Blackberry 1998 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1998 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

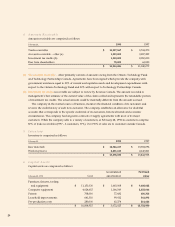

(b) Stock options

The Company has 4,252,000 options outstanding which expire at various dates between March 1, 1998

and December 4, 2006 and are exercisable at prices ranging from $0.05 to $7.25.

12. Capital Dividend

A capital dividend was declared on October 24, 1997 to the shareholders of record at that date.

13. Government Assistance

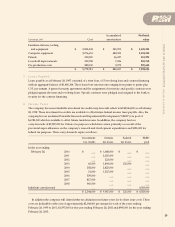

The government assistance from the Ontario Technology Fund may be repayable in the form of royalties

based on future sales related to the technology funded. Such amounts, if any, that may be repayable will be

accounted for in the period in which conditions arise that will cause repayment. These royalty payments

will be repayable over a period of ten years from the date of commencement of the future sales related to

the technology funded or until the total aggregate amount of all royalty payments equals the total amount

of government assistance, whichever occurs first. The royalty payments will be based on the company’s

value added component to the products, being the excess of selling price over material costs, and will be

1% in year 1, 2% in year 2, 3% in year 3, 4% in year 4 and 5% in each of years 5 to 10, subject to annual

maximum contributions of $100,000 in year 1, $400,000 in year 2, $600,000 in year 3, $800,000 in year 4,

$1,000,000 in year 5 and $1,250,000 per year in each of years 6 to 10, inclusive, until the total $4,710,000 of

the grant has been paid back.

The government assistance from Technology Partnerships Canada (“TPC”) is subject to royalty payments

of 2.2% of gross product revenues based on future sales related to the technology funded. The first royalty

payment is due 46 days after February 28, 2000. If by February 28, 2003, the royalty payments paid or due

equal or exceed $9,100,000, no further royalty payments will be payable. If by February 28, 2003, the royalty

payments paid or due do not equal or exceed $9,100,000, royalty payments will continue to be payable to a

limit of $9,100,000, but such royalty payments shall be payable on revenue from all two-way pager products

instead of solely products developed with the TPC funding.

No amounts have been accrued with respect to repayments as the conditions for repayment have not

been met.

Included in revenue are government grants and investment tax credits totalling $2,041,182 (1997 –

$2,234,255).

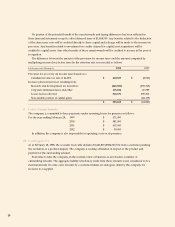

14. Comparative Figures

Certain of the prior year’s figures have been reclassified for consistency with the presentation adopted for

the current year.

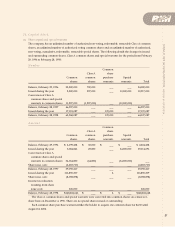

As at February 28, 1998, share issue costs previously charged to retained earnings have been reallocated

to share capital. As a result, as at February 28, 1997 and 1998, retained earnings increased and share capital

decreased by $2,253,717.