Alcoa 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Steady Progress

in Volatile Times

2012 Annual Report

Table of contents

-

Page 1

Steady Progress in Volatile Times 2012 Annual Report -

Page 2

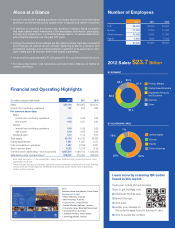

... at twitter.com/Alcoa. Europe Other Americas Paciï¬c 2012 Sales: $23.7 Billion BY SEGMENT $3.1 $0.3 $7.4 Primary Metals Global Rolled Products Financial and Operating Highlights $5.5 $ in millions, except per-share amounts Engineered Products and Solutions Alumina Other 2012 $23,700 191... -

Page 3

...long-term organic growth and profitability goals. * See Calculation of Financial Measures, at the end of this report for reconciliations of certain non-GAAP financial measures (adjusted income, adjusted EBITDA, free cash flow, and net debt amounts) presented in this letter. ALCOA 2012 Annual Report... -

Page 4

... the previous year. In 2013, we forecast that on average 48% of our external smelter-grade alumina sales will be priced against the API or spot price. Following the reï¬ning process, alumina is shipped from dedicated port facilities to Alcoa's smelters and customers. 2 ALCOA 2012 Annual Report -

Page 5

...1,500 ALUMINUM COST CURVE Alcoa 2012 47th Percentile Alcoa 2010 51st Percentile -10 points Global Rolled Products By driving the ï¬,at-rolled portfolio to higher value-add products and growing market share, our Global Rolled Products (GRP) business achieved a 35% increase in after-tax operating... -

Page 6

... proï¬table Northern European smelters in Alcoa's Primary Metals portfolio. In China, we are developing plans with our new joint venture partner, China Power Investment Corporation (CPI), for expansion in the world's fastest-growing market. We are shifting our rolling business to focus on the... -

Page 7

... - creating an unbeatable competitive edge for Alcoa's businesses and unmatched value for Alcoa's customers. That parental advantage consists of ï¬ve major levers. OPERATING SYSTEM The productivity and working capital savings that enabled Alcoa's businesses to manage costs and cash despite the... -

Page 8

... our long-term strategy, driving proï¬table growth by improving our cost competitiveness, growing in our strong end markets and gaining share through product innovation. We remain focused on annual ï¬nancial targets with the overarching goal of positive free cash ï¬,ow regardless of metal price... -

Page 9

... speeds and rate, which allows for reduced drilling time and cost. For many long wells, this process can save days of drilling time for signiï¬cant savings to our customers. Lightweight aluminum drill pipes are decreasing the time and cost of drilling for oil and gas. ALCOA 2012 Annual Report 7 -

Page 10

... smelting engineers and energy specialists have also found ways to reduce our energy costs while beneï¬tting the community through a partnership with the regional electric grid operator. At our Warrick smelter near Evansville, Indiana, we continuously adjust power consumption by reducing production... -

Page 11

...No.) 390 Park Avenue, New York, New York 10022-4608 (Address of principal executive offices) (Zip code) Registrant's telephone numbers: Investor Relations 212) 836-2674 Office of the Secretary--------(212) 836-2732 Securities registered pursuant to Section 12(b) of the Act: Name of each exchange on... -

Page 12

EXPLANATORY NOTE Alcoa Inc. (the "Registrant") is filing this Amendment No. 1 on Form 10-K/A ("Form 10-K/A") to its Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed with the Securities and Exchange Commission on February 15, 2013 (the "Original Filing"), for the sole ... -

Page 13

.... Item 14. Part IV Item 15. Exhibits, Financial Statement Schedules ...162 172 Signatures ...Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and... -

Page 14

...traded on the London Metal Exchange (LME) and priced daily. Aluminum and alumina represent more than 80% of Alcoa's revenues, and the price of aluminum influences the operating results of Alcoa. Non-aluminum products include precision castings and aerospace and industrial fasteners. Alcoa's products... -

Page 15

... exchange rates and interest rates, affect the results of operations in these countries. Alcoa's operations consist of four worldwide reportable segments: Alumina, Primary Metals, Global Rolled Products, and Engineered Products and Solutions. Description of the Business Information describing Alcoa... -

Page 16

...low in relation to annual production levels, they are consistent with historical levels of reserves for our mining locations. Given the Company's extensive bauxite resources, the abundant supply of bauxite globally and the length of the Company's rights to bauxite, it is not cost-effective to invest... -

Page 17

... and/or Alcoa share (proportion) of reserve and annual production tonnage. This entity is part of the AWAC group of companies and is owned 60% by Alcoa and 40% by Alumina Limited. AlumÃnio is owned 100% by Alcoa. Brazilian mineral legislation does not establish the duration of mining concessions... -

Page 18

... LLC purchase bauxite from MRN under long-term supply contracts. AWA LLC owns a 45% interest in Halco (Mining), Inc. Halco owns 100% of Boké Investment Company, a Delaware company, which owns 51% of CBG. The Guinean Government owns 49% of CBG, which has the exclusive right through 2038 to develop... -

Page 19

... tonnage in this declaration is AWAC share only (25.1%). The Al Ba'itha Mine is due to begin production during 2014. Brazil-Trombetas-MRN: Declared reserves are as of May 31, 2012. Declared and annual production tonnages reflect the total for AluminÃo and AWAC shares (18.2%). Declared tonnages are... -

Page 20

... for administration and services; workshops; power distribution; water supply; crushers; long distance conveyors. Mines and facilities are operating. Mining offices and services are located at the refinery. Numerous small deposits are mined by contract miners and the ore is trucked to either the... -

Page 21

...Production is to begin in 2014. The company will generate electricity at the mine site from fuel oil. The mine will include fixed plants for crushing and train loading; workshops and ancillary services; power plant; water supply. There will be a company village with supporting facilities. The mine... -

Page 22

...the joint venture. Alcoa owns a 25.1% interest in the smelter and rolling mill, with the AWAC group holding a 25.1% interest in the mine and refinery. For additional information regarding the joint venture, see the Equity Investments section of Note I to the Consolidated Financial Statements in Part... -

Page 23

... (Alumar) Jamaica Spain Suriname United States TOTAL 1 Owners (% of Ownership) AofA3 (100%) AofA (100%) AofA (100%) AlumÃnio4 (100%) AWA Brasil3 (39%) Rio Tinto Alcan Inc.5 (10%) AlumÃnio (15%) BHP Billiton5 (36%) Jamalco Alcoa Minerals of Jamaica, L.L.C.3 (55%) Clarendon Alumina Production Ltd... -

