Blackberry 1998 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1998 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

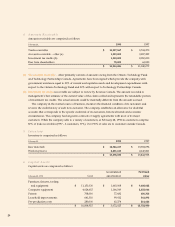

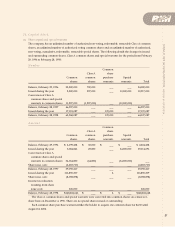

Accumulated Net book

February 28, 1997 Cost amortization value

Furniture, fixtures, tooling

and equipment $ 5,855,342 $ 345,951 $ 5,509,391

Computer equipment 2,076,651 482,321 1,594,330

Patents 350,000 36,027 313,973

Leasehold improvements 210,788 7,026 203,762

Pre-production costs 280,000 9,372 270,628

$ 8,772,781 $ 880,697 $ 7,892,084

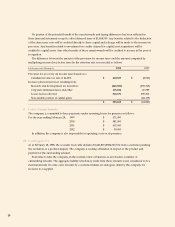

7. Loans Payable

Loans payable as at February 28, 1997 consisted of a term loan, a US revolving loan and contract financing

with an aggregate balance of $1,480,364. These loans bore interest rates ranging from prime to prime plus

1.5% per annum. A general security agreement and the assignment of inventory and specific contracts were

pledged against the term and revolving loans. Specific contracts were pledged and assigned to the bank as

security for the contract financing.

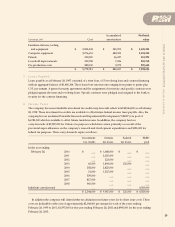

8. Income Taxes

The company has non-refundable investment tax credit carry-forwards which total $2,544,000 as at February

28, 1998. These investment tax credits are available to offset future federal income taxes payable. Also, the

company has an unclaimed Scientific Research and Experimental Development (“SRED”) tax pool of

$4,783,000 which is available to offset future taxable income. In addition, the company has loss

carry-forwards of $9,987,000 for Ontario tax purposes which have arisen primarily as a result of the

provincial super-allowance on the company’s research and development expenditures and $125,000 for

federal tax purposes. These carry-forwards expire as follows:

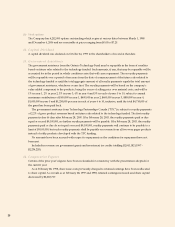

Investment Ontario Federal SRED

tax credits tax losses tax losses pool

In the year ending

February 28, 2000 $ ___ $ 1,688,000 $ ___ $ ___

2001 ___ 2,055,000 ___ ___

2002 ___ 223,000 ___ ___

2003 65,000 1,869,000 125,000 ___

2004 292,000 2,825,000 ___ ___

2005 51,000 1,327,000 ___ ___

2006 359,000 ___ ___ ___

2007 817,000 ___ ___ ___

2008 960,000 ___ ___ ___

Indefinite carryforward ___ ___ ___ 4,783,000

$ 2,544,000 $ 9,987,000 $ 125,000 $ 4,783,000

In addition the company will claim further tax deductions in future years for its share issue costs. These

costs are deductible at the rate of approximately $2,048,000 per annum for each of the years ending

February 28, 1999 to 2001, $1,597,000 for the year ending February 28, 2002 and $995,000 for the year ending

February 28, 2003.

25

RESEARCH IN MOTION Incorporated Under the Laws of Ontario