Blackberry 1998 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 1998 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

production mode and reduces its dependency on

these revenue sources. Gross margins were as forecast

in fiscal 1998, and are considered reasonable given the

dominance of hardware products in RIM’s sales mix.

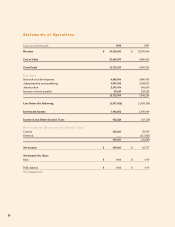

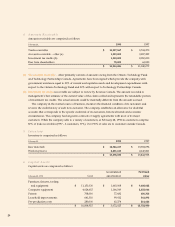

Research and development expenses

R&D investment rose 45% to $6.5 million in fiscal

1998, but declined as a percentage of revenue to 20%

from 37% in fiscal 1997 as a function of strong sales

growth. Increased total spending was a result of

the expansion of product development teams in

preparation for the launch of next-generation

products. R&D expenditures consisted largely of

salaries for technical personnel, the cost of related

engineering materials, software tools and support,

and third party R&D costs.

Administration and marketing expenses

Administrative and marketing expenses increased

57% to $4.0 million from $2.5 million in fiscal 1997,

again reflecting RIM’s growth. However, these

expenses declined to 12% of revenue from 21% a

year earlier – a trend which is expected to continue

as revenue increases.

Depreciation and amortization

Depreciation and amortization expense was $2.2

million in fiscal 1998, versus $0.6 million expensed

in fiscal 1997. The increase was related to significant

capital spending during the year for production and

R&D facilities which increased RIM’s depreciable

asset base.

Investment income

Investment income of $2.0 million was primarily

related to interest earned on net proceeds of

approximately $105 million from the Company’s

initial public offering in October 1997.

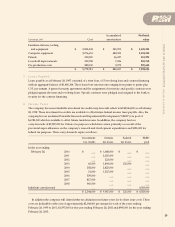

Income taxes

The Company’s past R&D activities have given rise

to income tax loss carryforwards and investment tax

credits (ITCs) which resulted in a net income tax

recovery in fiscal 1997 and restricted taxes payable in

fiscal 1998 to large corporations minimum tax. The

$0.4 million tax provision for the current year also

reflects the income tax offset arising from the

deduction of share issue costs. This benefit has been

allocated to share issue costs included in share capital.

As at February 28, 1998, the Company had

remaining tax loss carryforwards, allocable share issue

costs, and ITCs sufficient to shelter approximately

$22.7 million of federal taxable income and approxi-

mately $21.0 million of provincial taxable income. As

RIM intends to further invest in R&D in the future,

the accrual of additional tax credits to offset tax

payable is expected to be ongoing.

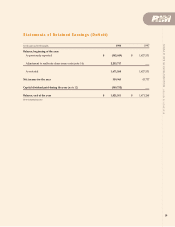

Net Income

Net income was $539,965 in fiscal 1998 compared to

$43,737 in fiscal 1997. Operating losses of $1.0 million

resulted from increasing R&D efforts and the

expansion of the Company’s production facilities

as RIM positioned itself to deliver new products to

the emerging wireless messaging market. These losses

were offset by investment income of $2.0 million.

Earnings per share were $0.01 on both a basic

and fully diluted basis, compared to EPS of $0.00 in

fiscal 1997.

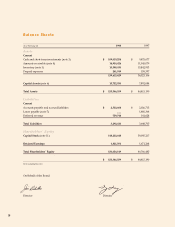

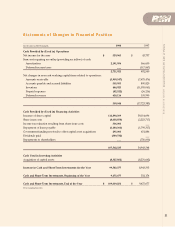

Liquidity and capital resources

Operating cash flow of $0.3 million was generated

in fiscal 1998, compared to a shortfall of $17.7 million

in fiscal 1997. Last year’s shortfall was mainly

attributable to a build-up in RIM’s components

inventory to fill backlogged orders. Operating cash

flow improved in fiscal 1998 as these components

were used in production.

The major uses of cash were capital expenditures

of $8.3 million for the expansion of RIM’s manufac-

turing and R&D facilities, up slightly from $8.2

million in fiscal 1997, and $1.4 million in debt

repayment. These amounts were easily funded by

$109.1 million in share issue proceeds from RIM’s

IPO and an equity investment by Intel.

15

MANAGEMENT’S DISCUSSION AND ANALYSIS