Page 24

... of a secure long-term energy supply in Western Australia. These constraints continue and as such the project remains under suspension. In May 2012, the Government of Western Australia granted Alcoa a 5 year extension of the 2006 environmental approval. In 2008, AWAC signed a cooperation... -

Page 25

... and Capacity The Company's primary aluminum smelters and their respective capacities are shown in the following table: Alcoa Worldwide Smelting Capacity Alcoa Nameplate Consolidated Capacity1 Capacity2 (000 MTPY) (000 MTPY) 190 1903 Country Australia Facility Point Henry Portland Brazil Po... -

Page 26

...conditions. In January 2012, Alcoa announced that it would permanently shut down the 215,000 mtpy facility as part of a larger strategy to improve its cost position and competitiveness. Demolition and remediation are ongoing. In January 2011, Alcoa and China Power Investment Corporation (CPI) signed... -

Page 27

... Government and a resulting long term power purchase agreement. Global Rolled Products The principal business of the Company's Global Rolled Products segment is the production and sale of aluminum plate, sheet and foil. This segment includes rigid container sheet, which is sold directly to customers... -

Page 28

... investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used in the aerospace, automotive, building and construction, commercial transportation, and power generation markets. These products are sold directly to customers... -

Page 29

... Forgings Fasteners Extrusions and Forgings Extrusions and Forgings Extrusions Architectural Products Aerospace and Industrial Gas Turbine Castings/ Alloy Fasteners Fasteners Architectural Products Fasteners China France Germany Hungary Japan Netherlands Mexico Morocco Russia South Korea Spain... -

Page 30

... Industrial Gas Turbine Castings 1 2 Facilities with ownership described as "Alcoa (100%)" are either leased or owned by the Company. The operating results of this facility are reported in the Global Rolled Products segment. Corporate Facilities The Latin American soft alloy extrusions business... -

Page 31

...2012 for each of the Company's reportable segments are listed below. Alumina Bauxite Caustic soda Electricity Fuel oil Lime (CaO) Natural gas Primary Metals Alloying materials Alumina Aluminum fluoride Calcined petroleum coke Cathode blocks Electricity Liquid pitch Natural gas Global Rolled Products... -

Page 32

...of the Company's total alumina refining production costs. Electric power accounts for approximately 26% of the Company's primary aluminum production costs. Alcoa generates approximately 20% of the power used at its smelters worldwide and generally purchases the remainder under long-term arrangements... -

Page 33

... 2012, Alcoa and the Bonneville Power Administration (BPA) operated under a contract providing for the sale of physical power to the Intalco smelter at the Northwest Power Act mandated industrial firm power (IP) rate. On January 1, 2013, a new contract executed between Alcoa and BPA became effective... -

Page 34

... amended and restated in 2012, and expires December 31, 2015. The contract includes a provision for follow-on service at the then current rate schedule for industrial customers. Australia - Electricity Power is generated from extensive brown coal deposits covered by a long-term mineral lease held by... -

Page 35

... purchased electricity for its smelters at Portovesme and Fusina, Italy under a power supply structure approved by the European Commission (EC) in 1996. That measure provided a competitive power supply to the primary aluminum industry and was not considered state aid from the Italian Government... -

Page 36

... 2012, Iceland extended the energy consumption tax though 2015. North America - Natural Gas In order to supply its refineries and smelters in the U.S. and Canada, Alcoa generally procures natural gas on a competitive bid basis from a variety of sources including producers in the gas production areas... -

Page 37

...'s competitive position depends, in part, on the Company's access to an economical power supply to sustain its operations in various countries. Research and Development Alcoa, a technology leader in the aluminum industry, engages in research and development programs that include process and product... -

Page 38

... it). Energy saving sensing devices are being integrated in Company manufacturing plants. Integrated thermal management products for consumer electronics have been developed and are being validated by our customers. A number of products were commercialized in 2012 including new fasteners, aluminum... -

Page 39

... in Alcoa's Australian smelting, rolling, extrusion, foil and alumina businesses and Alcoa's corporate office. Mr. Bottger was Chief Financial Officer of Alcoa's Engineered Products and Solutions business group from 2005 to August 2010. From 2003 to 2005, he was Vice President, Sales, for Alcoa Home... -

Page 40

... analysis and planning and as director of investor relations. He also has had major assignments in the Company's largest business, Global Primary Products, including controller, operational excellence director, chief financial officer, and his most recent position as chief operating officer. Item 1A... -

Page 41

...conditions and aluminum end-use markets. Alcoa sells many products to industries that are cyclical, such as the commercial construction and transportation industries, and the demand for our products is sensitive to, and quickly impacted by, demand for the finished goods manufactured by our customers... -

Page 42

... costs rise or if energy supplies are interrupted. Alcoa's operations consume substantial amounts of energy. Although Alcoa generally expects to meet the energy requirements for its alumina refineries and primary aluminum smelters from internal sources or from long-term contracts, certain conditions... -

Page 43

... Arabian Mining Company, to develop a fully integrated aluminum complex (including a bauxite mine, alumina refinery, aluminum smelter and rolling mill) in the Kingdom of Saudi Arabia. In November 2012, Alcoa and China Power Investment Corporation (CPI) established a joint venture company to produce... -

Page 44

... securities, or otherwise impair its business, financial condition and results of operations. Alcoa's long-term debt is currently rated BBB- with stable outlook by Standard and Poor's Ratings Services and BBBwith stable outlook by Fitch Ratings. Moody's Investors Services rates Alcoa's long-term... -

Page 45

... and growth capital projects. Over the long term, Alcoa's ability to take advantage of improved aluminum market conditions may be constrained by earlier capital expenditure restrictions, and the long-term value of its business could be adversely impacted. The Company's position in relation to... -

Page 46

...significant legal proceedings or investigations adverse to Alcoa. The Company may experience a change in effective tax rates or become subject to unexpected or rising costs associated with business operations or provision of health or welfare benefits to employees due to changes in laws, regulations... -

Page 47

... in which Alcoa operates. The Company may realize increased capital expenditures resulting from required compliance with revised or new legislation or regulations, costs to purchase or profits from sales of, allowances or credits under a "cap and trade" system, increased insurance premiums and... -

Page 48

...in the discount rate or lower-than-expected investment returns on plan assets could have a material negative effect on our cash flows. Adverse capital market conditions could result in reductions in the fair value of plan assets and increase the Company's liabilities related to such plans, adversely... -

