Airtran 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

Table of contents

-

Page 1

ANNUAL REPORT -

Page 2

-

Page 3

ANNUAL REPORT PG 01 :: Customer Focus :: New Offerings :: Booking Efï¬ciencies :: Corporate Partnerships :: Technological Advances :: Positive Work Environment -

Page 4

...moment they book their ticket to the point at which we say, "Thanks for flying with us." Being customer-centric has proven to be good business. It must be working because a recent study revealed that 93 percent of our frequent fliers said they are likely to fly us again. :: New Offerings As good as... -

Page 5

... Atlanta Savannah / Hilton Head Dallas / Ft. Worth Jacksonville Gulfport / Biloxi New Orleans Pensacola Orlando Tampa Sarasota / Bradenton Grand Bahama Island West Palm Beach Ft. Lauderdale Miami Houston (Hobby) Ft. Myers For schedules, go to airtran.com. Effective June 7, 2006 Routes and cities... -

Page 6

.... As other carriers reduce capacity and service in markets, AirTran Airways will be there to add new routes and increase frequency. Recently, we've added key business routes from Chicago, which include Boston, Minneapolis/St. Paul, Dallas/Ft. Worth, Charlotte and New York/Newark meeting the needs of... -

Page 7

.... So card-carrying Amex members can use the points they earn toward flights on AirTran Airways. Our other partners continue to provide a constant revenue stream. Like Juniper Bank, the bank that now offers the new AirTran Airways Visa Signature. Or Hertz, where customers who book their car rental... -

Page 8

... :: AirTran : Attn. Investor Relations : 9955 AirTran Blvd. : Orlando, FL 32827 Corporate Governance On June 7, 2005, Joseph B. Leonard, Chairman of the Board and Chief Executive Officer of AirTran Holdings, Inc., submitted to the New York Stock Exchange the Annual CEO Certification required by... -

Page 9

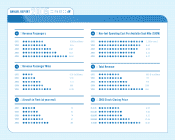

...-fuel Operating Cost Per Available Seat Mile (CASM) 7.20 (in cents) 6.64 6.50 6.35 6.27 :: Revenue Passenger Miles 2001 2002 2003 2004 2005 4.51 (in billions) 5.58 7.14 8.48 11.30 2001 2002 2003 2004 2005 :: Total Revenue 665 ($ in millions) 733 918 1,041 1,451 :: Aircraft in Fleet (at year end... -

Page 10

ANNUAL REPORT PG 08 2 0 0 5 F I N A N C I A L S -

Page 11

... PURCHASES OF EQUITY SECURITIES : : MARKET INFORMATION : : Our common stock, $.001 par value per share, is traded on the New York Stock Exchange under the symbol "AAI." The following table sets forth the reported high and low sale prices for our common stock for each quarterly period during 2005... -

Page 12

... Average fare Average yield per RPM(9) Passenger revenue per ASM(10) Operating cost per ASM (CASM)(11) Average stage length (miles) Average cost of aircraft fuel per gallon, including fuel taxes Average daily utilization (hours:minutes)(12) Number of operating aircraft in fleet at end of period 2005... -

Page 13

...and seats offered. We operate scheduled airline service primarily in short-haul markets principally in the eastern United States, with a majority of our flights originating and terminating at our hub in Atlanta, Georgia. As of March 1, 2006, we operated 85 Boeing 717-200 (B717) and 23 Boeing 737-700... -

Page 14

... increase in passenger unit revenues or passenger revenue available seat miles (RASM) to 9.09 cents per ASM. During the twelve months ended December 31, 2005, we took delivery of six B717 aircraft and 12 B737 aircraft. As a result, our capacity, as measured by available seat miles (ASMs), increased... -

Page 15

... periods: Twelve months ended December 31, 2005 Aircraft fuel Salaries, wages and benefits Aircraft rent Maintenance, materials and repairs Landing fees and other rents Distribution Marketing and advertising Aircraft insurance and security services Depreciation Other operating Total CASM 3.08... -

Page 16

....7 percent, resulting in a 0.3 percentage point decrease in passenger load factor to 70.8 percent. Other revenues increased $8.1 million (28.7 percent), primarily due to fees earned from our AirTran Airways branded credit card issued by a third-party financial institution, in addition to change and... -

