Alcoa 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

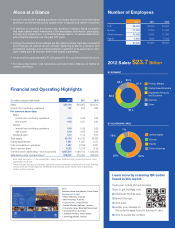

ALCOA 2012 Annual Report4

W

hile driving performance in each of those four businesses, we also are rebalancing Alcoa’s portfolio through organic growth,

acquisitions and divestitures. Our goal is to make ourselves less dependent on the commodity and LME changes in the upstream business

and increase our value-add mid-stream and downstream businesses. Each sector continues to draw on a powerful array of competitive

advantages unique to Alcoa – three strategic priorities, a strong global presence in growth markets, the parental benefi ts we call the

Alcoa Advantage and a solid foundation of values that have guided Alcoa for 125 years in good times and bad. For example, during the

economic crisis of 2009 we launched the Cash Sustainability Program that guided Alcoa successfully through the downturn while also

driving systemic changes to our cost structure. As that program continued to drive the improvements to our businesses, it enabled us

to achieve all of our cash sustainability targets in 2012.

In each of our global regions, we have built

on Alcoa’s local relationships and reputation

to improve the profi tability of our existing

operations and to introduce our business

units to new opportunities.

In China, we are developing plans with

our new joint venture partner, China Power

Investment Corporation (CPI), for expansion

in the world’s fastest-growing market. We are

shifting our rolling business to focus on the

tremendous potential in China’s automotive

and packaging markets. As a result of the

solid performance of our fasteners business in

China, Commercial Aircraft of China (COMAC)

recently contracted with Alcoa to partner in the

development and production of the new C-919

aircraft. Our new wheel production facility

in China continues to expand its capacity,

supporting more than half of our sales to the

growing Chinese commercial vehicle market

within months of its opening.

In Brazil, where we have a substantial

upstream presence, our initiative to introduce

and grow our mid-stream and downstream

businesses produced $256 million in organic

growth in 2012. To establish a presence in the

Brazilian commercial transportation business,

we are opening a forged wheels facility and

are partnering with the country’s largest bus

manufacturer to build and test a prototype

for what will be the world’s fi rst all-aluminum

bus. We are expanding sales of aluminum

risers to the country’s major off-shore oil

drilling program and are increasing sales to

the Brazilian commercial aerospace industry.

In Europe, we had a tale of two worlds.

InSouthern Europe, where energy is expensive,

we worked with government offi cials in Italy

to obtain approval to curtail our smelter in

Portovesme and in Spain to gain support for

more affordable electricity rates. In Norway

and Iceland, affordable energy and technical

advancements have helped our smelter

operations to be profi t leaders among our

global primary businesses.

In the Middle East, the construction of

our Ma’aden-Alcoa joint venture facilities

is progressing well. Infact, on December

12, 2012, we produced the fi rst hot metal

only 25 months after we broke ground, an

extraordinary achievement. Onthe same day,

we broke ground for a rolling mill expansion

targeted at the automotive market. When fully

operational, the integrated aluminum facility

will be the lowest-cost and most-effi cient in

the world. The Government of Saudi Arabia

is in discussions with manufacturers planning

to establish operations in the region, who

would become customers of the aluminum

joint venture.

Regional Growth and Profi tability

Alcoa is bringing its popular aluminum wheels to the growing

commercial transportation industry in Brazil.

The signing of a joint venture with China Power Investment

Corporation is a major step for Alcoa’s future growth in China.

The Fjarðaál smelter in Iceland is one of the highly profi table

Northern European smelters in Alcoa’s Primary Metals portfolio.

In December 2012, the Ma’aden-Alcoa Joint Venture produced

the fi rst metal in Saudi Arabia, only 25 months after construction

began.

LEVERAGING THE ALCOA PLATFORM

FOR PROFITABLE GROWTH

Achieved All 2012 Cash Sustainability Targets

Positive

Free

Cash Flow

Productivity & Overhead Target: $850m

Actual: $1.3b ✓

Working Capital Target: 1.5 days

Actual: 3.5 days

✓

Capital Spend and Investments Target: $1.7b

Actual: $1.4b ✓

Maintain Debt-to-Capital Target: 30%-35%

Actual: 34.8% ✓

✓