Page 49

... office is located at 390 Park Avenue, New York, New York 10022-4608. Alcoa's corporate center is located at 201 Isabella Street, Pittsburgh, Pennsylvania 15212-5858. The Alcoa Technical Center for research and development is located at 100 Technical Drive, Alcoa Center, Pennsylvania 15069. Alcoa... -

Page 50

... former employees of Alcoa or Reynolds Metals Company and spouses and dependents of such retirees alleging violation of the Employee Retirement Income Security Act (ERISA) and the Labor-Management Relations Act by requiring plaintiffs, beginning January 1, 2007, to pay health insurance premiums... -

Page 51

... offered Alba a long-term alumina supply contract. Based on the cash offer, Alcoa recorded a $45 million ($18 million after-tax and noncontrolling interest) charge in the 2012 second quarter representing Alcoa's estimate of the minimum end of the range probable to settle the case, and estimated an... -

Page 52

...As previously reported, on March 6, 2009, the Philadelphia Gas Works Retirement Fund filed a shareholder derivative suit in the civil division of the Court of Common Pleas of Philadelphia County, Pennsylvania. This action was brought against certain officers and directors of Alcoa claiming breach of... -

Page 53

... tariff in 2005, Alcoa had been operating in Italy for more than 10 years under a power supply structure approved by the EC in 1996. That measure provided a competitive power supply to the primary aluminum industry and was not considered state aid from the Italian Government. The EC's announcement... -

Page 54

... state aid rules. At the time the EC opened its investigation, Alcoa had been operating in Spain for more than nine years under a power supply structure approved by the Spanish Government in 1986, an equivalent tariff having been granted in 1983. The investigation is limited to the year 2005 and is... -

Page 55

... tribe, acting in their capacities as trustees for natural resources (Trustees), have asserted that Alcoa and Reynolds Metals Company (Reynolds) may be liable for loss or damage to such resources under federal and state law based on Alcoa's and Reynolds' operations at their Massena, New York and St... -

Page 56

... reported, in 1996, Alcoa acquired the Fusina, Italy smelter and rolling operations and the Portovesme, Italy smelter (both of which are owned by Alcoa's subsidiary, Alcoa Trasformazioni S.r.l.) from Alumix, an entity owned by the Italian Government. Alcoa also acquired the extrusion plants located... -

Page 57

... of a drinking water aquifer by Alcoa, certain of the entities that preceded Alcoa at the same locations as property owners and/or operators, and other current and former industrial and manufacturing businesses that operated in Orange County in past decades. OCWD seeks to recover the cost of aquifer... -

Page 58

.... Remaining in the case at this time are common law trespass and nuisance claims for a Phase 2 trial which has not been scheduled. OCWD has asserted a total remedy cost of at least $150 million plus attorneys' fees; however the amount in controversy at this stage is limited to sums already expended... -

Page 59

... statute of limitations. Other Contingencies In addition to the matters discussed above, various other lawsuits, claims, and proceedings have been or may be instituted or asserted against Alcoa, including those pertaining to environmental, product liability, safety and health, and tax matters. While... -

Page 60

...'s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. The Company's common stock is listed on the New York Stock Exchange where it trades under the symbol AA. The Company's quarterly high and low trading stock prices and dividends per common share for 2012 and 2011... -

Page 61

... 31, 2007 2008 2009 2010 2011 2012 Alcoa Inc. $100 $32 $47 $45 $26 $ 26 ® S&P 500 Index 100 63 80 92 94 109 S&P 500® Materials Index 100 54 81 99 89 102 Copyright© 2013 Standard & Poor's, a division of The McGraw-Hill Companies Inc. All rights reserved. Source: Research Data Group, Inc. (www... -

Page 62

... traded on the London Metal Exchange (LME) and priced daily. Aluminum and alumina represent more than 80% of Alcoa's revenues, and the price of aluminum influences the operating results of Alcoa. Nonaluminum products include precision castings and aerospace and industrial fasteners. Alcoa's products... -

Page 63

... demand over 2012 with China (11%) and India (9%) expected to have the highest growth rates in 2013. However, added production, along with few industry-wide capacity curtailments, will result in supply slightly exceeding demand for primary aluminum. For alumina, growth in global consumption is... -

Page 64

... innovative solutions to meet a wide-range of customer needs, as well as expansion of aluminum lithium capabilities in Lafayette, IN to meet the growing demand in the aerospace market and the opening of a forged wheels facility in Suzhou, China that will serve the commercial transportation market... -

Page 65

... long-term power solution; changed market fundamentals; cost competitiveness; required future capital investment; and restart costs. Also, at the end of 2011, management approved a partial or full curtailment of three European smelters as follows: Portovesme, Italy (150 kmt-per-year); Avilés, Spain... -

Page 66

... (390 in the Engineered Products and Solutions segment, 250 in the Primary Metals segment, 85 in the Alumina segment, and 75 in Corporate), including $10 ($7 after-tax) for the layoff of an additional 170 employees related to the previously reported smelter curtailments in Spain (see 2011 Actions... -

Page 67

... economically viable, long-term power solution; changed market fundamentals; cost competitiveness; required future capital investment; and restart costs. The asset impairments of $127 represent the write off of the remaining book value of properties, plants, and equipment related to these facilities... -

Page 68

... market fundamentals, cost competitiveness, other existing idle capacity, required future capital investment, and restart costs, as well as the elimination of ongoing holding costs. The asset impairments of $127 represent the write off of the remaining book value of properties, plants, and equipment... -

Page 69

...-to-market derivative contracts, a gain of $43 from the sale of land in Australia, and higher equity income from an investment in a natural gas pipeline in Australia due to the recognition of a discrete income tax benefit by the consortium (Alcoa World Alumina and Chemicals' share of the benefit was... -

Page 70

... reportable segments: Alumina, Primary Metals, Global Rolled Products, and Engineered Products and Solutions. Segment performance under Alcoa's management reporting system is evaluated based on a number of factors; however, the primary measure of performance is the after-tax operating income... -

Page 71

... operations and consists of the Company's worldwide refinery system, including the mining of bauxite, which is then refined into alumina. Alumina is mainly sold directly to internal and external smelter customers worldwide or is sold to customers who process it into industrial chemical products... -

Page 72

... when this segment purchases metal from external or internal sources and resells such metal to external customers or the midstream and downstream segments in order to maximize smelting system efficiency and to meet customer requirements. In November 2012, Alcoa completed the sale of its 351-megawatt... -

Page 73

... Alcoa's midstream operations, whose principal business is the production and sale of aluminum plate and sheet. A small portion of this segment's operations relate to foil produced at one plant in Brazil. This segment includes rigid container sheet (RCS), which is sold directly to customers... -