Page 17

... period: Twelve months ended December 31, 2004 Aircraft fuel Salaries, wages and benefits Aircraft rent Other operating Maintenance, materials and repairs Landing fees and other rents Distribution Marketing and advertising Aircraft insurance and security services Depreciation Total CASM 2.07... -

Page 18

... required for scheduled deliveries in future periods and purchases and sales of auction rate securities that for cash investments. Additionally, cash is used for the purchase of spare parts and equipment related to the B717 and B737 aircraft fleets. Financing activities for the twelve months ended... -

Page 19

...B717 and nine B737 aircraft were leased, under operating leases. The three additional B737 aircraft were purchased and financed with debt. As of December 31, 2005, we had on order two Boeing 717 aircraft with delivery dates in 2006 and 55 Boeing 737 aircraft with delivery dates between 2006 and 2009... -

Page 20

...a floating rate per annum above the one-month U.S. Dollar LIBOR. PDP-2 is secured by certain rights under our purchase agreement with an aircraft manufacturer for the 12 B737 aircraft. As of December 31, 2005, $57.2 million is outstanding under PDP-2, which is equivalent to pre-delivery payments due... -

Page 21

...with obtaining additional financing. As a result of the termination of the line of credit, $11.3 million of restricted cash on the accompanying consolidated balance sheet relates to outstanding letters of credit, primarily for airport facilities, as of December 31, 2005. : : OTHER COMMITMENTS : : In... -

Page 22

... in 2006 will relate to restricted stock awards and purchases under our employee stock purchase plan and not to stock options, as we accelerated the vesting of 0.4 million outstanding stock options in September 2005. We will use the modified prospective method to account for stock-based compensation... -

Page 23

...take to mitigate our exposure to such changes. Actual results may differ. See the Notes to the Consolidated Financial Statements for a description of our financial accounting policies and additional information. : : INTEREST RATES : : As of December 31, 2005 and 2004, the fair value of our long-term... -

Page 24

... statements referred to above present fairly, in all material respects, the consolidated financial position of AirTran Holdings, Inc. and subsidiaries at December 31, 2005 and 2004, and the consolidated results of their operations and their cash flows for each of the three years in the period ended... -

Page 25

... share data) Operating Revenues : : Passenger Other Total operating revenues Operating Expenses : : Aircraft fuel Salaries, wages and benefits Aircraft rent Maintenance, materials and repairs Landing fees and other rents Distribution Marketing and advertising Aircraft insurance and security services... -

Page 26

AIRTRAN HOLDINGS, INC. CONSOLIDATED BALANCE SHEETS December 31, (In thousands, except per share data) ASSETS Current Assets : : Cash and cash equivalents Restricted cash Short-term investments Accounts receivable, less allowance of $494 and $627 at December 31, 2005 and 2004, respectively Spare ... -

Page 27

... 2005 2004 $ 38,082 98,001 115,157 717 70,515 322,472 13,971 387,396 83,150 $ 20,988 80,024 87,571 886 12,950 202,419 14,559 285,575 69,142 Commitments and Contingencies Stockholders' Equity : : Preferred stock, $.01 par value per share, 5,000 shares authorized, no shares issued or outstanding... -

Page 28

... and equipment Aircraft purchase deposits payments Purchases of available-for-sale securities Sales of available-for-sale-securities Net cash used for investing activities Financing activities : : Issuance of long-term debt Debt issuance costs Payments on long-term debt Buy back of detachable stock... -

Page 29

...under stock purchase plan Unearned compensation on common stock issues Amortization of unearned compensation Tax benefit related to exercise of nonqualified stock options and restricted stock Net income Balance at December 31, 2005 See accompanying notes to consolidated financial statements. Shares... -

Page 30

... : : BUSINESS : : Airways offers scheduled airline services to 47 locations across the United States, primarily in short-haul markets principally in the eastern United States. The financial and operating results for any interim period are not indicative of those for the entire year. Air travel tends... -

Page 31

... flight credits in our frequent flyer program for promotional consideration. The transaction was recorded at the fair value of the credits exchanged resulting in approximately $4.6 million of advertising expense in 2005. The revenue relating to the flight credits will be recognized as passenger... -

Page 32

... the use of APB 25 and the intrinsic value method of accounting for stock-based compensation and requires companies to recognize the cost of employee services received in exchange for awards of equity instruments based on the grant date fair value of those awards in the financial statements. :: 30... -

