30 8 million shares of Company common stock, $280 million of cash, the assumption of $205...

-

Page 91

... reserves. Standardized Measure of Discounted Future Net Cash Flows (unaudited)

Statement of Financial Accounting Standards No. 69 ("SFAS 69") prescribes guidelines for computing a standardized measure of future net cash flows and changes therein relating to estimated proved reserves. The

Company...

-

Page 92

December31, 1998

U.S.

Canada (S in thousands)

474,143 (52,493) (29,634) (143,747) 248,269 (332,281) 115,988 $

$

$

Combined

Future cash inflows (a) Future production costs Future development costs Future income tax provision Net future cash flows Less effect of a 10% discount factor Standardized ...

-

Page 93

... net cash flows are as follows:

December 31, 1998

U.S.

Canada (5 in thousands)

$

Combined

Standardized measure, beginning of period Sales of oil and gas produced, net of production costs Net changes in prices and production costs Extensions and discoveries, net of production and development costs...

-

Page 94

...$

Combined

Standardized measure, beginning of period Sales of oil and gas produced, net of production costs Net changes in prices and production costs Extensions and discoveries, net of production and development costs Changes in future development costs Development costs incuned during the period...

-

Page 95

...Company's investment in preferred stock of Gothic Energy Corporation, and the remainder was related to certain of the Company's gas processing and transportation assets located in Louisiana.

14. Acquisitions

During 1998, the Company acquired approximately 750 Bcfe of proved reserves through merger...

-

Page 96

... related costs.

In March 1998, the Company acquired Hugoton Energy Corporation ("Hugoton") pursuant to a merger by issuing 25 8 million shares of the Company's common stock in exchange for 100% of Hugoton's common stock. The acquisition of Hugoton was accounted for using the purchase method...

-

Page 97

Schedule II

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS ($ in thousands)

Additions

Description

December 31, 1998: Allowance for doubtful accounts Valuation allowance for deferred tax assets December 31, 1997: Allowance for doubtful accounts Valuation allowance ...

-

Page 98

...ITEM 10. Directors and Executive Officers of the Registrant

The information called for by this Item 10 is incorporated herein by reference to the defmitive Proxy Statement to be filed by the Company pursuant to Regulation 1 4A of the General Rules and Regulations under the Securities Exchange Act of...

-

Page 99

... Gas Development Corporation and Chesapeake Exploration Limited

Partnership, as Subsidiary Guarantors, and United States Trust Company of New York, As Trustee, with respect to 8.5% Senior Notes due 2012. Incorporated herein by reference to Exhibit 4.1.3 to Registrant registration statement...

-

Page 100

... Chesapeake Energy Corporation 1996 Stock Option Plan. Incorporated herein by reference to Exhibit 10.1.4.1 to Registrant's quarterly report on Form 10-Q for the

quarter ended December 31, 1996.

10.2.lt

Amended and Restated Employment Agreement dated as of July 1, 1998 between Aubrey K. McClendon...

-

Page 101

...Restated Employment Agreement dated as of July 1, 1998 between Tom L. Ward and Chesapeake Energy Corporation. Incorporated herein by reference to Exhibit 10.2.2 to Registrant's quarterly report on Form I 0-Q for the quarter ended September 30, 1998.

Amended and Restated Employment Agreement dated as...

-

Page 102

... 18, 1998 reporting 1998 third quarter results.

December 8, 1998 announcing completion of a significant Tuscaloosa discovery. December 17, 1998 announcing capital budget and suspension of dividend of its preferred stock.

December 22, 1998 responding to Union Pacific Resources Corporation's press...

-

Page 103

... thereunto duly authorized.

CHESAPEAKE ENERGY CORPORATION

By Is! AUBREY K. McCLENDON

Aubrey K. McClendon Chairman of the Board.and Chief Executive Officer

Date: March 30, 1999 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following...

-

Page 104

... States Trust Company

of New York

114 West 47th Street

New York, New York 10036

Internet Address

Company financial information, public disclosures and other information are available at Chesapeake's website www.chesapeake-energy.com or by contacting Thomas S. Price, Jr., at the corporate office...

-

Page 105

CHESAPEAKE ENERGY CORPORATION

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

www.chesapeake-energy.com