Page 74

... investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used in the aerospace, automotive, building and construction, commercial transportation, and power generation markets. These products are sold directly to customers... -

Page 75

... compared with 2010, principally the result of the previously mentioned volume impacts and net productivity improvements across most businesses, somewhat offset by unfavorable price/product mix. In 2013, the aerospace end market is expected to remain strong, while the commercial transportation and... -

Page 76

... analysis of long-term liquidity, see Contractual Obligations and Off-Balance Sheet Arrangements. At December 31, 2012, cash and cash equivalents of Alcoa was $1,861, of which $659 was held outside the U.S. Alcoa has a number of commitments and obligations related to the Company's growth strategy in... -

Page 77

...an increase in certain environmental reserves of $194, higher accrual for pension plans, and an increase in deferred revenue related to a contract to deliver sheet and plate to a customer beginning in 2014. In June 2012, Alcoa received formal notification from the Italian Government requesting a net... -

Page 78

... the loans that support the Estreito hydroelectric power project in Brazil. As a result of an agreement between Alcoa and Alumina Limited in September 2012, Alcoa of Australia (part of the AWAC group of companies) will make minimum dividend payments to Alumina Limited of $100 in 2013. On July 25... -

Page 79

... will be to provide working capital and for other general corporate purposes, including contributions to Alcoa's pension plans ($561 was contributed in 2012). The two term loans were fully drawn on the same dates as the agreements and were subject to an interest rate equivalent to the 1-month... -

Page 80

... project and Juruti bauxite mine development; $374 in additions to investments, mostly for the equity contributions of $249 related to the aluminum complex joint venture in Saudi Arabia and purchase of $41 in available-for-sale securities held by Alcoa's captive insurance company; and $239 (net of... -

Page 81

... tax positions Financing activities: Total debt Dividends to shareholders Investing activities: Capital projects Equity contributions Payments related to acquisitions Totals Obligations for Operating Activities Energy-related purchase obligations consist primarily of electricity and natural gas... -

Page 82

... using current assumptions for discount rates, long-term rate of return on plan assets, rate of compensation increases, and health care cost trend rates, among others. The minimum required contributions for pension funding are estimated to be $460 for 2013, $575 for 2014, $535 for 2015, $465... -

Page 83

..., Alcoa signed an agreement to enter into a joint venture to develop a new aluminum complex in Saudi Arabia, comprised of a bauxite mine, alumina refinery, aluminum smelter, and rolling mill, which will require the Company to contribute approximately $1,100 over a five-year period (2010 through 2014... -

Page 84

...; the testing of goodwill, equity investments, and properties, plants, and equipment for impairment; estimating fair value of businesses to be divested; pension plans and other postretirement benefits obligations; stock-based compensation; and income taxes. Management uses historical experience and... -

Page 85

... Primary Metals segment, the Global Rolled Products segment, and the soft alloy extrusions business in Brazil, which is included in Corporate. Almost 90% of Alcoa's total goodwill is allocated to three reporting units as follows: Alcoa Fastening Systems (AFS) ($1,160) and Alcoa Power and Propulsion... -

Page 86

... markets and market share, sales volumes and prices, costs to produce, tax rates, capital spending, discount rate, and working capital changes. Most of these assumptions vary significantly among the reporting units. Cash flow forecasts are generally based on approved business unit operating plans... -

Page 87

... in the long-term demand for aluminum; substantial reductions in Alcoa's end markets and volume assumptions; and an increase in discount rates. As part of the 2012 annual review of goodwill, management considered the market capitalization of Alcoa's common stock in relation to the Company's total... -

Page 88

... and incorporate significant assumptions, including the interest rate used to discount the future estimated liability, the expected long-term rate of return on plan assets, and several assumptions relating to the employee workforce (salary increases, health care cost trend rates, retirement age, and... -

Page 89

... prior service costs. Additionally, in 2010, a charge of $2 was recorded in accumulated other comprehensive loss due to the reclassification of deferred taxes related to the Medicare Part D prescription drug subsidy. Stock-based Compensation. Alcoa recognizes compensation expense for employee equity... -

Page 90

... be applicable under relevant tax law until such time that the related tax benefits are recognized. Related Party Transactions Alcoa buys products from and sells products to various related companies, consisting of entities in which Alcoa retains a 50% or less equity interest, at negotiated arms... -

Page 91

...over financial reporting for the Company. In order to evaluate the effectiveness of internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act, management has conducted an assessment, including testing, using the criteria in Internal Control- Integrated Framework... -

Page 92

... of Independent Registered Public Accounting Firm To the Shareholders and Board of Directors of Alcoa Inc. In our opinion, the accompanying consolidated balance sheets and the related statements of consolidated operations, consolidated comprehensive (loss) income, changes in consolidated equity, and... -

Page 93

Alcoa and subsidiaries Statement of Consolidated Operations (in millions, except per-share amounts) For the year ended December 31, Sales (Q) Cost of goods sold (exclusive of expenses below) Selling, general administrative, and other expenses Research and development expenses Provision for ... -

Page 94

...loss) income, net of tax: Change in unrecognized net actuarial loss and prior service cost/benefit related to pension and other postretirement benefits (W) Foreign currency translation adjustments (A) Unrealized gains on available-for-sale securities (I): Unrealized holding gains (losses) Net amount... -

Page 95

..., plants, and equipment, net (H) Goodwill (E) Investments (I) Deferred income taxes (T) Other noncurrent assets (J) Total Assets Liabilities Current liabilities: Short-term borrowings (K & X) Commercial paper (K & X) Accounts payable, trade Accrued compensation and retirement costs Taxes, including... -

Page 96

... and other charges (D) Net gain from investing activities-asset sales (O) Loss from discontinued operations (B) Stock-based compensation (R) Excess tax benefits from stock-based payment arrangements Other Changes in assets and liabilities, excluding effects of acquisitions, divestitures, and foreign... -

Page 97

... dividends declared: Preferred @ $3.75 per share Common @ $0.12 per share Stock-based compensation (R) Common stock issued: compensation plans (R) Issuance of common stock (R) Distributions Contributions (M) Purchase of equity from noncontrolling interest (P) Other (P) Balance at December 31, 2010... -

Page 98

... the weighted-average useful lives of structures and machinery and equipment by reporting segment (numbers in years): Segment Alumina: Alumina refining Bauxite mining Primary Metals: Aluminum smelting Power generation Global Rolled Products Engineered Products and Solutions Structures 30 33 35 34 32... -

