BMW 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

12 Group Management Report

12 A Review of the Financial Year

14 General Economic Environment

18 Review of Operations

42

BMW Group – Capital Market

Activities

45 Disclosures pursuant to § 289 (4)

and § 315 (4) HGB

48 Financial Analysis

48 Internal Management System

50 Earnings Performance

52 Financial Position

54 Net Assets Position

56 Subsequent Events Report

56 Value Added Statement

58 Key Performance Figures

59 Comments on BMW AG

63 Internal Control System

64 Risk Management

70 Outlook

Group Management Report

A Review of the Financial Year

BMW Group performs well despite

economic crisis

The worldwide economic and financial crisis again had a

major impact on our business in 2009. The steep decline in

demand on key sales markets and unfavourable re

financ-

ing conditions on international capital markets were partic-

ularly pronounced during the first half of the year. Manufac-

turers of premium vehicles benefited only to a very minor

extent from the various stimulus programmes established

in many countries to help increase car sales volumes.

The first signs of moderate economic recovery, from which

our automobile business also profited, emerged during

the second half of the year. With a total of 1,286,310 BMW,

MINI and Rolls-Royce cars sold in 2009, we ended the year

10.4 % down on the previous year’s sales volume perform-

ance and within the predicted range of 10 % to 15 %. In-

tense competition and model life-cycle factors also played

a role in reducing sales volumes to below the previous

year’s figures. We were nevertheless able to increase mar-

ket share in the premium segment and retain our position

as the world’s leading premium manufacturer.

International motorcycle markets contracted on average

by roughly one third in 2009. Despite this difficult

environ-

ment, we were still able to sell 87,306

BMW

motorcycles

worldwide (– 14.1 %), convincingly outperforming the mar-

ket

as a whole.

The weak state of the global economy also cast its shadow

over financial services business in 2009. Ongoing adverse

conditions on the international car markets also caused new

financing and lease business to decline. The situation on

the international used car markets differed greatly from

market

to market. Whereas demand for previously owned

cars stabilised over the course of the year in North America

and the United Kingdom, the situation in Continental

Europe

remained difficult. The economic and financial crisis

was especially reflected in this region in a higher volume

of

bad debts. Narrower risk spreads on the international

capital markets reduced refinancing costs during the year.

Due to the uncertain conditions on international capital

markets, we increased our liquidity levels at the beginning

of 2009. As the financial markets have settled somewhat

and with economic conditions stabilising, we have been

able to reduce those levels. Some of the liquidity

raised was

used to externalise the financing of a second tranche of

pension liabilities.

Positive earnings achieved

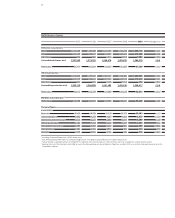

With the economy performing so weakly, revenues fell

short of their previous year’s level. Group revenues in 2009

totalled euro 50,681 million, 4.7 % down on the previous

year. Excluding the exchange rate impact, revenues would

have fallen by 5.1 %.

Efficiency improvement measures initiated at an early stage

as part of our Strategy Number ONE and rigorous cost

management policies have both helped to enable us to

report positive Group earnings for the full year. A steep

sales volume decline, adverse exchange rate factors and

a difficult competitive environment had a negative impact

on business performance. The BMW Group reports a

profit before financial result (

EBIT

) of euro 289 million

(– 68.6 %). At euro 413 million, the profit before tax was up

by 17.7 % on the previous year.

In line with the sales volume performance, automobile

business revenues fell short of the previous year, dropping

by 10.3 % to euro 43,737 million. Reflecting the weak

state of most of the major car markets, the Automobiles

segment recorded a negative

EBIT

of euro 265 million

(2008: positive EBIT of euro 690 million). The slight eco-

nomic recovery in the final months of 2009 resulted in

a resurgence in car sales volume, enabling the segment

to achieve a positive EBIT of euro 93 million in the last quar-

ter

of 2009. The segment recorded a loss before tax of

euro 588 million for the year (2008: profit before tax of

euro 318

million).

The Motorcycles segment generated revenues totalling

euro 1,069 million in 2009, 13.1 % down on the previous

year. The difficult market environment in 2009 pushed

down EBIT by 68.3 % to euro 19 million, with profit before

tax falling to euro 11 million (– 78.4 %).

The total business volume of the Financial Services seg-

ment was similar to that of the previous year, with revenues

of euro 15,798 million (+ 0.5 %). The positive

EBIT

gen-

erated

by this line of business, at euro 355 million, was well

above the previous year’s level (2008: negative

EBIT

of

euro 216 million). The pre-tax segment result turned around

from a segment loss before tax of euro 292 million to a seg-

ment profit before tax of euro 365 million. The slight im-

provement in the global economy brought with it lower risk

levels in terms of residual values and within the lending

business. Narrower risk spreads on capital markets nudged

refinancing costs down during the year.

The income tax expense for the year was euro 203 million

(2008: euro 21 million). The sharp increase in the effective

tax rate was due to the lower level of tax-exempt income

and partly to the tax expense incurred for prior years

in con-

junction with a tax field audit at the level of BMW AG,

mostly

relating to intragroup transfer pricing arrangements.

The