Cemex 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1999 ANNUAL REPORT

Table of contents

-

Page 1

1999 ANNUAL REPORT -

Page 2

...'s top executives. 72 Directory - Lists CEMEX's global offices. 73 Investor information - Provides helpful investor and media contacts. CEMEX today Founded in 1906, CEMEX is one of the three largest cement companies in the world, with approximately 65 million metric tons of production capacity... -

Page 3

...-digit, ten-year compound annual operating cash flow growth rate. Brand matters, and CEMEX cement is the building material of choice in the primary markets that it serves. CEMEX is changing how the global cement game is played, offering a total solution to its customers' needs. CEMEX is capitalizing... -

Page 4

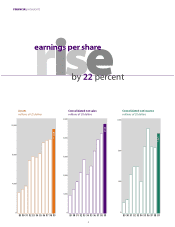

FINANCIAL HIGHLIGHTS rise earnings per share Assets millions of US dollars 5,000 12,000 by 22 percent Consolidated net sales millions of US dollars 1,200 Consolidated net income millions of US dollars 11,864 4,828 4,000 800 8,000 3,000 2,000 400 4,000 1,000 0 0 0 89 90 91 92 93 94 95 ... -

Page 5

...321 2 Consolidated Stockholders' Equity 6,435 5,138 25 Data in millions of US dollars, except per-share information *Convenience translation from constant Mexican pesos to US dollars at the year-end exchange rate. The exchange rate of the Mexican peso to the US dollar at December 31, 1999 and... -

Page 6

... volatility in many of the regions in which we do business. Our cash flow is more diversified, and we are financially stronger, than ever. In September, CEMEX enhanced its liquidity by listing its stock on the New York Stock Exchange (NYSE). That listing was a corporate milestone, the culmination of... -

Page 7

... the CEMEX brands with strength, durability, and tradition - the very essence of a good cement product. We are also constantly developing new services to improve the speed and efficiency with which all of our customers can build. We make our customers' concerns central to our business in order to... -

Page 8

... largest distributors and major contractors. CEMEX is also seeking innovative ways to provide more value for customers and shareholders and to improve the communities in which it operates. The company is currently exploring financing options for the poor in Latin America so that they can build homes... -

Page 9

...its products are commodities. Although this perception has affected CEMEX's stock performance, the company's operational and financial successes are reshaping this view. I am committed to bringing the company's true value to the attention of the market. I am also committed to sharing CEMEX's success... -

Page 10

Joseph Stern, CEMEX shareholder from Aptos, California. -

Page 11

1. WHY C E M E N T why? c e m e n t 3 -

Page 12

.... These innovative solutions include high-strength cement that can effectively compete with steel at significantly lower cost. Durable cement, which can last up to 100 years, gives customers the option of building in difficult regions. Fluid fill, another of the company's specialty products, greatly... -

Page 13

... highways. branded cement is the Cement is a consumer product and the building material of choice in most of the markets that CEMEX serves. By year-end 1999, CEMEX sold customers more than 500 million bags of cement. In three of the company's newest markets, the Philippines, Indonesia, and Egypt... -

Page 14

Alejandra Saiz, CEMEX Spain. -

Page 15

why? WHY 2. i s d i f f e r e n t 3 CEMEX IS DIFFERENT C E M E X -

Page 16

..., contractors can track the location of their readymix concrete shipments. changi because CEMEX is how the game CEMEX cares CEMEX makes life easier for its customers. After the Puebla, Mexico, earthquake destroyed thousands of homes, the company offered a solution to facilitate the reconstruction... -

Page 17

... post-merger integration (PMI) teams. The PMI teams constantly improve and disseminate CEMEX's knowledge capital throughout the company. CEMEX's ing is played Concrete B-to-B e-commerce solutions Time is of the essence in the cement business. Accordingly, CEMEX launched an Internet-based program... -

Page 18

Joe Andres, from Caterpillar, a CEMEX equipment supplier. -

Page 19

why? c e m e n t ' s f u t u r e i s C E M E X WHY 3. 3 CEMENT 'S FUTURE IS CEMEX -