Page 99

... Primary Metals segment, the Global Rolled Products segment, and the soft alloy extrusions business in Brazil, which is included in Corporate. Almost 90% of Alcoa's total goodwill is allocated to three reporting units as follows: Alcoa Fastening Systems (AFS) ($1,160) and Alcoa Power and Propulsion... -

Page 100

... operations and shareholders' equity. During the 2012 annual review of goodwill, management proceeded directly to the two-step quantitative impairment test for three reporting units as follows: the Primary Metals segment, the Alumina segment, and the Global Rolled Products segment. For Global Rolled... -

Page 101

... intangible assets by reporting segment (numbers in years): Segment Alumina Primary Metals Global Rolled Products Engineered Products and Solutions Software 10 9 10 9 Other intangible assets 36 13 19 Equity Investments. Alcoa invests in a number of privately-held companies, primarily through joint... -

Page 102

...to the customer during the term of the contracts. Deferred revenue is included in Other current liabilities and Other noncurrent liabilities and deferred credits on the accompanying Consolidated Balance Sheet. Environmental Matters. Expenditures for current operations are expensed or capitalized, as... -

Page 103

... period that such interest and penalties would be applicable under relevant tax law until such time that the related tax benefits are recognized. Stock-Based Compensation. Alcoa recognizes compensation expense for employee equity grants using the nonsubstantive vesting period approach, in which the... -

Page 104

... for Alcoa's operations is made based on the appropriate economic and management indicators. Effective January 1, 2010, the functional currency of a subsidiary located in Brazil (that is part of Alcoa World Alumina and Chemicals, which is 60% owned by Alcoa and 40% owned by Alumina Limited) was... -

Page 105

... businesses following their divestiture, primarily in the form of equity participation, or ongoing aluminum or other significant supply contracts. Recently Adopted Accounting Guidance. Fair Value Accounting-On January 1, 2012, Alcoa adopted changes issued by the Financial Accounting Standards Board... -

Page 106

... to become effective for Alcoa for any goodwill impairment test performed on January 1, 2012 or later; however, early adoption is permitted. Alcoa elected to early adopt these changes in conjunction with management's annual review of goodwill in the fourth quarter of 2011 (see the Goodwill and Other... -

Page 107

... from customers and Short-term borrowings on the accompanying Consolidated Balance Sheet. Effective January 1, 2010, Alcoa adopted changes issued by the FASB on February 24, 2010 to accounting for and disclosure of events that occur after the balance sheet date but before financial statements are... -

Page 108

... ("Tapoco"), along with an allocation of goodwill from the Primary Metals reporting unit, were classified as held for sale as of December 31, 2011. In June 2012, management committed to a plan to sell the assets, consisting of properties, plants, and equipment and intangible assets, of Tapoco. As... -

Page 109

...and deferred credits on the accompanying Consolidated Balance Sheet. C. Asset Retirement Obligations Alcoa has recorded AROs related to legal obligations associated with the normal operations of bauxite mining, alumina refining, and aluminum smelting facilities. These AROs consist primarily of costs... -

Page 110

... (390 in the Engineered Products and Solutions segment, 250 in the Primary Metals segment, 85 in the Alumina segment, and 75 in Corporate), including $10 ($7 after-tax) for the layoff of an additional 170 employees related to the previously reported smelter curtailments in Spain (see 2011 Actions... -

Page 111

... economically viable, long-term power solution; changed market fundamentals; cost competitiveness; required future capital investment; and restart costs. The asset impairments of $127 represent the write off of the remaining book value of properties, plants, and equipment related to these facilities... -

Page 112

... market fundamentals, cost competitiveness, other existing idle capacity, required future capital investment, and restart costs, as well as the elimination of ongoing holding costs. The asset impairments of $127 represent the write off of the remaining book value of properties, plants, and equipment... -

Page 113

..., respectively. The remaining reserves are expected to be paid in cash during 2013, with the exception of approximately $50 to $55, which is expected to be paid over the next several years for lease termination costs, special separation benefit payments, and ongoing site remediation work. 102 -

Page 114

... 31, 2012, $1,247 of the amount reflected in Corporate is allocated to each of Alcoa's four reportable segments ($161 to Alumina, $751 to Primary Metals, $62 to Global Rolled Products, and $273 to Engineered Products and Solutions) included in the table above for purposes of impairment testing (see... -

Page 115

... assets were revised to conform to the 2012 presentation. Computer software consists primarily of software costs associated with an enterprise business solution (EBS) within Alcoa to drive common systems among all businesses. Amortization expense related to the intangible assets in the tables... -

Page 116

..., plants, and equipment and intangible assets, along with an allocation of goodwill ($94) from the Primary Metals reporting unit, were classified as held for sale (see Note B). 2011 Acquisitions. On March 9, 2011, Alcoa completed an acquisition of the aerospace fastener business of TransDigm Group... -

Page 117

...-tax) in 2010. H. Properties, Plants, and Equipment, Net December 31, Land and land rights, including mines Structures: Alumina: Alumina refining Bauxite mining Primary Metals: Aluminum smelting Power generation Global Rolled Products Engineered Products and Solutions Other Machinery and equipment... -

Page 118

... and Brazil and the natural gas pipeline in Australia are held by wholly-owned subsidiaries of Alcoa World Alumina and Chemicals (AWAC), which is owned 60% by Alcoa and 40% by Alumina Limited. In 2012, 2011, and 2010, Alcoa received $101, $100, and $33, respectively, in dividends from its equity... -

Page 119

... of Petroleum"). The letter authorizing the gas allocation provides for gas to be tolled and power to be supplied to the refinery, smelter, and rolling mill from an adjacent power and water desalination plant being constructed by a company ultimately owned by the government of Saudi Arabia, with... -

Page 120

..., Intangibles, net (E) Cash surrender value of life insurance Value-added tax receivable Fair value of derivative contracts (X) Prepaid gas transmission contract (N) Deferred mining costs, net Prepaid pension benefit (W) Unamortized debt expense Assets held for sale (B) Other 2012 $ 407 464 408 364... -

Page 121

...of $101 in outstanding loans related to the bauxite mine development in Brazil (see BNDES Loans below), and the remainder was used for general corporate purposes. The original issue discount and financing costs were deferred and are being amortized to interest expense over the term of the 2021 Notes... -

Page 122

... to pay for certain expenditures of the Juruti bauxite mine development. Interest on four of the subloans totaling $233 (R$470) is a Brazil real rate of interest equal to BNDES' long-term interest rate, 5.00% and 6.00% as of December 31, 2012 and 2011, respectively, plus a weighted-average margin of... -

