Airtran 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

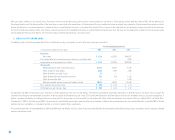

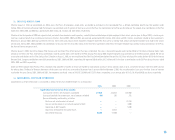

: : 12. EMPLOYEE BENEFIT PLANS : :

Effective January 1, 1998, we consolidated our 401(k) plans (the Plan). All employees, except pilots, are eligible to participate in the consolidated Plan, a defined contribution benefit plan that qualifies under

Section 401(k) of the Internal Revenue Code. Participants may contribute up to 15 percent of their base salary to the Plan. Our contributions to the Plan are discretionary. The amount of our contributions to the Plan

expensed in 2005, 2004 and 2003 was approximately $0.6 million, $0.3 million and $0.2 million, respectively.

Effective in the third quarter of 2000, we agreed to fund, on behalf of our mechanics and inspectors, a monthly fixed contribution per eligible employee to their union’s pension plan. In May of 2001, a similar agree-

ment was made on behalf of our maintenance training instructors. During 2005, 2004 and 2003, we expensed approximately $0.4 million, $0.4 million and $0.3 million, respectively, related to these agreements.

Beginning in January 2002, additional agreements with our stores clerks and ground service equipment employees took effect that call for a monthly fixed amount per eligible employee to be made to the union’s

pension plan. During 2005, 2004 and 2003, the contributions to this plan were less than $0.1 million. At the time these agreements take effect, the eligible employee may continue making contributions to the Plan,

but there will be no company match.

Effective August 1, 2001, the AirTran Airways Pilot Savings and Investment Plan (Pilot Savings Plan) was established. This plan is designed to qualify under Section 401(k) of the Internal Revenue Code. Funds

previously invested in the Plan, representing contributions made by and for pilots, were moved to the Pilot Savings Plan during 2001. Eligible employees may contribute up to the IRS maximum allowed. We will not

match pilot contributions to this Pilot Savings Plan. Effective on August 1, 2001, we also established the Pilot-Only Defined Contribution Pension Plan (DC Plan) which qualifies under Section 403(b) of the Internal

Revenue Code. Company contributions were 10.5 percent during 2003, 2004 and 2005, respectively. We expensed $10.0 million, $8.2 million and $5.4 million in contributions to the DC Plan during the years ended

2005, 2004 and 2003, respectively.

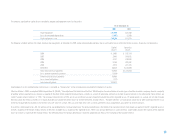

Under our 1995 Employee Stock Purchase Plan, employees who complete 12 months of service are eligible to make periodic purchases of our common stock at up to a 15 percent discount from the market value on

the offering date. The Board of Directors determines the discount rate, which was increased to 10 percent from 5 percent effective November 1, 2001. We are authorized to issue up to 4 million shares of common

stock under this plan. During 2005, 2004 and 2003, the employees purchased a total of 144,597, 116,488 and 117,125 shares, respectively, at an average price of $9.13, $9.84 and $8.00 per share, respectively.

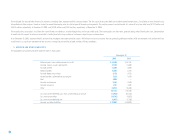

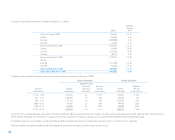

: : 13. SUPPLEMENTAL CASH FLOW INFORMATION : :

Supplemental cash flow information is summarized as follows for the years ended December 31, (in thousands):

2005 2004 2003

Supplemental disclosure of cash flow activities : :

Cash paid for interest, net of amounts capitalized $11,038 $14,832 $22,400

Cash paid (received) for income taxes, net of amounts refunded (46) 107 231

Non-cash financing and investing activities:

Purchase and sale/leaseback of aircraft —— 22,359

Gain on sale/leaseback of aircraft and payment of debt —— 3,000

Conversion of debt to equity —— 5,500

Acquisition of equipment for capital leases —15,513 —

Aircraft debt financing 86,500 57,500 —

:: ::

43