Airtran 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

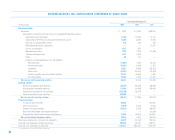

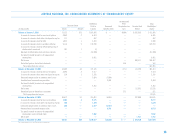

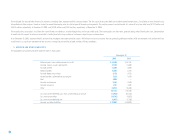

: : 6. DEBT : :

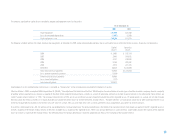

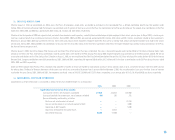

The components of long-term debt, including capital lease obligations were (in thousands):

December 31,

2005 2004

Floating rate aircraft notes payable due 2017, 5.63% weighted-average interest rate $138,906 $ 57,500

7.00% Convertible notes due 2023 125,000 125,000

Aircraft notes payable through 2017, 10.68% weighted-average interest rate 107,036 116,025

Floating rate aircraft pre-delivery deposit financing payable through 2007, 5.74% 57,153 —

Floating rate aircraft pre-delivery deposit financing payable through 2008, 6.30% 19,950 —

Floating rate aircraft pre-delivery deposit financing payable through 2006, 6.65% 9,866 —

Capital lease obligations payable through 2015, 14.03% weighted-average interest rate 14,688 15,445

Total long-term debt 472,599 313,970

Less current maturities (71,232) (13,836)

$401,367 $300,134

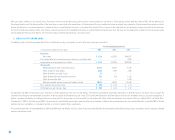

Maturities of long-term debt and capital lease obligations for the next five years and thereafter, in aggregate, are (in thousands): 2006–$71,232; 2007–$57,502; 2008–$16,765; 2009–$16,250; 2010–$18,690;

thereafter–$292,160.

:: DEBT : :

:: PERMANENT AIRCRAFT FINANCING FACILITIES : :

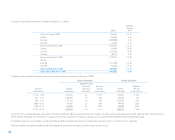

Through December 31, 2005, we have entered into three separate facilities (each a “permanent facility”) for purposes of financing the acquisition of B737 aircraft on order with an aircraft manufacturer.

We entered into the first permanent facility in August 2004, pursuant to which we financed the acquisition of three B737 aircraft. We took delivery of the three B737 aircraft in August 2004, July 2005 and August

2005, respectively. In conjunction with the financing of these B737 aircraft, we issued equipment notes as aircraft were delivered for an aggregate amount of $87.0 million, which are scheduled to mature between

August 2016 and August 2017. The equipment notes bear interest at a floating rate per annum above the six-month U.S. Dollar London Interbank Offering Rate (LIBOR) in effect at the commencement of each

semiannual period, and payments of principal and interest under the notes are payable semiannually. Each note is secured by a first mortgage on the aircraft to which it relates, valuing at approximately $96.5 million

as of December 31, 2005.

We entered into the second permanent facility in September 2004, pursuant to which we financed the acquisition of three additional B737 aircraft. We took delivery of such aircraft in September 2004, June 2005 and

January 2006, respectively. In conjunction with the financing of these B737 aircraft, we issued equipment notes as aircraft were delivered for an aggregate amount of $85.5 million, which are scheduled to mature

between September 2016 and January 2018. The notes bear interest at a floating rate per annum above the six-month U.S. Dollar LIBOR in effect at the commencement of each semiannual period, and payments of

principal and interest under the notes are payable semiannually. Each note is secured by a first mortgage on the aircraft to which it relates, valuing at approximately $63.7 million as of December 31, 2005.

We entered into the third permanent facility in September 2005, pursuant to which we shall be entitled to borrow up to $354 million for purposes of acquiring 12 B737 aircraft currently scheduled to be delivered to

us in 2006 and 2007 and satisfying our repayment obligations under a related pre-delivery payment financing facility, which is described in more detail below. On the delivery date of each aircraft subject to this

third permanent facility, we will issue equipment notes evidencing the loans made under this permanent facility for that aircraft. The equipment notes will mature on the twelfth anniversary of the delivery date of

the aircraft to which such notes relate and will be secured by the aircraft to which such loans relate. We intend to obtain a loan in respect of the first aircraft subject to this permanent facility during May 2006.

:: ::

35