Page 20

... return on equity. For example, CEMEX has achieved a significant presence in Costa Rica, Chile, and the Philippines. CEMEX now brings its expertise to Egypt, where the company acquired a controlling stake in Assiut Cement Co., that country's largest cement producer. CEMEX's global trading operations... -

Page 21

... Asian Infrastructure Fund II L.P. and GIC Special Investments Pte. Ltd., the private equity arm of the Government of Singapore Investment Corporation. Asia Europe Latin America U.S.& Canada Africa & Middle East 61 19 8 8 4 World cement consumption by region percentage CEMEX's business portfolio... -

Page 22

...record year for CEMEX Mexico. The company experienced continuing high demand from the self-construction sector, which comprises 40% of the domestic market. Human Resource Development - CEMEX Mexico's record performance is testament to its talented people and ongoing employee development programs. It... -

Page 23

...-name product in bags through exclusive and nonexclusive distributors. In many of these countries, cement is the most commonly used building material, and brand positioning plays a major role in market share. CEMEX holds a leading position in Mexico, Spain, Venezuela, Dominican Republic, Costa Rica... -

Page 24

Value Opportunities Research and Development - CEMEX Mexico's state-of-the-art laboratory continues to exceed its goal of introducing at least one new product every year. Since its 1997 opening, it has developed five new ready-mix products, accounting for over 20% of 1999 concrete sales. The ... -

Page 25

... largest cement producer. Its 850,000-metric-ton cement plant is located near the Nicaraguan border and exports about 100,000 metric tons of cement annually to that market. CEMEX also acquired two terminals in Haiti, which supply almost 70% of the local market. Regional Integration - Using Venezuela... -

Page 26

... to the appropriate CEMEX personnel. It also offers clients a growing array of new products and services, such as five-kilogram bags of white cement, toll-free telephone service, and points programs to reward customer loyalty. 21 18 15 Shared Practices - CEMEX's regional commercial strategy... -

Page 27

... from the company's operations in Costa Rica, Indonesia, Mexico, the Philippines, Spain, and Venezuela. This figure includes 493,000 metric tons of white cement exported from Mexico and Spain. Floating Silo - CEMEX's floating silo, Corregidora, began operating in the port of Adabya, Egypt, in the... -

Page 28

...45 376 0.35 0.06 1,077 1.75 0.31 Number of CPO Shares Outstanding Earnings per ADS (NYSE: CX) Dividends per ADS (4)(5)(8)(9) Balance Sheet Information Cash and Temporary Investments Net Working Capital Total Assets Short-term Debt Long-term Debt Total Liabilities Minority Interest (3) (10) 186 226... -

Page 29

... equity interest participation of the shareholders in the Company's common stock did not change as a result of the exchange offer and the stock split mentioned above. The earnings per CPO and the number of CPOs outstanding disclosed in these notes to the financial statements for the years... -

Page 30

... • Core cement, ready-mix concrete, and aggregates base • Low operating costs • Use of state-of-the-art management information systems and production technology • Versatile and resourceful financial management and capital structure • Developing-market experience and focus CEMEX's business... -

Page 31

...• Leverage its core cement and ready-mix concrete franchise • Concentrate on developing markets • Maintain high growth by applying free cash flow toward selective investments that further its geographic diversification the result Value of US$1,000 invested in CEMEX shares* US$97,414 simple... -

Page 32

... ready-mix play in the markets it serves. Distribution of EBITDA percentage Branded cement sales account for a high percentage of CEMEX's cash flow. 1999 CONSOLIDATED RESULTS Nineteen ninety-nine was a strong year for CEMEX in terms of operating performance, financial flexibility, and investments... -

Page 33

...million in net debt. The company obtained more favorable terms and conditions on its debt, due to its focus on improving its capital structure and financial condition. Effective tax rate was 9.6% for 1999, comprising 64% income tax and 36% PTU (employees' statutory profit sharing). Minority interest... -

Page 34

review global Sales 1999 1998 % Change 1999 EBITDA 1998 % Change 1999 Assets 1998 % Change North America: Mexico U.S. South America & Caribbean: Venezuela and Dominican Republic Colombia Central America and the Caribbean Europe and Asia: Spain Philippines Others/eliminations* Consolidated 764 121... -

