Airtran 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

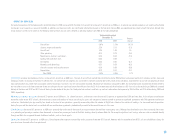

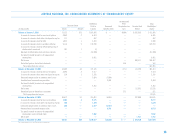

:: AIRCRAFT PURCHASE COMMITMENTS : :

In the year ended December 31, 2005, we took delivery of six B717 and 12 B737aircraft of which six B717 and nine B737aircraft were leased, under operating leases. The three additional B737aircraft were purchased

and financed with debt.

As of December 31,2005, we had on order two Boeing 717 aircraft with delivery dates in 2006 and 55 Boeing 737 aircraft with delivery dates between 2006 and 2009. In January 2006, we exercised an option for the

delivery of one additional B737 with a 2007 delivery date.

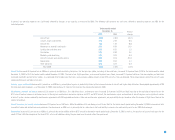

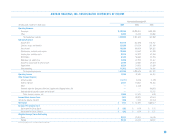

The table below illustrates all aircraft scheduled for delivery through 2010, including the effect of the aforementioned transaction:

B737 Deliveries B717 Deliveries

Firm Options Purchase Rights Firm Options

2006 18 —— 2—

2007 19 ————

2008 4 14 ———

2009 15 ————

2010 ——10 ——

Total 56 14 10 2—

Of the 56 B737 aircraft on order, we secured lease financing on seven of the aircraft through an arrangement with an aircraft leasing company and have secured debt financing for 15 B737 aircraft through

arrangements with financial institutions. Additionally, we have entered into sale/leaseback transactions with the aircraft leasing company referred to above with respect to six related spare engines to be delivered

through 2010.

During 2006, we are scheduled to take delivery of two remaining B717 aircraft, which are to be leased through an affiliate of the aircraft manufacturer. Additionally, we are scheduled to take delivery of 18 B737

aircraft during 2006, of which seven of such B737aircraft are to be acquired pursuant to individual operating leases through the aircraft leasing arrangements and 11 B737 aircraft are to be financed through debt.

Additionally, we have entered into sale/leaseback transactions with that aircraft leasing company with respect to six related spare engines to be delivered between the remainder of 2005 and 2010.

During 2005, in connection with our agreements with an aircraft manufacturer, Airways was refunded $29.8 million in previously paid aircraft deposits while paying $9.5 million in new aircraft deposits under the

agreement for the acquisition of B737 aircraft.

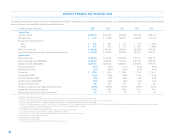

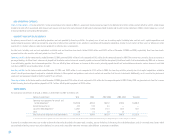

:: DEBT : :

:: PERMANENT AIRCRAFT FINANCING FACILITIES : :

Through December 31, 2005, we have entered into three separate facilities (each a “permanent facility”) for purposes of financing the acquisition of B737 aircraft on order with an aircraft manufacturer.

We entered into the first permanent facility in August 2004, pursuant to which we financed the acquisition of three B737 aircraft. We took delivery of the three B737 aircraft in August 2004, July 2005 and August

2005, respectively. In conjunction with the financing of these B737 aircraft, we issued equipment notes as aircraft were delivered for an aggregate amount of $87.0 million, which are scheduled to mature between

August 2016 and August 2017. The equipment notes bear interest at a floating rate per annum above the six-month U.S. Dollar London Interbank Offering Rate (LIBOR) in effect at the commencement of each semi-

annual period, and payments of principal and interest under the notes are payable semiannually. Each note is secured by a first mortgage on the aircraft to which it relates, valuing at approximately $96.5 million

as of December 31, 2005.

:: ::

17