Carphone Warehouse 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Statement

It has been a year of strong financial and operational

performance for the Group. The mobile phone

market has continued to grow steadily but our own

rate of growth has far exceeded it as we continue

to invest in building scale and taking market share.

On the fixed line side, we have supplemented our

strong organic growth with the acquisition of two

major competitors. The new financial year also

promises to be an exciting one, with the launch of

our free broadband proposition in April stimulating

unprecedented consumer interest.

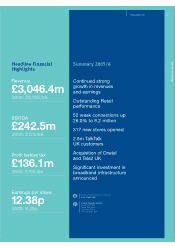

Group revenue for the period was £3,046.4m, compared

to £2,355.1m for the prior year, representing growth

of 29.4%. Headline pre-tax profit was £136.1m, an

increase of 35.5% on the year to March 2005. Earnings

per share on the same basis grew by 33.8% to 12.38p.

Statutory profit before tax, after reorganisation costs

of £35.2m and acquisition intangibles amortisation

of £19.8m, decreased by 11.9% from £91.9m to

£81.0m, while statutory earnings per share decreased

by 5.3% from 8.44p to 7.99p. Cash generated from

operations increased by 16.5% from £168.6m to

£196.4m. The Board is proposing a final dividend of

1.75p, taking the total for the year to 2.50p, up 38.9%

on last year’s pay-out.

I believe there are two fundamental factors that make

Carphone Warehouse different from most other

companies: its approach to business, and the quality

of its people. It is a privilege to be involved with

a company that makes bold business decisions,

and will not compromise its ability to pursue long-term

strategic goals because of the risk to short-term

earnings targets. The launch of TalkTalk three years

ago showed the conviction and determination of the

management team to seize the opportunity with both

hands despite the short-term cost, and that approach

has been vindicated. The same is true today with the

planned investment in TalkTalk broadband and our

MVNO operations. It is worth noting that our share

register has remained remarkably stable over the last

three years, underlining the support for this approach

from our major external shareholders.

However, at the same time as pursuing new and

exciting opportunities, we continue to invest in our

core Distribution business. After opening over 550

stores over the last two years, we plan to open a

further 250 stores in the forthcoming year, to take our

total portfolio over 2,000 stores. New space continues

www.cpwplc.com 3

Highlights and Strategy

A company that will not

compromise its pursuit of

long term strategic goals

317

NEW STORES OPENED

23.6%

52 WEEK GROWTH IN

SUBSCRIPTION CONNECTIONS

33.8%

GROWTH IN HEADLINE

EARNINGS PER SHARE

John Gildersleeve, Chairman

to generate a very attractive return for us, and we see

plenty of room for further growth in our ten markets.

We will continue to pursue our successful strategy

of reinvesting the benefits of our increasing scale into

the customer proposition rather than our margin, to

establish a business with economics that remain

sustainable in the long term.

The year has seen a number of changes to the Board.

I would like to thank Hans Roger Snook for his three

years’ service as Chairman during a period of rapid

and successful growth for the Group. In addition,

Martin Dawes stepped down as a Non-Executive

Director, and just after the year end Geoffroy Roux

de Bezieux relinquished his role as Chief Operating

Officer, Distribution, to run our new mobile venture in

France under the Virgin brand. Geoffroy has played

a pivotal role in the successful development of our

retail proposition across Europe and I would like to

thank him for his significant contribution.

David Goldie, Chief Operating Officer, Telecoms,

joined the Board during the year, and Andrew

Harrison, Chief Executive of the UK business, joined

just after the year end. We have also attracted three

new Non-Executives of the highest calibre in Steven

Esom, David Mansfield and Sally Morgan, and they

have already made valuable contributions to our

Board discussions.

As I highlighted above, the quality of the Group’s

people is a fundamental factor in its continued

success. This year we have welcomed more people

than ever before into the business, both through our

continued organic growth and the acquisitions we

have made. I would like to thank all our employees

for their outstanding contributions and commitment.

Key achievements