Alcoa 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

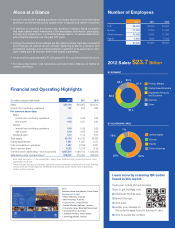

ALCOA 2012 Annual Report 3

Our smelter portfolio is on course to achieve

our 2015 targets, moving four percentage

points down the cost curve in 2012. We made

$245million in productivity improvements,

curtailed 240,000 metric tons of European

smelter capacity, permanently closed 291,000

metric tons of smelter capacity in the United

States, secured benefi cial long-term power

contracts and produced fi rst metal ahead of

schedule from the smelter coming online in

Saudi Arabia, which will be the lowest-cost

smelter in the world. We are also improving

margins in the Primary Metals segment by

converting more of the output from our cast

houses to value-add products, resulting in a

65% increase in value-add volume to external

customers and a 51% profi t increase since

2009.

Every year, more than 200 teams of Alcoa employees are nominated

for extraordinary achievements producing substantial business

results. The teams compete for Alcoa Impact Awards in six

categories, and the winners are recognized at the annual Alcoa

Leadership Conference.

A team from Alcoa Global Primary Products in Europe won the

2012 Alcoa Impact Award in the Asset Management category for

implementing a project to improve forecasting accuracy and free

cash fl ow. The project resulted in a $67 million improvement in

accounts receivable.

Primary Metals

By driving the fl at-rolled portfolio to higher

value-add products and growing market

share, our Global Rolled Products (GRP)

business achieved a 35% increase in after-tax

operating income (ATOI) and a 19% increase in

adjusted EBITDA per metric ton, another year

of historically high returns. GRP continues to

make progress against its three-year $2.5billion

organic revenue growth target. We expect

to achieve $1.5 billion targeted growth from

regions, new customers, share gains, new

products and innovation by the end of 2013.

The remaining organic revenue growth depends

on the LME metal price and end-market

growth. To accelerate future growth, we are

expanding our Davenport, Iowa, facility to

meet demand as the U.S. automotive industry

shifts to aluminum to achieve light weighting

and signifi cantly higher fuel effi ciency. We are

also building a rolling mill in Saudi Arabia to

produce sheet for packaging, automotive,

building and construction and foil with our

joint venture partner, Ma’aden. This will be

an integral part of the lowest-cost aluminum

complex in the world.

Global Rolled Products

After using the downturn to reposition its

portfolio, reduce costs and prepare for

profi table growth, this segment continues to win

new business and improve adjusted EBITDA

margins year-over-year. Our downstream

businesses increased ATOI by 14% in 2012

and achieved a full-year record high 19.2%

adjusted EBITDA margin, which is more than

double the margins of 10 years ago. With

organic revenue growth of $180 million in

2012, we made progress toward our three-

year $1.6 billion revenue growth target for our

fi ve industry-leading downstream business

units. By the end of 2013, we expect $1.0

billion in targeted growth from regions, new

customers, share gains, new products and

innovation. The remaining organic growth will

depend on end-market growth.

Engineered Products and Solutions

Alcoa is expanding the rolling mill at Davenport, Iowa, to produce

aluminum coils for an automotive market shifting from steel to aluminum.

Alcoa aluminum is the metal of choice for building durable structures and

striking designs for buildings like this Cancer Center in Cleveland, Ohio.

GRP: GROWING PROFITABILITY

AT RECORD LEVELS

0

50

100

150

200

250

300

350

400

$X.X

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

273 253 249

276

226

201

108 119

314 327

390

Adjusted EBITDA/MT 10-YR

Average

~ $235/MT

$

PRIMARY METALS:

COST CURVE DOWN 4% POINTS

0

500

1,000

1,500

2,000

2,500

3,000

3,500

20,000 40,000 60,0000

Alcoa 2012

47th

Percentile Alcoa 2010

51st

Percentile

Alcoa 2015

41st

Percentile

ALUMINUM COST CURVE

CUMULATIVE PRODUCTION (000MT)

-10 points

$/mt

ALUMINA: COST CURVE HOLDING STEADY

0

100

200

300

400

500

600

700

100,00080,00060,00040,00020,0000120,000

Alcoa 2015

23rd

Percentile

Alcoa 2012

30th

Percentile

Alcoa 2010

30th

Percentile

ALUMINA COST CURVE

CUMULATIVE PRODUCTION (000MT)

-7 points

$/mt

EPS: RECORD MARGINS EXCEEDING

HISTORICAL LEVELS

0

5

10

15

20

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

89

12 11 12 13

15

13

17 18 19

Adjusted EBITDA Margin

%