BT 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADDITIONAL INFORMATION FINANCIAL STATEMENTS REPORT OF THE DIRECTORS BUSINESS AND FINANCIAL REVIEWS OVERVIEW

BUSINESS AND FINANCIAL REVIEWS BUSINESS REVIEW

9BT GROUP PLC ANNUAL REPORT & FORM 20-F

BUSINESS AND FINANCIAL REVIEWS

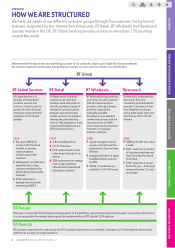

Becoming more agile

Our goal is to combine the strengths of being a large company with

the speed and flexibility of a small company. Our people are

becoming more agile in the way they work together to serve

customers. We are making our company more agile as well, cutting

out any bureaucracy that can slow us down. As a result we will be

more responsive to customer needs.

We are continuing to simplify our business to give people more

authority and to allow them to do their jobs more effectively.

As we become a more agile organisation, we reduce our costs as

well as the number of people we need to employ. In the past year

we have reduced the number of full-time employees by around

5,000. In addition to this, the number of indirect employees

working through agencies or third party contractors was reduced

by around 10,000, giving a reduction in our total labour resource of

some 15,000. We expect further reductions of a similar level in

2010. We have sought to retain our permanent workforce through

redeployment and retraining, and will continue to do so. We

continue our drive to reduce costs across the business, and made

further progress in 2009 towards transforming our cost base.

Three out of four of our lines of business have made a strong

contribution towards the delivery of cost savings, although BT

Global Services still has to control costs more tightly and

deliver greater savings.

Maintaining a sustainable business

BT is committed to contributing positively to the communities in

which it works and to operating in a socially responsible way. We

are using communications technology to help create a better, more

sustainable world. Our goal is to help meet the challenge of climate

change, to promote a more inclusive society and to enable

sustainable economic growth.

We believe that being a recognised leader in the field of

corporate responsibility contributes to shareholder value. It builds

our brand and is central to the way we do business. It encourages

the best people to want to work for BT. It is a powerful reason for

customers to do business with us and stay loyal to us.

We commit a minimum of 1% of our pre-tax profits to activities

that support society. We invested a total of £25m, comprising time,

cash and in-kind contributions, in the community in 2009. Of this

amount, £2.3m was in the form of charitable donations.

Measuring our performance

For 2009, the key performance indicators (KPI) against which we

measured the delivery of our strategy were:

customer service

earnings per share

free cash flow.

Our customer service results were encouraging and we delivered

significant improvements during the year. However, the

unacceptable performance in BT Global Services impacted free cash

flow and earnings per share, which were well below target.

Customer service

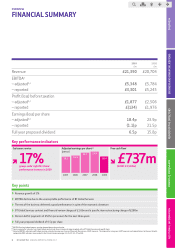

We set ourselves a group-wide stretching target in 2009 of

improving right first time by 24%. We achieved an increase of 17%,

compared with 9% in 2008 and we are targeting further

improvements in 2010. We are now delivering excellent customer

service levels in many areas.

Earnings per share

Adjusted basic earnings per sharea,b were 18.4p in 2009, compared

with 23.9p in 2008 and 22.7p in 2007 (see Financial review

page 39). The reported basic loss per share was 1.1p in 2009,

compared with basic earnings per share of 21.5p and 34.4p in

2008 and 2007, respectively.

Free cash flow

Free cash flowbin 2009 was £737m, compared with £1,503m in

2008 and £1,354m in 2007 (see Financial review page 41).

Outlook

We expect revenue to decline by 4% to 5% in the 2010 financial

year, reflecting a continuation of the trends seen towards the end

of the 2009 financial year, the impact of lower mobile termination

rates, together with the impact of refocusing BT Global Services.

We expect to deliver a net reduction in group capital

expenditure and operating costs of well over £1bn in 2010.

Included within this is a reduction in group capital expenditure to

around £2.7bn. As a result, we expect group free cash flow, before

any pension deficit payments, but after the cash costs of the BT

Global Services restructuring charges, to reach over £1bn

in 2010 and beyond.

Earnings per share will be impacted by the movement of the net

finance expense on the pension obligations which moves from a

credit of £313m in the 2009 financial year to a charge of about

£275m in 2010.

The proposed final dividend of 1.1p gives a full year dividend of

6.5p which rebases dividend payments to a level we are confident is

sustainable. The Board is committed to delivering attractive returns

for shareholders and believes that the operational improvements in

the business will generate sufficient cash flow to allow the dividend

to grow at the same time as investing in the business, reducing debt

and supporting the pension scheme.

aItems presented as ‘adjusted’ are stated before contract and financial review charges and specific

items.

bAdjusted basic earnings per share and free cash flow are ‘non-GAAP measures’ provided in

addition to disclosure requirements defined under IFRS. The rationale for using non-GAAP

measures is explained on pages 33, 47 and 48, and a reconciliation of adjusted basic earnings

per share and free cash flow, to the most directly comparable IFRS indicator, is provided on

pages 39 and 41 respectively.