Page 123

... of which are to be used to provide working capital or for other general corporate purposes of Alcoa, including support of Alcoa's commercial paper program. Subject to the terms and conditions of the Credit Agreement, Alcoa may from time to time request increases in lender commitments under the... -

Page 124

... will be to provide working capital and for other general corporate purposes, including contributions to Alcoa's pension plans ($561 was contributed in 2012). The two term loans were fully drawn on the same dates as the agreements and were subject to an interest rate equivalent to the 1-month... -

Page 125

... Credits December 31, Fair value of derivative contracts (X) Asset retirement obligations (C) Environmental remediation (N) Deferred income taxes (T) Deferred credit related to derivative contract (X) Accrued compensation and retirement costs Deferred alumina sales revenue Other 2012 $ 606 535 458... -

Page 126

... of $45. Alcoa also offered Alba a long-term alumina supply contract. Based on the cash offer, Alcoa recorded a $45 ($18 after-tax and noncontrolling interest) charge in the 2012 second quarter representing Alcoa's estimate of the minimum end of the range probable to settle the case, and estimated... -

Page 127

... District Court entered an order discharging Alcoa from the jury verdict and, on March 14, 2012, the Third Circuit Court of Appeals dismissed the matter. This matter is now fully resolved. Before 2002, Alcoa purchased power in Italy in the regulated energy market and received a drawback of a portion... -

Page 128

... tariff in 2005, Alcoa had been operating in Italy for more than 10 years under a power supply structure approved by the EC in 1996. That measure provided a competitive power supply to the primary aluminum industry and was not considered state aid from the Italian Government. The EC's announcement... -

Page 129

...uneconomical power costs. In February 2010, management agreed to continue to operate its smelters in Italy for up to six months while a long-term solution to address increased power costs could be negotiated. Also in February 2010, the Italian Government issued a decree, which was converted into law... -

Page 130

... increase of $3 related to the acquisition of an aerospace fasteners business (see Note F). Included in annual operating expenses are the recurring costs of managing hazardous substances and environmental programs. These costs are estimated to be approximately 2% of cost of goods sold. The following... -

Page 131

...of an ice control structure, and significant monitoring. From 2004 through 2008, Alcoa completed the work outlined in the ROPS. In November 2008, Alcoa submitted an update to the EPA incorporating the new information obtained from the ROPS related to the feasibility and costs associated with various... -

Page 132

... a number of years, Alcoa has been working with Sherwin Alumina Company to develop a sustainable closure plan for the active waste disposal areas, which is partly conditioned on Sherwin's operating plan for the Copano facility. In 2012, Alcoa received the technical analysis of the closure plan and... -

Page 133

...a wholly-owned subsidiary of Alcoa, is a participant in four consortiums that each owns a hydroelectric power project in Brazil. The purpose of AlumÃnio's participation is to increase its energy self-sufficiency and provide a long-term, low-cost source of power for its two smelters and one refinery... -

Page 134

... as an equity investment, was made in order to secure a competitively priced long-term supply of natural gas to Alcoa's refineries in Western Australia. Alcoa has made additional contributions of $141 (A$176) for its share of the pipeline capacity expansion and other operational purposes of... -

Page 135

... earnings from an investment in a natural gas pipeline in Australia due to the recognition of a discrete income tax benefit by the consortium (Alcoa World Alumina and Chemicals' share of the benefit was $24). Also in 2011, Net gain from asset sales included a $43 gain related to the sale of land in... -

Page 136

... and to meet customer requirements. Global Rolled Products. This segment represents Alcoa's midstream operations, whose principal business is the production and sale of aluminum plate and sheet. A small portion of this segment's operations relate to foil produced at one plant in Brazil. This segment... -

Page 137

...small number of customers. Engineered Products and Solutions. This segment represents Alcoa's downstream operations and includes titanium, aluminum, and super alloy investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used... -

Page 138

The operating results and assets of Alcoa's reportable segments were as follows: Global Rolled Products Engineered Products and Solutions Alumina 2012 Sales: Third-party sales Intersegment sales Total sales Profit and loss: Equity income (loss) Depreciation, depletion, and amortization Income taxes... -

Page 139

... Deferred income taxes Corporate goodwill Corporate fixed assets, net LIFO reserve Other Consolidated assets Sales by major product grouping were as follows: 2012 Sales: Alumina Primary aluminum Flat-rolled aluminum Investment castings Fastening systems Architectural aluminum systems Aluminum wheels... -

Page 140

... Netherlands include aluminum from Alcoa's smelter in Iceland. Geographic information for long-lived assets was as follows (based upon the physical location of the assets): December 31, Long-lived assets: U.S. Brazil Australia Iceland Canada Norway Russia Spain Jamaica China Other 2012 $ 4,621 4,318... -

Page 141

... registration statement dated February 18, 2011) for resale by the master trust, as selling stockholder. In January 2010, Alcoa contributed 44,313,146 newly issued shares of its common stock to a master trust that holds the assets of certain U.S. defined benefit pension plans in a private placement... -

Page 142

...of interest rates at the time of the grant based on the contractual life of the option. The dividend yield was based on a one-year average. Volatility was based on historical and implied volatilities over the term of the option. Alcoa utilized historical option forfeiture data to estimate annual pre... -

Page 143

...exercises was $12, $37, and $13 and the total tax benefit realized from these exercises was $1, $11, and $2, respectively. The following tables summarize certain stock option information at December 31, 2012 (number of options and intrinsic value in millions): Options Fully Vested and/or Expected to... -

Page 144

... 18 1 $57 2013 2014 2015 Totals S. Earnings Per Share Basic earnings per share (EPS) amounts are computed by dividing earnings, after the deduction of preferred stock dividends declared and dividends and undistributed earnings allocated to participating securities, by the average number of common... -

Page 145

... Less: preferred stock dividends declared Income from continuing operations available to common equity Less: dividends and undistributed earnings allocated to participating securities Income from continuing operations available to Alcoa common shareholders-basic Add: interest expense related to... -

Page 146

... tax rate and law changes Tax law change related to Medicare Part D Changes in valuation allowances Amortization of goodwill related to intercompany stock sales/reorganizations Change in legal structure of investment Interest income related to income tax positions Company-owned life insurance... -

Page 147

...was signed into law. The Acts effectively change the tax treatment of federal subsidies paid to sponsors of retiree health benefit plans that provide prescription drug benefits that are at least actuarially equivalent to the corresponding benefits provided under Medicare Part D. Alcoa pays a portion... -