Page 33

... 2006 earnings by less than $1 million. On September 13, 2005, we accelerated the vesting of unvested stock options awarded more than one year prior to such date to employees and officers under our stock option plans. The affected options had exercise prices greater than the current market price of... -

Page 34

... weighted average price of $1.65 and $1.54, respectively, per gallon of aviation fuel for 2006 and 2007, including delivery to our operations hub in Atlanta and other locations. : : AIRCRAFT PURCHASE COMMITMENTS : : As of December 31, 2005, we had on order two Boeing 717 aircraft with delivery dates... -

Page 35

... and related indemnities, as described above with respect to the aircraft we operate. Additionally, if there is a change in the law which results in the imposition of any reserve, capital adequacy, special deposit or similar requirement which will increase the cost to the lender, we will pay the... -

Page 36

... fair value of other financial instruments, excluding debt, approximate their carrying amount. The fair values of long-term debt are based on quoted market prices, if available, or are estimated using discounted cash flow analyses, based on current incremental borrowing rates for similar types... -

Page 37

...Offering Rate (LIBOR) in effect at the commencement of each semiannual period, and payments of principal and interest under the notes are payable semiannually. Each note is secured by a first mortgage on the aircraft to which it relates, valuing at approximately $96.5 million as of December 31, 2005... -

Page 38

...$45 million, through April 2007, at which time the deposit requirements for the 19 aircraft will have been met. : : 7. LEASES : : Total rental expense charged to operations for aircraft, facilities and office space for the years ended December 31, 2005, 2004 and 2003 was approximately $238.0 million... -

Page 39

...: Accumulated depreciation Flight equipment-net $21,560 (3,322) $18,238 2004 $21,560 (2,281) $19,279 The following schedule outlines the future minimum lease payments at December 31, 2005, under noncancelable operating leases and capital leases with initial terms in excess of one year (in thousands... -

Page 40

...value of the aircraft. This is the case in the majority of our aircraft leases; however, we have two aircraft leases that contain fixed-price purchase options that allow us to purchase the aircraft at predetermined prices on specified dates during the lease term. We have not consolidated the related... -

Page 41

... requires that the information be determined as if we had accounted for our employee stock options granted subsequent to December 31, 1994, under the fair value method of that statement. The fair value for these options was estimated at the date of grant using the Black-Scholes option pricing model... -

Page 42

... weighted-average fair value of options granted during 2004 and 2003, with option prices equal to the market price on the date of grant, was $7.24 and $3.14, respectively. There were no options granted during 2004 and 2003 with option prices greater than the market price of the stock on the date of... -

Page 43

...average fair value of options granted during 2004 and 2003, with option prices less than the market price on the date of grant was $9.52 and $4.35, respectively. During 2005 and 2004 we granted stock awards to our officers and key employees pursuant to our 2002 Long-Term Incentive Plan. Stock awards... -

Page 44

... tax assets: Deferred gains from sale and leaseback of aircraft Accrued liabilities Federal operating loss carryforwards State operating loss carryforwards AMT credit carryforwards Other Gross deferred tax assets Valuation allowance Net deferred tax assets Total net deferred taxes $ 89,375 23... -

Page 45

... market value on the offering date. The Board of Directors determines the discount rate, which was increased to 10 percent from 5 percent effective November 1, 2001. We are authorized to issue up to 4 million shares of common stock under this plan. During 2005, 2004 and 2003, the employees purchased... -

Page 46

...) $ - $ - Fourth $409,870 2,054 (1,380) $ (0.02) $ (0.02) The results of the fourth quarter of 2005 include expense of $2.7 million, net of tax, related to an advertising barter transaction in which we exchanged flight credits in our frequent flyer program for promotional consideration. :: 44 :: -

Page 47

..., as of December 31, 2005, the Company had not fully remediated the material weakness in the Company's internal control over financial reporting. The Company's remediation plan is as follows: • The Company has staffed a number of key accounting and financial management positions and is diligently... -

Page 48

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM : : THE BOARD OF DIRECTORS AND STOCKHOLDERS OF AIRTRAN HOLDINGS, INC. : : We have audited management's assessment, included in the accompanying Management's Annual Report on Internal Control over Financial Reporting, that AirTran Holdings, Inc. did... -

Page 49

NOTES :: 47 :: -

Page 50

NOTES :: 48 :: -

Page 51

-

Page 52

AIRTRAN HOLDINGS, INC. airtran.com