Build-A-Bear Workshop 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Build-A-Bear Workshop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

2012 Financial

Re s u lts

• Total revenues were $380.9 million

compared to $394.4 million in

fiscal 2011.

• Consolidated net retail sales

were $374.6 million. In the

fourth quarter, net retail sales

were flat despite closing ten stores

in the fiscal year and excluding

the benefits from adjustments

to deferred revenue related to

our loyalty program.

• Consolidated e-commerce sales

rose 7.7 percent which comes on

top of an increase of 8.5 percent

in fiscal 2011.

• Net loss for 2012 was $3.02 per

share and included a $33.7 million,

or $2.06 per share non-cash charge

to impair the goodwill associated

with our United Kingdom business.

Adjusted net loss was $10.1 million,

or $0.62 per share compared to

adjusted net loss of $0.4 million

or $0.03 per share in the 2011

fiscal year.

Our balance sheet remains strong

with consolidated cash of $45 million

at year end. During the year, we

invested $1.3 million to repurchase

367,000 shares of our common

stock. We had no borrowings

under our revolving credit facility

which was renewed with U.S. Bank

National Association at the end of

the year. We are in a strong financial

position to continue to execute our

strategic plans.

Strategic Priorities

We are in the midst of a multi-year

turnaround plan that builds on a strong

base of profitable stores that we are

working to make stronger. To put

that in perspective, today our top

200 company-owned stores have

an average 20 percent store level

contribution, and we believe our store

base will be more profitable by the

end of 2014 as we benefit from our key

initiatives. Importantly, Build-A-Bear

Workshop remains a powerful global

brand, one that kids love and Moms

trust. To increase long term shareholder

value, we continue to execute our

strategic initiatives which include:

1. Introduce a new store design

— We opened the first six newly

imagined stores starting in September

2012 to great Guest response. As a

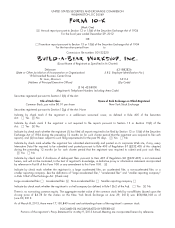

Financial Highlights

(dollars in thousands, except per share, per store, and per gross square foot data)

Fiscal Year 2012 2011 2010

REVENUES

Net retail sales .................................... $ 374,553 $ 387,041 $ 387,163

Commercial revenue ................................ $ 2,790 $ 3,943 $ 11,246

Franchise fees..................................... $ 3,598 $ 3,391 $ 3,043

Total revenues..................................... $ 380,941 $ 394,375 $ 401,452

Net income (loss) .................................... $ (49,295) $ (17,062) $ 104

EARNINGS (LOSS) PER COMMON SHARE

Basic .......................................... $ (3.02) $ (0.98) $ 0.01

Diluted .......................................... $ (3.02) $ (0.98) $ 0.01

OTHER FINANCIAL AND STORE DATA(1)

Retail gross margin (dollars)(2) .......................... $ 145,687 $ 154,468 $ 155,128

Retail gross margin (percent)(2).......................... 38.9% 39.9% 40.1%

Number of company-owned stores at end of period .......... 351 356 359

Average net retail sales per store ....................... $ 1,003 $ 1,021 $ 1,030

Net retail sales per gross square foot .................... $ 350 $ 354 $ 356

(1) For descriptions of this financial and store data, please see the fiscal 2012 annual report on Form 10-K.

(2) Retail gross margin represents net retail sales less cost of retail merchandise sold. Retail gross margin percentage represents retail gross margin divided by net retail sales.