Page 148

... net earnings for which no deferred taxes have been provided was approximately $8,000 at December 31, 2012. Alcoa has a number of commitments and obligations related to the Company's growth strategy in foreign jurisdictions. As such, management has no plans to distribute such earnings in... -

Page 149

...impact the annual effective tax rate for 2012, 2011, and 2010 would be approximately 6%, 2%, and 4%, respectively, of pretax book income. Alcoa does not anticipate that changes in its unrecognized tax benefits will have a material impact on the Statement of Consolidated Operations during 2013. It is... -

Page 150

...March 1, 2006 participate in a defined contribution plan instead of a defined benefit plan. Alcoa also maintains health care and life insurance benefit plans covering eligible U.S. retired employees and certain retirees from foreign locations. Generally, the medical plans pay a percentage of medical... -

Page 151

... Balance Sheet consist of: Noncurrent assets Current liabilities Noncurrent liabilities Net amount recognized Amounts recognized in Accumulated Other Comprehensive Loss consist of: Net actuarial loss Prior service cost (benefit) Total, before tax effect Less: Amounts attributed to joint venture... -

Page 152

... cost(5) (1) (2) (3) (4) (5) In 2012, 2011, and 2010, net periodic benefit cost for U.S pension plans was $288, $190, and $155, respectively. In 2012, 2011, and 2010, net periodic benefit cost for other postretirement benefits reflects a reduction of $64, $43, and $39, respectively, related... -

Page 153

... discount rates presented. The expected long-term rate of return on plan assets is generally applied to a five-year market-related value of plan assets (a four-year average or the fair value at the plan measurement date is used for certain non-U.S. plans). The process used by management to develop... -

Page 154

... expected future return developed by asset class. For calendar year 2013, management used the same methodology as it did for 2012 and 2011 and determined that 8.50% will be the expected long-term rate of return. Assumed health care cost trend rates for U.S. other postretirement benefit plans were as... -

Page 155

... are included in Level 2. Additionally, these securities include direct investments in short and long equity hedge funds and private equity (limited partnerships and venture capital partnerships) and are valued by investment managers based on the most recent financial information available, which... -

Page 156

... other postretirement plans' assets classified under the appropriate level of the fair value hierarchy: December 31, 2012 Equities: Equity securities Short and long equity hedge funds Private equity Fixed income: Intermediate and long duration government/credit Other Other investments: Real estate... -

Page 157

... 31, 2013 2014 2015 2016 2017 2018 through 2022 Defined Contribution Plans Alcoa sponsors savings and investment plans in several countries, including the U.S. and Australia. Expenses related to these plans were $146 in 2012, $139 in 2011, and $119 in 2010. In the U.S., employees may contribute... -

Page 158

... the chief executive officer selects. The SRMC meets on a periodic basis to review derivative positions and strategy and reports to Alcoa's Board of Directors on the scope of its activities. The aluminum, energy, interest rate, and foreign exchange contracts are held for purposes other than trading... -

Page 159

...% $111 3 249 8 1 Aluminum contracts Embedded credit derivative Energy contracts Foreign exchange contracts Interest rate contracts Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the... -

Page 160

... consist of aluminum, energy, interest rate, and foreign exchange contracts. The fair values for the majority of these derivative contracts are based upon current quoted market prices. These financial instruments are typically exchange-traded and are generally classified within Level 1 or Level 2 of... -

Page 161

... of Level 3* Foreign currency translation Closing balance-December 31, 2012 Change in unrealized gains or losses included in earnings for derivative contracts held at December 31, 2012: Sales Cost of goods sold Other income, net Aluminum contracts $ 10 (8) (107) 16 10 596 30 $ 547 Energy contracts... -

Page 162

... Statement of Consolidated Operations. In July 2012, as provided for in the arrangements, management elected to modify the pricing for two existing power contracts, which end in 2014 and 2016 (see directly below), for Alcoa's two smelters in Australia and the Point Henry rolling mill in Australia... -

Page 163

... will be included in Cost of goods sold on the accompanying Statement of Consolidated Operations as gas purchases are made under the contract. Additionally, an embedded derivative in a power contract that indexes the difference between the long-term debt ratings of Alcoa and the counterparty from... -

Page 164

...information for Level 3 derivative contracts: Fair value at December 31, 2012* Assets: Aluminum contract $ 2 Valuation technique Discounted cash flow Unobservable input Interrelationship of future aluminum and oil prices Range ($ in full amounts) Aluminum contract 537 Discounted cash flow Energy... -

Page 165

... aluminum products. As a condition of sale, customers often require Alcoa to enter into long-term, fixed-price commitments. These commitments expose Alcoa to the risk of fluctuating aluminum prices between the time the order is committed and the time that the order is shipped. Alcoa's aluminum... -

Page 166

...into contracts to hedge the anticipated power requirements at two smelters in Australia. These derivatives hedge forecasted power purchases through December 2036. Interest Rates. Alcoa had no outstanding cash flow hedges of interest rate exposures as of December 31, 2012, 2011 or 2010. An investment... -

Page 167

...income) expenses, net) entered into to minimize Alcoa's price risk related to other customer sales and certain pricing arrangements. The embedded credit derivative relates to a power contract that indexes the difference between the long-term debt ratings of Alcoa and the counterparty from any of the... -

Page 168

... consist of exchange-traded fixed income and equity securities, which are carried at fair value and were classified in Level 1 of the fair value hierarchy. Long-term debt, less amount due within one year. The fair value was based on quoted market prices for public debt and on interest rates that are... -

Page 169

... Financial Information (unaudited) Quarterly Data (in millions, except per-share amounts) First 2012 Sales Amounts attributable to Alcoa common shareholders: Income (loss) from continuing operations Loss from discontinued operations Net income (loss) Earnings per share attributable to Alcoa... -

Page 170

... Controls and Procedures Alcoa's Chief Executive Officer and Chief Financial Officer have evaluated the Company's disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as of the end of the period covered by this report, and they have... -

Page 171

... under the captions "Executive Compensation" (excluding the information under the caption "Compensation Committee Report"), "Corporate Governance-Director Independence and Related Person Transactions" of the Proxy Statement and is incorporated by reference. The information required by Item 407... -

Page 172

... Fees and Services. The information required by Item 9(e) of Schedule 14A is contained under the captions "Item 2-Ratification of the Appointment of the Independent Registered Public Accounting Firm-Report of the Audit Committee" and " Audit and Non-Audit Fees" of the Proxy Statement and in... -

