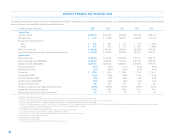

Airtran 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

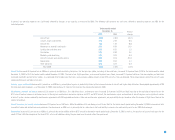

If an entity is determined to be a VIE, the entity must be consolidated by the “primary beneficiary.” The primary beneficiary is the holder of the variable interests that absorb a majority of the VIE’s expected losses or

receive a majority of the entity’s residual returns in the event no holder has a majority of the expected losses. There is no primary beneficiary in cases where no single holder absorbs the majority of the expected

losses or receives a majority of the residual returns. The determination of the primary beneficiary is based on projected cash flows at the inception of the variable interest.

We have variable interests in our aircraft leases. The lessors are trusts established specifically to purchase, finance and lease aircraft to us. These leasing entities meet the criteria of VIEs. We are generally not the

primary beneficiary of the leasing entities if the lease terms are consistent with market terms at the inception of the lease and do not include a residual value guarantee, a fixed-price purchase option or similar

feature that obligates us to absorb decreases in value or entitles us to participate in increases in the value of the aircraft. This is the case in the majority of our aircraft leases, however, we have two aircraft leases

that contain fixed-price purchase options that allow us to purchase the aircraft at predetermined prices on specified dates during the lease term. We have not consolidated the related trusts because even taking

into consideration these purchase options, we are not the primary beneficiary based on our cash flow analysis.

:: CRITICAL ACCOUNTING POLICIES AND ESTIMATES : :

General. The discussion and analysis of our financial condition and results of operations are based upon the consolidated financial statements, which have been prepared in accordance with accounting principles

generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amount of assets and liabilities, revenues and expenses,

and related disclosure of contingent assets and liabilities at the date of our financial statements. Our actual results may differ from these estimates under different assumptions or conditions. Critical accounting

policies are defined as those that are reflective of significant judgments and uncertainties, and are sufficiently sensitive to result in materially different results under different assumptions and conditions. The

following is a description of what we believe to be our most critical accounting policies and estimates (see Note 1 to the Consolidated Financial Statements).

Revenue Recognition. Passenger revenue is recognized when transportation is provided. Ticket sales for transportation which has not yet been provided are recorded as air traffic liability. Air traffic liability

represents tickets sold for future travel dates. The balance of the air traffic liability fluctuates throughout the year based on seasonal travel patterns and fare sale activity. Nonrefundable tickets expire one year from

the date the ticket is purchased. A percentage of tickets expire unused. We estimate the amount of unused tickets based on historical experience. Passenger traffic commissions and related fees are expensed when

the related revenue is recognized. Passenger traffic commissions and related fees not yet recognized are included as a prepaid expense.

Stock-based Compensation. The adoption of SFAS No. 123(R), “Share Based Payment,” in 2006 will require the recording of stockbased compensation expense for issuances under our equity incentive plans over their

requisite service period using a fair value approach similar to the current pro forma disclosure requirements of SFAS No. 123, “Accounting for Stock-Based Compensation.” SFAS No. 123(R) does not mandate an

option-pricing model to be used in determining fair value, but does require that the model selected consider certain variables. Different models would result in different valuations. Regardless of the method selected,

significant judgment is required for some of the valuation variables. The most significant of these is the volatility of our common stock and the estimated term over which our stock options will be outstanding. The

valuation calculation is sensitive to even slight changes in these estimates.

Although there will be no impact to our overall cash flows, the adoption of SFAS No. 123(R) will have a impact on our results of operations. Most of the stock-based compensation expense to be recorded in 2006 will

relate to restricted stock awards and purchases under our employee stock purchase plan and not to stock options, as we accelerated the vesting of 0.4 million outstanding stock options in September 2005. We will

use the modified prospective method to account for stock-based compensation. We expect that the adoption of SFAS 123(R) will reduce 2006 earnings by less than $1 million.

:: ::

20