Atmos Energy 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

Outlook

We will continue to execute our strategy of growth by

investing in our existing assets.

Our announced guidance for earnings per diluted

share in fiscal 2016 ranges between $3.20 and $3.40,

excluding unrealized margins. Contributions to net income

from regulated operations are forecast to be between

$315 million and $355 million, and net income from

nonregulated operations is expected to be in the range of

$14 million to $19 million.

We operate approximately 76,000 miles of distribution

and transmission pipelines and more than 3.1 million

service lines connected to customers’ premises.

Our primary focus is to replace as soon as possible

all the remaining cast iron pipe in our system and to

evaluate for replacement all existing bare steel pipelines.

In addition, our modernization program will continue to

emphasize the replacement or fortification of older coated

steel pipelines and early-vintage plastic pipe.

We have replaced nearly 1,000 miles of cast iron, bare

steel and early-generation plastic pipe since 2010, and we

expect to double our replacement mileage during the next

five years.

We project our capital expenditures in fiscal 2016 to

be between $1.0 billion and $1.1 billion and our annual

capital expenditures from fiscal 2017 through fiscal 2020

to range between $1.1 billion and $1.4 billion.

Our total regulated rate base value is expected to grow

at a compounded annual growth rate between 9 percent

and 10 percent, from approximately $5.5 billion at year-

end of fiscal 2015 to between $8.5 billion and $9.0 billion

by fiscal 2020.

Accordingly, we project that earnings per diluted share

will increase between 6 percent and 8 percent a year. This

growth rate, combined with an attractive dividend, should

yield an overall shareholder return between 9 percent and

11 percent each year through fiscal 2020.

Management Changes

As part of our senior-management succession planning,

the board of directors announced promotions for two key

officers, effective October 1, 2015.

Michael E. Haefner, 55, was promoted

from executive vice president to president

and chief operating officer of Atmos

Energy Corporation. In this role, he has

oversight for Atmos Energy’s regulated

distribution divisions, customer service

operations, regulated intrastate pipeline

division, nonregulated operations and the gas supply and

services group. Mike also was elected to the board of

directors, effective November 4, 2015.

One of the most important responsibilities of the board

is to establish for the CEO position a succession plan

that is seamless and transparent to continue the success

of the company. It is equally important that the plan is

controlled by the board—that it is not required due to

Large Investments, Yet Low Customer Bills

Regulatory authorities in the states we serve recognize the

critical need to accelerate capital outlays to continue to

make our safe system even safer. With the resulting rate

mechanisms in place today, we plan to continue investing

in our pipeline infrastructure program far into the future.

Equally important, even with these large expenditures

for improvements, the average monthly bill for our service

remains very affordable.

Our average residential bill, adjusted for seasonality,

has averaged less than $60 a month since 2007, and we

expect our residential bills will remain in that range for

at least several more years.

After taking inflation into account, we expect our bills

will actually go down. This positive benefit is occurring

because natural gas continues to be abundant, affordable,

domestically available and clean. Reputable forecasts show

prices supporting this outcome for at least the next decade.

The net effect is that we are significantly upgrading our

infrastructure—with all the incumbent benefits of public

safety and reliability of gas deliveries even on the coldest

days—without our customers paying more for these

service improvements.

Atmos Energy’s annualized monthly gas bills, in fact,

may be one of the lowest costs in the household budget of

our average residential customer, as shown on page 4.

Financial Results

Contributions to fiscal 2015 net income were $205 million

from regulated distribution operations, $94 million from

poor operational performance, failing health or financial

distress. This plan reflects the board’s deliberate and

careful consideration and their confidence that succession

will be successful.

Mike had been executive vice president from January

2015 through September 2015 and had previously served

as senior vice president of human resources.

Before joining Atmos Energy in 2008, he had worked

for 10 years as senior vice president, human resources, at

Sabre Holdings Corporation, the parent company of Sabre

Airline Solutions, Sabre Travel Network and Travelocity.

