Barclays 2011 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2011 Barclays annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Implementing our strategy

To achieve the primary objective of maximising Total Shareholder

Returns, we focus on four key execution priorities.

These execution priorities drive Barclays performance and continue

to improve our competitive position. We have made solid progress,

with a resilient financial performance despite the difficult trading

conditions in 2011, and the bank is well positioned to generate the

financial returns that we are targeting over time.

Strategy

Our focus is on execution and in particular delivering our promises

in four key areas.

At the beginning of 2011 we set out our execution priorities based on a

three year plan to improve both the bank’s performance and its position.

We have made solid progress in 2011 despite the market uncertainty.

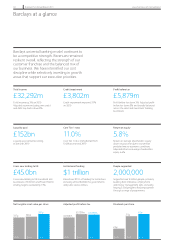

1. Capital, Funding and Liquidity

We remain mindful of the changing regulatory environment and our rock

solid capital, funding and liquidity positions give us confidence that we

will meet future requirements. Our robust Core Tier 1 ratio of 11.0% is

supported by our ability to generate capital organically and we do not

expect to seek additional capital from our shareholders. We have also

maintained resilient funding and liquidity profiles despite recent market

stresses caused by the Eurozone crisis. This has allowed us to access

diverse funding sources, minimising the cost of funding and providing

protection against unexpected fluctuations.

2. Returns

Our focus on delivering returns is a key driver in the way we manage

the business. We seek to improve return on equity to ultimately increase

shareholder returns, reflecting the strong link between the share price

and return on equity. In doing so we also look to maintain strong capital,

liquidity and leverage ratios, to enable us to deliver returns on a

sustainable basis. Although the worse than predicted macroeconomic

conditions as well as new regulatory constraints mean that we may not be

able to deliver 13% returns by 2013, we will continue to focus on delivering

a steady improvement in returns and achieve 13% over time.

3. Income Growth

A component of delivering improved returns is generating income growth.

Despite the macro environment depressing income growth, we generated

momentum and improved the competitive positions of all our major

businesses in 2011. We grew net operating income in all businesses,

except Barclays Capital which was most affected by difficult trading

conditions, as we remain focused on improving the quality of assets to

ensure that we do not grow at the expense of future credit losses.

4. Citizenship

We believe that being a valued, respected and trusted citizen is vital in

creating long term value for all our stakeholders. We produce a Citizenship

Report each year in order to benchmark our progress in the key areas of

focus: contributing to growth in the real economy; the way we do

business; and supporting our communities.

Total Shareholder Return (TSR)

Our primary objective is to maximise returns for shareholders and in

doing so, we aim to deliver top quartile TSR.

TSR consists of two components: the movement in market value of

the shares and the income received on those shares in the form of

dividends. Over the past five years there has been a clear relationship

between TSR and return on equity (RoE) with the market value of

shares improving with higher reported RoE. Increased dividend

payments positively affect both TSR and RoE. Therefore, improving

the bank’s RoE is a key driver in the way we manage the business to

maximise TSR.

While we seek to have a progressive dividend policy, we must balance

this with requirements for capital in order to ensure sustainable and

long term TSR creation.

As RoE declined throughout the crisis to a low point in 2008, so too

did TSR. Barclays maintained positive RoE and outperformed peers

during the crisis as we remained profitable.

In recent years TSR and RoE have become more closely aligned as

share prices have reflected market uncertainty, low sector RoEs, and

low dividend payout ratios. This has strengthened the link between

market valuation and returns, and therefore TSR and RoE.

For more detailed information, please see Financial review,

please see page 159

Barclays PLC Annual Report 2011 www.barclays.com/annualreport 11

The strategic report Governance Risk management Financial review Financial statements Shareholder information