Blackberry 1998 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1998 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

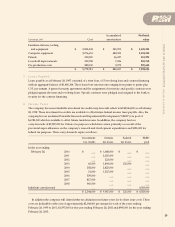

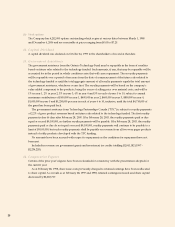

(e) Income taxes

Income taxes are accounted for using the deferral method of tax allocation under which income taxes are

provided for in the year in which transactions affect net income regardless of when such transactions are

recognized for tax purposes.

(f) Foreign currency translation

Foreign currency denominated monetary items are translated into Canadian dollars at the exchange rate in

effect at year end. Transactions in foreign currencies are translated at the rate prevailing at the date of the

transactions. Any resulting gains or losses are included in income.

(g) Revenue recognition

The company recognizes revenue from the sale of manufactured goods when the goods have been shipped.

Government assistance is recognized when the related expenses have been incurred. On long-term

contracts, the company recognizes revenue on the percentage of completion basis such that completion is

recognized based on the stage of production. Losses on such contracts are accrued when the estimate of

total costs indicates that a loss will be realized. Contract billings in excess of cost and accrued profit margins

are included as deferred revenue under current liabilities.

Deferred revenue is taken into income in the period in which it is earned. Deferred revenue of $759,744

for year ended February 28, 1998 relates to deferred warranty revenue which will be taken into income in

the period to which the warranty relates.

(h) Research and development

The company is engaged at all times in research and development work. The research and development

costs other than capital asset acquisitions are charged as an operating expense of the company as incurred.

(i) Government assistance

Government assistance towards research and development expenditures is received as grants from the

Ontario Technology Fund, Technology Partnerships Canada and in the form of investment tax credits.

Assistance related to the acquisition of capital assets used for research and development is credited against

the related capital assets and all other assistance is credited to income.

(j) Net income per share

Net income per share is calculated based on the average number of shares outstanding during the year.

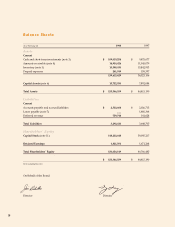

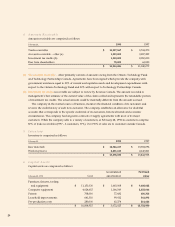

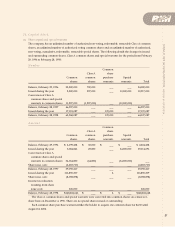

3. Cash and Short-term Investments

Cash and short-term investments are comprised as follows:

February 28, 1998 1997

Cash (overdraft) $ 2,606,514 $ (24,323)

Redeemable guaranteed investment certificates bearing

interest from 3.97% to 4.42% per annum,

maturing October 27, 1998 93,411,430 ___

Preferred shares 1,750,428 ___

Canadian corporate bonds bearing interest at 7.5% per annum,

maturing September 15, 2003, callable September 15, 1998 11,250,882 ___

Loan receivable bearing interest at 2.73% per annum,

maturing March 12, 1997 ___ 9,500,000

$ 109,019,254 $ 9,475,677

23

RESEARCH IN MOTION Incorporated Under the Laws of Ontario