Blackberry 1998 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1998 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

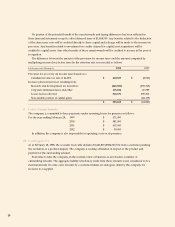

No portion of the potential benefit of the carryforwards and timing differences has been reflected in

these financial statements except to offset deferred taxes of $1,868,700. Any benefits related to the deduction

of the share issue costs will be credited directly to share capital and a charge will be made to the income tax

provision. Any benefits related to investment tax credits claimed for capital asset acquisitions will be

credited to capital assets. Any other benefits of these carryforwards will be credited to income in the year of

recognition.

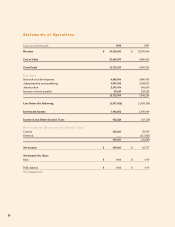

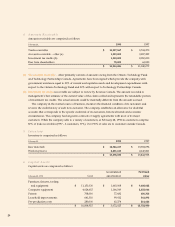

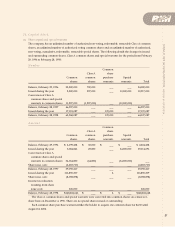

The difference between the amount of the provision for income taxes and the amount computed by

multiplying income (loss) before taxes by the statutory rate is reconciled as follows:

For the year ended February 28, 1998 1997

Provision for (recovery of) income taxes based on a

Canadian income tax rate of 44.62% $ 412,837 $ (8,527)

Increase (decrease) in taxes resulting from:

Research and development tax incentives (643,580) (290,315)

Corporate minimum taxes and other 115,836 27,789

Losses not tax effected 500,170 290,315

Non-taxable portion of capital gains ___ (82,109)

$ 385,263 $ (62,847)

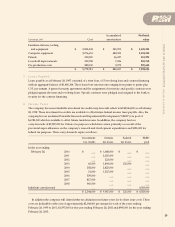

9. Lease Commitments

The company is committed to lease payments under operating leases for premises as follows:

For the year ending February 28, 1999 $ 571,000

2000 $ 581,000

2001 $ 457,000

2002 $ 39,000

In addition, the company is also responsible for operating costs on its premises.

10. Contingencies

As at February 28, 1998, the accounts receivable includes $1,426,800 ($984,000 US) from a customer pending

the resolution of a product dispute. The company is seeking arbitration in respect of the product and

payment of the outstanding amount.

From time to time the company, in the normal course of business, is involved in a number of

outstanding lawsuits. The aggregate liability which may result from these lawsuits is not considered to be a

material amount. In some cases lawsuits by a customer initiate an analogous claim by the company for

recourse to a supplier.