Alcoa 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ALCOA 2012 Annual Report 1

s a young boy growing up in a harbor town not far from the North

Sea coast, Iwas intrigued by adventure stories about sea captains and

explorers. Stormy seas, dangerous currents and stubborn headwinds

seemed to be part of their daily lives. Uncertain what the next day would

bring, they always had to be ready to respond quickly and confi dently.

No matter how bad things were, the call from the ship’s bridge, “Steady

as she goes!” kept the crew focused on their work as they dealt with the

dangers and uncertainties of their voyage.

That image of plowing through stormy seas came to mind as I thought of

the theme for this year’s shareholder report. For Alcoa in 2012, “steady

as she goes” was the call to action as we worked to keep the Company

on course in the face of major headwinds and market turbulence. We

succeeded because we had a strong team of Alcoans that had been

tested in the economic crisis of 2009. We succeeded because our

businesses leveraged Alcoa’s unique strengths and staying power to

gain advantages that none of their competitors enjoy. We succeeded

because we stayed focused on what we do best: create value for our

customers and manage well those operational and fi nancial factors we

can control.

Despite exceeding our 2012 goals and outperforming many of our peers,

it is disappointing that factors we cannot control resulted in barely any

appreciation in our stock price. The threat of the U.S. fi scal cliff, the worry over defaults in several European countries, and a once-

in-a-century leadership change in China all created tremendous business uncertainty. It’s not surprising that economic and political

volatility had a major impact on an industry that provides a metal that is vital to so many other industries. It also created volatility in the

price of aluminum, which trades as a commodity on the London Metal Exchange (LME) and which has become a proxy for uncertainty

in the world economy. Building on the sharp decline in the LME price in 2011, the average LME price dropped 16% further in 2012

and had several swings of more than 30%. That aluminum price volatility and decline had a $1 billion negative impact on Alcoa’s 2012

results, created signifi cant headwinds for our businesses and had a major impact on the stock price of Alcoa and our aluminum peers.

“

STEADY PROGRESS

IN VOLATILE TIMES

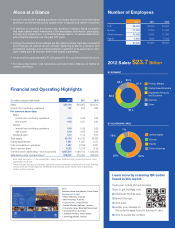

Income from continuing operations of $191 million, or $0.18

per share

Excluding impact of special items, income from continuing

operations of $262 million, or $0.24 per share

Revenue of $23.7 billion, despite lower metal prices

Adjusted EBITDA of $2.0 billion

Cash from operations of $1.5 billion; free cash ow of

$236 million

Days working capital an all-time record low of 24 days

Debt-to-capital of 34.8%

Strong cash on hand of $1.9 billion

Reduced net debt more than $450 million; year-end balance

29% lower than 2008

Achieved cash sustainability targets for the fourth consecutive

year

Each of our four business segments contributed to our 2012

nancial performance and made substantial progress toward

their long-term organic growth and pro tability goals.

YEAR END FINANCIAL RESULTS*

* See Calculation of Financial Measures, at the end of this report for reconciliations

of certain non-GAAP financial measures (adjusted income, adjusted EBITDA, free

cash flow, and net debt amounts) presented in this letter.

Klaus Kleinfeld

Chairman of the Board

and Chief Executive Offi cer

A