Alcoa 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ALCOA 2012 Annual Report2

When increases in the cost of energy, raw materials, labor and pensions, among others,

were added to the net impact of the aluminum price decline and foreign currency movements,

the total negative impact to Alcoa’s 2012 income from continuing operations was $1.6 billion.

Fortunately, we were able to stay on course by following the three strategic priorities we

committed to in 2007: profi table growth, the Alcoa Advantage and disciplined execution.

One of the main examples of disciplined execution continues to be our Cash Sustainability

Program initiatives. We used this approach successfully during the 2009 economic crisis to

reduce costs, improve productivity and generate cash; and we have made it part of our way

of doing business ever since. Thanks to the rigorous execution of those initiatives by every

Alcoa employee, and improvements in volume, price and mix, we offset the cost headwinds

and more than 35% of the net market impact of LME price and foreign currency movements.

After four consecutive years of achieving our cash sustainability targets, Alcoa is in a signifi cantly

stronger liquidity position than it was four years ago. We achieved free cash fl ow of $236 million

by capturing productivity improvements, managing total spend of capital expenditures and

reducing days working capital to a record low. Nowhere has the hard work and achievements

of Alcoans been more evident than in driving down days working capital by nearly 45% in the

last four years. We ended the year with less debt and a strong cash position, resulting in the

lowest year-end net debt level since 2006.

By successfully addressing the factors that we can control – operational, commercial and

fi nancial – we were able to compensate for the impact of those beyond Alcoa’s infl uence:

the economic and political volatility affecting our industry coupled with the decline in the LME

price of aluminum.

Offsetting price declines, we held steady on the refi ning cost curve by

capturing $190 million in productivity improvements and by curtailing

390,000 metric tons per year of high-cost refi nery capacity. To reach

our goal of moving seven points down the cost curve by 2015, we will

be optimizing our refi nery portfolio, moving to less expensive energy,

sustaining existing cost reductions and bringing on line the Ma’aden-

Alcoa joint venture refi nery in Saudi Arabia. We are also increasing

margins by shifting the pricing of smelter-grade alumina to an Alumina

Price Index (API) that better refl ects market fundamentals than the

LME. We increased external sales of API or spot-priced smelter-grade

alumina to approximately 40% in the fourth quarter of 2012, a jump

of 12 percentage points over the previous year. In 2013, we forecast

that on average 48% of our external smelter-grade alumina sales will

be priced against the API or spot price.

Alumina

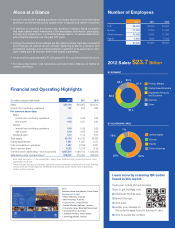

FINANCIAL PERFORMANCE

REDUCED DAYS WORKING CAPITAL

TO RECORD LEVELS

2008 2009 2010 2011 2012

43

33

30

27

24

-3 days

EXCEEDED PRODUCTIVITY* GAIN TARGETS

2009 2010 2011 2012 Total

2,410

742

1,099

1,291 5,542

$850

target for

2012

$ in millions

DISCIPLINED CAPITAL AND INVESTMENT SPEND

Capital Expenditures

2008 2009 2010 2011 2012

3,438

1,622

1,015

1,287 1,261

Saudi Arabia JV*

2010 2011 2012

160

249

177

$ in millions

REDUCED NET DEBT BY 29% SINCE 2008

2008 2009 2010 2011 2012

Cash Net Debt Debt to Cap

10,578

9,819

9,165 9,371 8,829

9,816

762

1,481

8,338 7,622 7,432 6,968

1,543 1,939 1,861

34.8%

35.3%

34.9%

38.7%

42.5%

$ in millions

Following the refi ning process,

alumina is shipped from

dedicated port facilities

to Alcoa’s smelters

and customers.

2011 LME

-$885

Market

+$1,005

Performance

-$670

Cost Headwinds

Currency Volume Price/Mix Productivity Energy Raw

Materials

Cost Increases/

Other

2012

-200

40

280

520

760

1,000

812 1,014

129

92

127

786 91

20

559

262

INCOME FROM CONTINUING OPERATIONS EXCLUDING RESTRUCTURING & OTHER SPECIAL ITEMS

$ in millions

* All fi gures are pretax and pre-minority interest. 2009/2010 represent net

productivity; 2011/2012 represent gross productivity.

* Includes spend related to the rolling mill automotive expansion project.