Blackberry 1998 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 1998 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Nature of Business

The company is in the business of developing, manufacturing and supplying radios and other network

access devices for use in wireless data communications systems. The company was incorporated on March

7, 1984 under the Ontario Business Corporations Act.

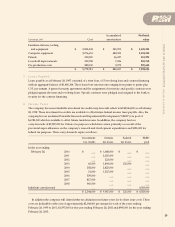

1. Amalgamation

On October 27, 1997 the company amalgamated with a holding company which was formed as a result of

the amalgamation of certain other holding companies (collectively, the “Holdcos”). The Holdcos’ sole assets

prior to the amalgamations were shares of the company. The Holdcos had no liabilities. The shareholders of

the Holdcos received upon amalgamation, shares of the amalgamated company equal to the number of

shares of the company previously owned by their respective Holdco.

2. Summary of Significant Accounting Policies

(a) General

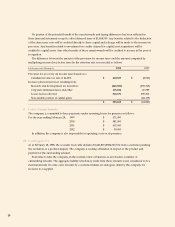

These financial statements have been prepared by management in accordance with generally accepted

accounting principles on a basis consistent with prior years. Because a precise determination of assets and

liabilities depends on future events, the preparation of financial statements for a period necessarily involves

the use of estimates and approximation. Actual amounts may differ from these estimates. These financial

statements have, in management’s opinion, been properly prepared within reasonable limits of materiality

and within the framework of the accounting policies summarized below.

(b) Financial instruments

Short-term investments include those financial instruments which mature within one year or which

management intends to convert to cash within one year of the date of purchase. Marketable shares and

bonds which may be included are subject to market risk in that their value will fluctuate as a result of

changes in market prices.

The fair value of financial instruments approximates amounts recorded. A significant portion of the

company’s sales and purchases are transacted with companies outside Canada. As a result, the company is

exposed to risks relating to foreign exchange fluctuations. The company mitigates this risk by maintaining

currency in foreign funds.

(c) Inventory

Inventory of raw materials and work in process is stated at the lower of cost and net realizable value, with

cost determined on a first-in-first-out basis.

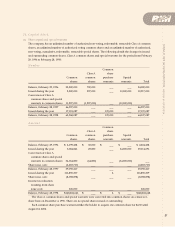

(d) Capital assets

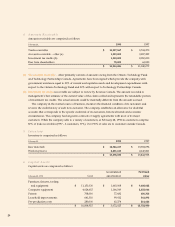

Capital assets are stated at cost and amortization is provided using the following methods:

Furniture, fixtures, tooling and equipment - 20% per annum on the declining balance;

Computer equipment - straight-line over five years;

Patents - straight-line over seventeen years;

Leasehold improvements - straight-line over five years;

Pre-production costs - straight-line over five years.

Amortization is recorded from the date of acquisition.

Notes to Financial Statements February 28, 1998