Page 35

... America South America & Caribbean Europe & Asia Distribution of sales by region percentage Distribution of EBITDA by region percentage Distribution of assets by region percentage Mexico's GDP grew 3.7% in 1999 due to increased exports, foreign direct investment, and domestic consumption. CEMEX... -

Page 36

strength Country Company Investment (millions of US dollars) continued in financial position % acquired Installed cement capacity (million metric tons) Date of acquisition Indonesia Philippines Chile Costa Rica Egypt *Economic interest PT Semen Gresik APO Cement Cementos Bio-Bio Cementos del ... -

Page 37

... were used to reduce debt. 92 93 94 95 96 97 98 At the annual shareholders meeting on April 29, 1999, stockholders approved the dividend program for the year. Under this dividend program, CEMEX shareholders elected to receive a cash dividend of $1.30 pesos per share or its equivalent in CPOs. Of... -

Page 38

..., 10-year Euro Medium-term Note with a put option on year 5 MANAGEMENT AND SHAREHOLDER INTERESTS ALIGNED Variable Compensation Program. Fifteen hundred executives participate in this initiative, which ties annual bonuses to shareholder value initiatives. A Total Business Return approach is used to... -

Page 39

... 46 47 48 50 Auditors' report Management responsibility for internal control Consolidated balance sheets Consolidated statements of income Consolidated statements of changes in financial position Balance sheets (parent company only) Statements of income (parent company only) Statements of changes in... -

Page 40

... have audited the consolidated and parent company-only balance sheets of Cemex, S.A. de C.V. and Cemex, S.A. de C.V. and Subsidiaries as of December 31, 1999 and 1998, and the related consolidated and parent company-only statements of income, changes in stockholders' equity and changes in financial... -

Page 41

... test of accounting information records as they considered necessary in order to reach their opinion. Their report is presented separately. KPMG Cárdenas Dosal, S.C. Rafael Gómez Eng Lorenzo H. Zambrano Chairman of the Board and Chief Executive Officer Monterrey, N.L. Mexico January 17, 2000... -

Page 42

CONSOLIDATED BALANCE SHEETS CEMEX, S.A. DE C.V. AND SUBSIDIARIES (THOUSANDS OF CONSTANT MEXICAN PESOS AS OF DECEMBER 31, 1999) DECEMBER 31, ASSETS CURRENT ASSETS Cash and temporary investments Trade accounts receivable, less allowance for doubtful accounts $511,061 in 1999 and $606,570 in 1998 ... -

Page 43

...term debt Total long-term debt OTHER NONCURRENT LIABILITIES Pension and seniority premium (note 13) Deferred income taxes (note 16) Other noncurrent liabilities Total other noncurrent liabilities Total liabilities STOCKHOLDERS' EQUITY (note 14) Majority interest: Common stock-historical cost...500,100 ... -

Page 44

... financing income (cost): Financial expenses Financial income Foreign exchange result, net Monetary position result Net comprehensive financing income (cost) Other expense, net Income before income taxes, employees' statutory profit sharing and equity in income of affiliates Income tax and business... -

Page 45

... foreign exchange effect (note 3E) Investment by subsidiaries Dividends paid Issuance of common stock from reinvestment of dividends Issuance of preferred stock by subsidiaries Other financing activities, net Acquisition of shares under repurchase program Issuance of common stock Resources used... -

Page 46

... RECEIVABLES (Note 7) Investments in subsidiaries and affiliated companies Other investments Long-term intercompany receivables (note 12) Total investments and noncurrent receivables PROPERTY AND BUILDINGS Land Buildings Accumulated depreciation Total property and buildings 1999 $ 54,859 20... -

Page 47

... current liabilities LONG-TERM DEBT (note 11) Bank loans Notes payable Current maturities of long-term debt Total long-term debt Other long-term liabilities Total liabilities STOCKHOLDERS' EQUITY (note 14) Common stock-historical cost basis Common stock-accumulated inflation adjustments Additional... -