He also held leadership positions within Sabre from 1991

to 1997 while it was a division of AMR Corporation, the

parent of American Airlines. Earlier, he had worked as an

outside management consultant for Xerox Corporation and

in computing research at Eastman Kodak Company.

Mike earned a bachelor’s degree in mathematics from

St. John Fisher College and a master’s degree in computer

science from State University of New York at Buffalo.

Mike has the vision, experience and leadership skills,

as well as the understanding of our culture and values, to

ensure our continued financial and operational success.

The board of directors also named

Marvin L. Sweetin, 52, to the newly created

position of senior vice president, safety

and enterprise services. Marvin had been

senior vice president, utility operations,

since 2011.

He also had served as vice president of

customer service, director of technical training and director

of procurement.

Before joining Atmos Energy in 2000, Marvin worked at

Atlantic Richfield for 13 years in various roles, supporting

petroleum exploration and production activities around

the world.

He earned a bachelor’s degree in petroleum engineering

technology from Oklahoma State University and a master’s

degree in business administration from the University

of Dallas.

Investing these two officers with increased responsibilities

for the company’s success helps ensure our progress

toward becoming the safest natural gas provider. Both

leaders have demonstrated managerial excellence and

made valuable contributions to our company.

They are supported by our 4,800 employees, who are

committed to serving our customers exceptionally well

while ensuring safety for themselves, their fellow employees

and the people in the 1,408 communities we serve. On

our journey to becoming the safest natural gas company,

we have the right employees in the right place, getting the

right results the right way.

Kim R. Cocklin

Chief Executive Officer

November 6, 2015

regulated pipeline operations and $16 million from

nonregulated operations.

Our financial performance continues to reflect the

successful implementation of our long-term strategy of

enhancing the safety and reliability of our infrastructure.

Fiscal 2015 benefited from rate outcomes approved in

fiscal 2014 and 2015; they increased our regulated gross

profit by $118 million.

Additionally, weather, which was 8 percent colder than

normal in fiscal 2015, contributed 5 cents per diluted share

of earnings for the year.

Recent rate-design changes in Tennessee, Mississippi

and Colorado are expected to support increased capital

investments in those states in the future.

At September 30, 2015, our balance sheet had a debt-

to-capitalization ratio of 47.7 percent, compared to 46.2

percent at year-end in fiscal 2014. The company also had

nearly $900 million in net liquidity to meet anticipated

financial needs.

In late September 2015, we replaced an existing $1.25

billion revolving credit agreement, which was set to expire

in August 2019, with a new $1.25 billion revolving credit

agreement through September 2020 on substantially

the same terms. The new credit agreement retains an

“accordion” feature, which allows us the opportunity to

increase the facility to $1.5 billion.

Our strong financial position contributed to the recent

upgrade of our corporate credit rating to A by Fitch Ratings

and to an improvement in our outlook to Positive by

Standard & Poor’s.

22

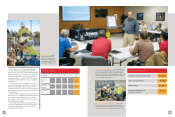

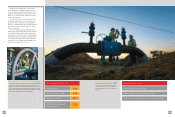

Earnings Growth Through Infrastructure Investments and Rate Mechanisms

Constructive regulatory mechanisms support efficient conversion of our rate-base growth opportunities into our financial results.

$1.0 billion to $1.4 billion in annual

capital investments through 2020

Constructive rate mechanisms

reducing regulatory lag 6% to 8% annual EPS growth

Regulated Pipeline

Regulated Distribution

Within 0–6 Months

Within 7–12 Months

Greater than 12 Months

Earning on Annual Investments:

>90%

$10.0

$8.0

$6.0

$4.0

$2.0

$0.0

$5.00

$4.00

$3.00

$2.00

$1.00

$0.00

2015 2020E

2015 2016E 2020E

Rate base in billions of dollars