Airtran 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

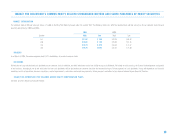

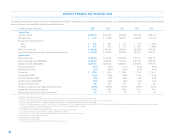

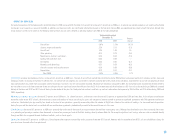

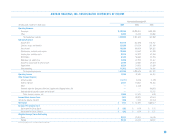

:: OPERATING EXPENSES : :

Our operating expenses for the twelve months ended December 31, 2004 increased $176.9 million (21.3 percent) or increased 1.7 percent on an ASM basis. In general, our operating expenses are significantly affected

by changes in our capacity, as measured by ASMs. In addition, our financial results are significantly affected by changes in the fuel price. During 2004, we experienced then record aircraft fuel prices derived from

sharp increases in the cost of crude oil. The following table presents our unit costs, defined as operating expenses per ASM, for the indicated period:

Twelve months ended

December 31, Percent

2004 2003 change

Aircraft fuel 2.07¢ 1.78¢ 16.3%

Salaries, wages and benefits 2.28 2.31 (1.3)

Aircraft rent 1.26 1.24 1.6

Other operating 0.75 0.78 (3.8)

Maintenance, materials and repairs 0.58 0.63 (7.9)

Landing fees and other rents 0.52 0.52 —

Distribution 0.42 0.45 (6.7)

Marketing and advertising 0.23 0.24 (4.2)

Aircraft insurance and security services 0.19 0.20 (5.0)

Depreciation 0.12 0.13 (7.7)

Total CASM 8.42¢ 8.28¢ 1.7%

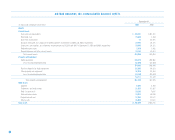

Aircraft fuel, including fuel-hedging activities, increased 16.3 percent on an ASM basis. The cost of aircraft fuel reached then record highs during 2004 with our average per gallon cost, including all fees, taxes and

hedging activities increasing 22.4 percent to 120.42 cents. Our overall fuel consumption also increased 13.4 percent primarily due to the growth of our operations. Improvements to our fuel consumption per block

hour partially offset our greater fuel consumption and the record price increases. Our fuel consumption improved 2.0 percent per block hour compared to 2003. Our fuel performance improvements directly relate to

our transition to an aircraft fleet comprised of two aircraft types that are significantly more fuel-efficient than the DC-9s that were replaced. We retired our last DC-9 aircraft at the beginning of 2004 and accepted

delivery of fourteen new B737 and B717 aircraft during the remainder of the year. Our fixed-price fuel contracts and fuel cap contracts reduced our fuel expense by $38.6 million and $7.4 million during 2004 and

2003, respectively.

Maintenance, materials and repairs decreased 7.9 percent on an ASM basis. On a block hour basis, maintenance costs decreased 3.0 percent to approximately $224 per block hour. As the original manufacturer

warranties expire on our B717 aircraft, the maintenance, repair and overhaul of major aircraft engine, parts and components become covered by previously negotiated agreements with FAA-approved maintenance

contractors. Contractually we pay monthly fees based on the level of our operations, generally measured by either the number of flight hours flown or the number of landings. Our increased level of operations

during the year and the related costs associated with our maintenance agreements predominantly account for the overall increase in this area.

Distribution costs decreased 6.7 percent on an ASM basis primarily due to the overall decrease of passenger revenues derived from travel agency sales. Although total distribution costs have increased, these costs

as a percentage of passenger revenues have decreased as more of our passengers have shifted their bookings directly onto our Web site. We recognize significant cost savings when our sales are booked directly

through our Web site as opposed to more traditional methods, such as travel agents.

Depreciation decreased 7.7 percent on an ASM basis. Overall depreciation expense increased due to the purchase of two new B737 aircraft. However, with the exception of two B737s, all aircraft additions during the

year were lease-financed rather than purchased.

:: ::

15