Airtran 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

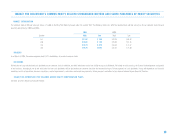

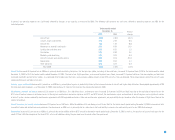

:: CREDIT AGREEMENT : :

During April 2005, we signed a new credit agreement with a bank lender. The new credit agreement included a revolving line of credit for up to $25 million, and, additionally, allowed us to obtain letters of credit for

up to $15 million and enter into hedge agreements with the bank. Any advances on the revolving line of credit would bear interest at a base rate plus a margin of 1.5 percent per annum. In September 2005, as a

result of obtaining additional financing, we terminated the credit agreement in conjunction with obtaining additional financing. As a result of the termination of the line of credit, $11.3 million of restricted cash on

the accompanying consolidated balance sheet relates to outstanding letters of credit, primarily for airport facilities, as of December 31, 2005.

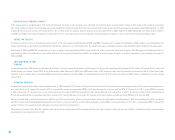

:: OTHER COMMITMENTS : :

In May 2004, we opened a two bay hangar facility at Hartsfield-Jackson Atlanta International Airport. The 56,700-square-foot hangar will hold four of our B717 aircraft simultaneously and has a 20,000-square-foot,

two-story office building attached to the hangar to house engineers and other support staff. We have a 20-year lease on the facility which expires in 2024.

:: AQUARIUM : :

As a presenting sponsor of the Georgia Aquarium, we have committed to pay $7.5 million in five yearly installments expiring October 31,2010.

:: OTHER SOURCES OF LIQUIDITY : :

The Company has various options available to meet its capital and operating commitments including internally generated funds and various borrowing or leasing options. Additionally, the Company has an outstanding

shelf registration which it may utilize to raise funds for aircraft financings or other purposes in the future. There can be no assurance that financing will be available for all B737 aircraft deliveries or for other

capital expenditures not covered by firm financing commitments. Should fuel prices remain high and if we are unable to raise prices to cover our costs, we may slow our growth, including through the subleasing of

certain numbers of our aircraft.

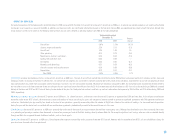

:: OFF-BALANCE SHEET ARRANGEMENTS : :

An off-balance sheet arrangement is any transaction, agreement or other contractual arrangement involving an unconsolidated entity under which a company has (1) made guarantees, (2) a retained or a

contingent interest in transferred assets, (3) an obligation under derivative instruments classified as equity or (4) any obligation arising out of a material variable interest in an unconsolidated entity that provides

financing, liquidity, market risk or credit risk support to the company, or that engages in leasing, hedging or research and development arrangements with the company.

We have no arrangements of the types described in the first three categories that we believe may have a material current or future affect on our financial condition, liquidity or results of operations. Certain

guarantees that we do not expect to have a material current or future effect on our financial condition, liquidity or resulted operations are disclosed in Note 7 to our Consolidated Financial Statements.

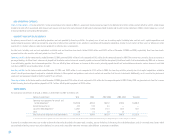

Effective October 1, 2003, we adopted Financial Accounting Standards Board (FASB) Interpretation 46 (FIN 46), “Consolidation of Variable Interest Entities.” FIN 46 requires the consolidation of certain types of

entities in which a company absorbs a majority of another entity’s expected losses, receives a majority of the other entity’s expected residual returns, or both, as a result of ownership, contractual or other financial

interests in the other entity. These entities are called “variable interest entities” or “VIEs.” The principal characteristics of VIEs are (1) an insufficient amount of equity to absorb the entity’s expected losses; (2) equity

owners as a group are not able to make decisions about the entity’s activities, or (3) equity that does not absorb the entity’s losses or receive the entity’s residual returns. “Variable interests” are contractual,

ownership or other monetary interests in an entity that change with fluctuations in the entity’s net asset value. As a result, VIEs can arise from items such as lease agreements, loan arrangements, guarantees or

service contracts.

:: ::

19