Atmos Energy 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

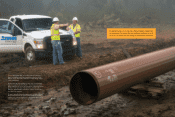

The capital investments we are making to replace, fortify

and expand our distribution and transmission assets are

driving our financial results.

Since fiscal 2010, our capital spending has risen at a

compounded annual growth rate of 12.4 percent to reach

$975 million in fiscal 2015. More than 75 percent of our

investment during the past five years has been dedicated

to safety and reliability projects.

This significant increase in capital investment has oc-

curred because most regulators in our market areas have

approved constructive and balanced rate mechanisms.

These mechanisms provide for the recovery of more than

90 percent of our capital within six months of the test year.

The balanced regulatory environments in our markets

today are the result of relationships built on trust with our

regulators, legislators, community leaders and custom-

ers. These relations were fostered by our former CEO

and current chairman, Robert W. Best. Bob built upon the

foundation laid by our founder, Charles K. Vaughan, that

a successful utility is one that is trusted and is focused on

providing safe, reliable and competitively priced service.

To Our Shareholders

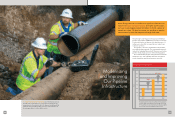

We replaced 575 miles

of aging natural gas

distribution and trans-

mission pipelines to

enhance the safety and

reliability of our system.

Earnings per diluted

share grew for the 13th

consecutive year in fiscal

2015, and net income

increased by 8.7 percent

to $315.1 million, as

compared to $289.8

million in fiscal 2014.

In fiscal 2015, we made spectacular progress on our quest to become the nation’s safest natural gas distributor.

We also did very well financially.

575 miles 148,000 hours Highly Advanced Technology

$3.09 EPS $1. 5 6 |share 25.5 percent $63.77|share

Our fiscal 2015 cash

dividend was $1.56 per

share. In November

2015, the board of

directors continued our

consecutive annual div-

idend increases for the

32nd year by raising the

indicated rate for fiscal

2016 by 7.7 percent to

$1.68 per share.

Total shareholder return

in fiscal 2015 was 25.5

percent.

The market price of our

stock reached an all-

time high on November

4, 2015, of $63.77

a share.

Kim R. Cocklin

Chief Executive Officer

Pipeline Modernization

Our strategy is to grow by investing in our regulated assets to

increase their safety and reliability. Through fiscal 2020, we

expect to spend between $5.4 billion and $6.4 billion to replace,

fortify and expand pipelines and service lines. Work is under way

near Canton, Texas, on one of our largest projects. We are

adding 62 miles of new pipelines to boost reliability and to meet

our customers’ growing demand for natural gas.

We provided nearly

148,000 hours of

technical and safety

training to our service

and construction tech-

nicians to help them

render even safer, more

reliable and superior

customer service.

We began evaluating the latest and most advanced

technology designed to detect pipeline leaks, and we

launched a multi-year information technology project

to manage and document the construction in our

pipeline modernization program.