Carphone Warehouse 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

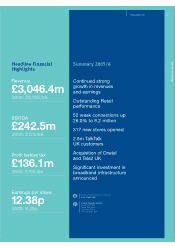

CONTRIBUTION FROM

NON-UK OPERATIONS

(£m)

’06’05’04’03

48.0

87.6

116.9

163.7

INSURANCE BASE

UP 16.7% (000s)

’06’05’04’03

1,060

1,324

1,645

1,921

SALES PER SQUARE METRE

UP 2.0% (£)

’06’05’04’03

11,676

14,303 15,343 15,654

stream represents an important element of our overall

commercial agreement with many networks. Again,

the key underlying driver for Ongoing is our

subscription connection sales.

Ongoing revenues grew by 25.6% to £58.4m year-

on-year (2005: £46.5m). This performance reflects

the sustained strong subscription connections growth

over the last few years. We continue to view Ongoing

share as a vital element of our network agreements,

as it provides us excellent earnings visibility and clearly

aligns our interests with those of the networks.

£203.5m (2005: £128.2m) and contribution was

£14.7m (2005: £7.7m). Underlying growth continued

to be strong as our web and direct sales activities

grew their market share, and overall performance was

boosted by the acquisition of One Stop Phone Shop,

a further online brand in the UK market, at the end

of the previous year. We continue to review the

European opportunity for direct and online channels.

Insurance

The Group offers a range of insurance products to

its retail customers, providing protection against

the replacement cost of a lost, stolen or damaged

handset, as well as cover for any outstanding

contractual liability and the cost of any calls made

if a mobile phone falls into the wrong hands. Insurance

is a core element of the Group’s customer proposition.

Our Insurance customer base continued to grow

strongly during the year. Overall the customer base

grew by 16.7% to 1.92m. Within this figure, the

business mix improved, with high tier policyholders

(typically mobile subscription customers) up 24.1%.

The non-UK base now represents 45.8% of the total.

Insurance revenues grew 13.8% to £116.1m (2005:

£102.0m) and contribution increased by 30.0% to

£45.5m (2005: £35.0m). The contribution margin

expanded significantly as we began to benefit from

the scale of our operations in a number of markets,

fully underwriting our own business and the

investment in new systems developed in the prior year.

We continue to see good growth prospects in our

Insurance business. The main driver will continue to

be growth in our subscription connections, but we

have also recently relaunched the product suite with

a move to risk-based pricing, which allows us to tailor

individual policies much more closely to a customer’s

needs, while also matching the level of premium to

the customer risk profile.

Ongoing

Ongoing revenue represents the share of customer call

spend (or ARPU) we receive as a result of connecting

subscription customers to certain networks. We are

typically contractually entitled to our share of revenue

for as long as a customer is active, so this income

Operating and Financial Performance Review continued www.cpwplc.com 11

Operating and Financial Performance

STRONG IMPROVEMENT

IN INSURANCE MARGIN

SUBSCRIPTION GROWTH

DRIVING RECURRING REVENUES