Page 48

... EARNINGS PER SHARE) YEARS ENDED ON DECEMBER 31, 1999 Equity in income of subsidiaries and affiliates Rental income License fees Total revenues (note 12) Administrative expenses Operating income Comprehensive financing income (cost): Financial expenses Financial income Foreign exchange result, net... -

Page 49

... Financing activities Proceeds from bank loans (repayments), net Notes payable Issuance of common stock Acquisition of shares under repurchase program Dividends paid Issuance of common stock from reinvestment of dividends Others Resources used in financing activities Investing activities Long-term... -

Page 50

... 31, 1999) Common stock Series A Series B Balances at December 31, 1996 Acquisition of shares under repurchase program Appropriation of net income from prior year Issuance of common stock (note 14B) Result from holding nonmonetary assets Updating of investments and other transactions relating to... -

Page 51

Additional paid-in capital Deficit in equity restatement Retained earnings Net income Majority interest Minority interest Total stockholders' equity 15,363,226 - - 18,000 - - - - 15,381,226 1,347,046 - 9,706 - - - - 16,737,978 1,677,974 - 88,056 231,827 - - - - 18,735,835 (29,912,... -

Page 52

... 15, 1999, the Company successfully completed its registration before the United States Securities and Exchange Commission ("SEC") and the listing of the new American Depositary Share ("ADS") in the New York Stock Exchange ("NYSE"), as well as the exchange process of the new CPO mentioned in... -

Page 53

... improvement program, the Company integrated within the structure of one entity the cement and concrete operations in Mexico in order to eliminate redundant processes and take advantage of synergies. This administrative process included mergers, as well as sales-purchases of companies within... -

Page 54

... a sale and purchase of shares within the Group, ETM became a direct subsidiary of Cemex Mexico. Through these mergers and the sale of ETM (see note 23), starting the year 2000, the cement and concrete operations of the Company in Mexico are integrated in Cemex Mexico and subsidiaries. E) FOREIGN... -

Page 55

... and future contracts in order to reduce its exposure to market risks from changes in interest rates, foreign exchange rates, the price of the Company's shares and the price of energy. Some financial instruments have been designated as hedges of the Company's costs, debt or equity and their economic... -

Page 56

... assets for lines of business other than the Company's, which are mainly originated from (i) non-cement related assets acquired in the acquisition of our international subsidiaries, and (ii) assets held for sale including land and buildings received from customers as payment of trade receivables. As... -

Page 57

... benefits of APO Cement Corporation ("APO"), a Philippine cement producer, for approximately US dollars $400 million. As of December 31, 1999, the consolidated financial statements of the Company include the balance sheet and results of APO for the year ended December 31, 1999. Through transactions... -

Page 58

... income statement of approximately $325.5 million. The sale included the ready-mix concrete, mortar and aggregates operations related to that plant. 9.- DEFERRED CHARGES Deferred charges are summarized as follows: 1999 CONSOLIDATED PARENT CONSOLIDATED 1998 PARENT Excess of cost over book value of... -

Page 59

...The consolidated long-term debt is summarized as follows: 1999 RATE 1998 RATE A) Bank Loans 1. Syndicated loans denominated in foreign currency, due from 2000 to 2006 $ 13,453,507 2. Bank loans denominated in foreign currency, due from 2000 to 2007 4,786,905 3. Revolving line of credit in foreign... -

Page 60

... of its strategy to manage the overall cost of borrowing. The results of these instruments are recognized as part of the financial expense. As of December 31, 1999, the Company's maturity dates, interest rates being hedged, current interest rates and estimated market value related to debt hedge with... -

Page 61

... balance sheets there are current liabilities amounting to US dollars 226 and 168 million, respectively, classified as long-term debt due to the ability and intention of the Company to refinance such indebtedness with the available amounts of the long-term lines of credit. As of December 31, 1999... -

Page 62

... Acquisitions Foreign exchange rate changes and inflation adjustments Employer contribution Benefits paid from the funds Fair value of plan assets at end of year Amounts recognized in the statements of financial position consist of: Funded status Unrecognized prior service cost Unrecognized... -

