Carphone Warehouse 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONTINUED STRONG LFL

GROSS PROFIT

PERFORMANCE (%)

’06’05’04’03

4.8

14.2

5.0

9.0

Operational Performance

Distribution Division

The Distribution division comprises our Retail

operations and all directly-related business

streams. The key operating assets of the division

are our 1,778 stores across 10 European countries

and our Retail and Online brands. Distribution

revenues grew by 22.0% in the year to £1,753.5m,

and the division generated Headline EBIT of £115.5m,

a rise of 38.7% on the prior year. Growth was strong

across all business units, with Online growth continuing

to be exceptional, supported by the acquisition of One

Stop Phone Shop in March 2005. From the year to

March 2007, we are combining our Retail and Online

business units for reporting purposes.

Retail and Online

The Group achieved 8.19m connections during the

year, representing year-on-year growth of 24.1%.

However, last year was a 53 week accounting period

and on an equivalent 52 week basis, connections

were up 26.0%.

In subscription connections, the key driver for our

Distribution business, we achieved 52 week growth

of 23.6% to 3.42m. Market conditions continued to

be attractive, with further growth in the European

handset market driven by good customer offers

and the strong handset pipeline. In addition, we

again enjoyed a year of improving execution, allying

a focus on exclusive product with an aggressive

pricing strategy. We have now achieved compound

annual growth of 17.1% in subscription connections

over the last five years.

Our pre-pay business had a very good year, with

52 week connections up 31.7% to 4.25m. The

strength of the overall pre-pay market continued

unabated, and we successfully invested in pricing

to take market share from generalist retailers. Our

SIM-free sales were marginally up year-on-year

at 0.52m, reflecting the relative strength of the

pre-pay market.

www.cpwplc.com 9

Operating and Financial Performance

Operating and Financial

Performance Review

Growth was strong across all

business units, with Online growth

continuing to be exceptional

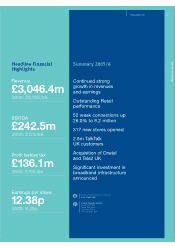

2006 2005

Headline Financials £m £m

Revenue 1,753.5 1,436.9

Retail 1,375.5 1,160.2

Online 203.5 128.2

Insurance 116.1 102.0

Ongoing 58.4 46.5

Contribution 246.1 190.1

Retail 127.5 100.9

Online 14.7 7.7

Insurance 45.5 35.0

Ongoing 58.4 46.5

Support costs (84.1) (71.5)

EBITDA 162.0 118.6

Depreciation and amortisation (46.5) (35.4)

EBIT 115.5 83.2

EBIT % 6.6% 5.8%