Page 173

...the required information is included in the consolidated financial statements or notes thereto. (3) Exhibits. Exhibit Number 3(a). 3(b). 4(a). 4(b). 4(c). Description* Articles of the Registrant as amended May 7, 2012, incorporated by reference to exhibit 3(a) to the Company's Current Report on Form... -

Page 174

... dated November 28, 2001. Shareholders Agreement dated May 10, 1996 between Alcoa International Holdings Company and WMC Limited, incorporated by reference to exhibit 99.5 to the Company's Current Report on Form 8-K (Commission file number 1-3610) dated November 28, 2001. Side Letter of May 16, 1995... -

Page 175

... Inc., Alcoa World Alumina LLC, and William Rice, incorporated by reference to exhibit 10(a) to the company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2012. Employees' Excess Benefits Plan, Plan A, incorporated by reference to exhibit 10(b) to the Company's Annual Report on... -

Page 176

... to Employees' Excess Benefits Plan A, effective January 1, 2012, incorporated by reference to exhibit 10(l)(7) to the Company's Annual Report on Form 10-K for the year ended December 31, 2011. Alcoa Internal Revenue Code Section 162(m) Compliant Annual Cash Incentive Compensation Plan, incorporated... -

Page 177

...Deferred Fee Plan for Directors, as amended effective July 9, 1999, incorporated by reference to exhibit 10(g)(1) to the Company's Quarterly Report on Form 10-Q (Commission file number 1-3610) for the quarter ended June 30, 1999. Restricted Stock Plan for Non-Employee Directors, as amended effective... -

Page 178

..., 2010, effective January 1, 2011. Amendment to Deferred Compensation Plan, effective January 1, 2013. Summary of the Executive Split Dollar Life Insurance Plan, dated November 1990, incorporated by reference to exhibit 10(m) to the Company's Annual Report on Form 10-K (Commission file number 1-3610... -

Page 179

...Alcoa Supplemental Pension Plan for Senior Executives, effective January 1, 2012, incorporated by reference to exhibit 10(aa)(5) to the Company's Annual Report on Form 10-K for the year ended December 31, 2011. Deferred Fee Estate Enhancement Plan for Directors, effective July 10, 1998, incorporated... -

Page 180

... Agreement between the Company and new officers entered into after July 22, 2010, incorporated by reference to exhibit 10(a) to Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2010. Summary of 2013 Non-Employee Director Compensation and Stock Ownership Guidelines. Form of... -

Page 181

... to the Reynolds Metals Company Benefit Restoration Plan for New Retirement Program, effective January 1, 2012, incorporated by reference to exhibit 10(xx)(2) to the Company's Annual Report on Form 10-K for the year ended December 31, 2011. 10(xx). Global Expatriate Employee Policy (pre-January... -

Page 182

...Director Plan: You Make a Difference Award, incorporated by reference to exhibit 10(uu) to the Company's Annual Report on Form 10-K for the year ended December 31, 2008. Form of Award Agreement for Stock Options, effective January 1, 2010, incorporated... defining the rights of holders of long-term ... -

Page 183

... of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. Signature Title Date Chairman and Chief Executive Officer (Principal Executive Officer and Director) Klaus Kleinfeld... -

Page 184

... of the interest factor in rents: Consolidated Proportionate share of 50 percent-owned persons Fixed charges added to earnings Interest capitalized: Consolidated Proportionate share of 50 percent-owned persons Preferred stock dividend requirements of majority-owned subsidiaries Total fixed charges... -

Page 185

... LLC Alcoa Securities Corporation Howmet International Inc. Howmet Holdings Corporation Howmet Corporation Howmet Castings & Services, Inc. Alcoa International Holdings Company Alcoa Australian Holdings Pty. Ltd. Alcoa of Australia Limited1 Alcoa of Australia Rolled Products Pty. Ltd. Alcoa (China... -

Page 186

...) of Alcoa Inc. and its subsidiaries of our report dated February 15, 2013 relating to the Alcoa Inc. consolidated financial statements and the effectiveness of internal control over financing reporting, which appears in this Form 10-K. PricewaterhouseCoopers LLP Pittsburgh, Pennsylvania February... -

Page 187

...financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 19, 2013 3. 4. Name: Klaus Kleinfeld Title: Chairman and Chief Executive Officer... -

Page 188

...'s ability to record, process, summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 19, 2013 3. 4. Name: Charles... -

Page 189

... of the Securities Exchange Act of 1934 and information contained in the Form 10-K fairly presents, in all material respects, the financial condition and results of operations of the Company. Dated: February 19, 2013 Name: Klaus Kleinfeld Title: Chairman and Chief Executive Officer Dated: February... -

Page 190

-

Page 191

This page intentionally left blank. -

Page 192

...47 17.60 Low 7.98 8.45 9.81 Other Data Number of employees 61,000 61,000 59,000 (1) Reflects the cumulative effect of the accounting change for conditional asset retirement obligations in 2005, asset retirement obligations in 2003, and goodwill in 2002. (2) Primary aluminum product shipments are not... -

Page 193

... listed and include registered shareholders and beneficial owners holding stock through banks, brokers, or other nominees. Represents earnings per share on net income (loss) attributable to Alcoa common shareholders. Book value per share = (Total shareholders' equity minus Preferred stock) divided... -

Page 194

.... Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. Adjusted EBITDA is a non-GAAP financial measure. Management believes... -

Page 195

..., trade Working capital Sales Days working capital Days Working Capital = Working Capital divided by (Sales/number of days in the quarter). * The deferred purchase price receivable relates to an arrangement to sell certain customer receivables to a financial institution on a recurring basis. Alcoa... -

Page 196

... 19% Alcoa's definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative... -

Page 197

This page intentionally left blank. -

Page 198

... Executive Vice President Group President, Engineered Products and Solutions John Kenna Vice President Tax Printed in USA 1303 Form A07-15058 © 2013 Alcoa Alan J. Cransberg Vice President President, Global Primary Products - Australia Raymond J. Kilmer Executive Vice President Chief Technology Of... -

Page 199

... cost at www.alcoa.com or by writing to Corporate Communications at the corporate center address located on the back cover of this report. SHAREHOLDER SERVICES Shareholders with questions on account balances, dividend checks, reinvestment, or direct deposit; address changes; lost or misplaced stock... -

Page 200

Our Vision Alcoa. Advancing each generation. Our Values We live our values every day, everywhere, collaborating for the beneï¬t of our customers, investors, employees, communities and partners. Integrity We are open, honest and accountable. Environment, Health and Safety We work safely, promote ...