Carphone Warehouse 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

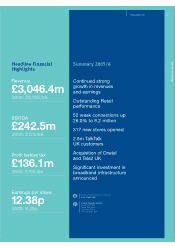

Becoming the leading alternative fixed line

provider in the UK

We have set our UK fixed line operations a bold

objective but one that we believe, with the combination

of assets that we have at our disposal, is achievable:

to become the leading alternative fixed line provider.

Four years ago, we had no presence in the fixed line

market. Through the combination of acquisitions and

strong organic growth, we have built a business that

now has a 10% share of the residential market for

voice calls and is the clear number three operator. The

highlights of the year were our acquisitions of Onetel

and Tele2 UK, two of our biggest competitors in the

Carrier Pre-Select (CPS) market, which not only took our

combined customer base to 2.6m at the year end but

also underlined the success of our own business model.

We have always maintained that the ability to recruit

customers through our store base has given us

a much lower overall cost of customer acquisition,

and our ownership of a highly efficient voice network

in Opal has allowed us to generate an attractive and

sustainable margin on our tariffs. These deals

demonstrate that our strategy to date has been the

right one, and we expect the combined residential CPS

businesses to deliver a contribution of approximately

£50m in the coming year. A key goal this year will be

to sell line rental as well as voice services to as many of

our customers as possible. While there is no additional

margin in the wholesale line rental product, it does

serve to strengthen the customer relationship. We aim

to have 60% of our CPS customers on our own line

rental service by March 2007.

The most important development of the last 12 months

has been the establishment by the regulator, Ofcom,

of a structure for the industry that encourages

infrastructure-based competition on a level playing

field. As a result, we have announced plans to invest

in local loop unbundling, a process that allows us to

install our own exchange equipment on BT’s premises,

and take over the copper wire between a customer’s

house and the local exchange at fair rates.

On 11 April 2006, we were pleased to announce

our new proposition: TalkTalk broadband for free, for

customers who take our line rental and Talk 3 calls

package. This offer has re-priced the broadband

market in the UK, undercutting similar bundled tariffs

from competitors by up to 60%. Our approach has

6

Smart

methodologies

driving improved

performance

INVESTMENT

Our long-term approach to investment creates

sustainable competitive advantage in our

chosen markets. Investment is not just about

capex – although our commitment to store

openings and exchange unbundling is

significant – it is also about marketing,

brand-building and customer recruitment.

PROPOSITION

We are absolutely committed to delivering

value to customers across all our services.

Investment in the right platforms is key to

our ability to develop a compelling customer

proposition, as it allows us to build scale

and offer greater value.

SCALE

We aim to be a mass market provider in our

major business lines by driving for volume

ahead of margin. We then use our increased

presence in the market to improve our supplier

terms and reinvest these benefits in the

customer proposition.

EFFICIENCY

Scale also creates significant efficiencies for

our business, through leveraging our fixed cost

store base and telecoms infrastructure. We

seek to maintain our competitive advantage

by continued investment across the business.