Page 63

...common stock. Through this program, the Company grants to eligible executives, designated by a technical committee, stock option "rights" to subscribe up to 72,100,000 new CPO's. As of December 31, 1999 and 1998 the option balances are as follows: 1999 NUMBER OF CPO'S EXCERCISE PRICE * NUMBER OF CPO... -

Page 64

... from changes in interest rates (see note 11), foreign exchange rates and the price of its common shares. These instruments have been negotiated with major domestic and international institutions and corporations, which have a solid financial capacity. Therefore, the Company considers that the risk... -

Page 65

... of its ADS's. The Company may exercise these call options until October 15, 2000, at a weighted average strike price of US dollars 41.89 per ADS. Regarding the public offer for warrants' subscription made by the Company during December 1999, and the related sale of CPO's and shares of a subsidiary... -

Page 66

... Additional deductions and tax credits for income tax purposes Expenses and other non-deductible items Non-taxable sale of marketable securities and fixed assets Difference between book and tax inflation Business assets tax Depreciation Inventories Others Effective consolidated tax rate 35.0 (27... -

Page 67

...and marketing of cement and concrete. The following table presents information about the Company by geographic area for 1999, 1998 and 1997: NET SALES OPERATING INCOME 1999 1998 1997 1999 1998 1997 Mexico $ Spain Venezuela United States Colombia Caribbean and Central-America Philippines Egypt... -

Page 68

...224,316 537,233 171,927 - - 308,598 4,251,988 TOTAL ASSETS INVESTMENT IN FIXED ASSETS * 1999 1998 1999 1998 Mexico Spain Venezuela United States Colombia Caribbean and Central-America Philippines Others Asian Egypt Others Eliminations Consolidated $ 46,721,332 20,165,143 10,615,906 6,676,227... -

Page 69

... average number of shares for 1999, 1998 and 1997 above is attributable to the additional shares issued under the Company's executive stock option plan (see note 14B). 21.- CONTINGENCIES AND COMMITMENTS A) GUARANTEES At December 31, 1999, Cemex, S.A. de C.V. has signed as guarantor for loans made... -

Page 70

...the electrical energy costs, and the supply will be enough to cover approximately 60% of the electrical energy usage of 12 cement plants in Mexico. For effect of these agreements, the Company is not required to make capital investment in the project. 22.- YEAR 2000 PROGRAM The CEMEX 2000 program was... -

Page 71

... and water, produces concrete or mortar. Today, our research and development focuses on blended cements. These special cements not only meet our customers' more stringent demands, but they also reduce our energy consumption. Installed capacity is the theoretical annual production capacity of a plant... -

Page 72

... OF DIRECTORS experienced an management team CHAIRMAN HONORARY CHAIRMAN EXAMINER ALTERNATE EXAMINER Lorenzo H. Zambrano Marcelo Zambrano Hellion Luis Santos de la Garza Fernando Ruiz Arredondo DIRECTORS Juan F. Muñoz Terrazas (deceased) Eduardo Brittingham Lorenzo Milmo Armando J. GarcÃa Rodolfo... -

Page 73

... is directly responsible for supervising CEMEX's interests and operations in Spain, the Philippines, Indonesia, and Egypt. Armando J. GarcÃa, 47 Executive Vice President of Development Mr. GarcÃa, who originally joined CEMEX in 1975 and rejoined the company in 1985, is a graduate of ITESM and has... -

Page 74

... de Desamparados San José, Costa Rica Phone: (506) 276-6001 Egypt P.O. Box: 82 New Maadi Cairo, Egypt Phone: (202) 754-5461 Houston One Riverway, Suite 2200 Houston, Texas 77056 U.S.A. Phone: (713) 881-1000 Fax: (713) 881-1012 Indonesia Jakarta Stock Exchange Building Tower II, 24th Floor Sudirman... -

Page 75

... AND MEDIA INFORMATION Exchange listings: Media relations contact: Bolsa Mexicana de Valores (BMV), Mexico New York Stock Exchange (NYSE), U.S. Share series: [email protected] Phone: (528) 152-2739 Fax: (528) 152-2750 Investor relations contact: CPO shares (representing two A shares and one...