Air Canada 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1. PREFACE

The following management's discussion and analysis of results of operations and financial condition ("MD&A")

should be read in conjunction with Air Canada’s combined consolidated financial statements and notes which

have been prepared in accordance with GAAP in Canada and are based on accounting policies consistent with

those disclosed in Note 2 to Air Canada’s combined consolidated financial statements. Except where the

context otherwise requires, all monetary amounts are stated in millions of Canadian dollars. Except as

otherwise noted, this MD&A is current as of February 14, 2007.

Forward-looking statements are included in this MD&A. See "Caution Regarding Forward Looking Statements"

in this MD&A for a discussion of risks, uncertainties and assumptions relating to these statements. For a

detailed description of the risks affecting the business of Air Canada and its subsidiaries, see the "Risk Factors"

section in this MD&A.

Air Canada's combined consolidated financial statements include the financial position, results of operations

and cash flows of the various entities as described in Note 1 to Air Canada's combined consolidated financial

statements. In this MD&A, the term “Corporation” refers to, as the context may require, Air Canada and/or Jazz

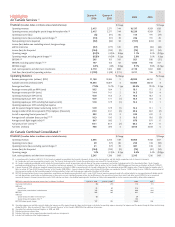

LP (“Jazz”) and/or one or more of Air Canada’s subsidiaries. Air Canada has two business segments: Air

Canada Services and Jazz. Air Canada Services is the passenger and cargo transportation services business

operated by Air Canada and related ancillary services. Jazz operates under the capacity purchase agreement

between Air Canada and Jazz that came into effect September 30, 2004 (the “initial Jazz CPA”) and was

amended and restated effective January 1, 2006 (the “Jazz CPA”). Due to the terms of the Jazz CPA, Air

Canada has a variable interest in Jazz, as defined under Accounting Guideline15 - Consolidation of Variable

Interest Entities (AcG-15). It has been determined that Air Canada is most closely associated with Jazz and, as

a result, Air Canada is the entity that consolidates Jazz. Notwithstanding the consolidation of Jazz by Air

Canada, Air Canada does not hold any of the limited partnership units of Jazz Air LP or any of the shares of its

general partner, Jazz Air Holding GP Inc.

Basis of Presentation

On November 24, 2006 Air Canada completed its initial public offering of class A variable voting shares and

class B voting shares of Air Canada (the “Air Canada IPO”). Refer to Note 1 to Air Canada’s combined

consolidated financial statements for additional information. For periods prior to the Air Canada IPO, ACE

Aviation Holdings Inc. (“ACE”) was the direct or indirect parent holding company of Air Canada, ACGHS Limited

Partnership (“Air Canada Ground Handling”), Touram Limited Partnership (“Air Canada Vacations”) and AC

Cargo Limited Partnership (“Air Canada Cargo”). Immediately prior to the closing of the Air Canada IPO, the

partnership interests, as well as the interests in the general partners of Air Canada Cargo and Air Canada

Ground Handling not held by Air Canada, were transferred to Air Canada and ACE transferred a 51 percent

ownership interest in Air Canada Vacations and Air Canada Vacations' general partner to Air Canada. As at

December 31, 2006, ACE directly holds 75 percent of Air Canada's outstanding shares.

In accordance with Emerging Issue Committee Abstract No. 89, Exchange of Ownership Interests between

Enterprises under Common Control – Wholly and Partially-Owned Subsidiaries, Air Canada’s combined

consolidated financial statements combine the assets and liabilities, results of operations and cash flows of Air

Canada, Jazz and all of Air Canada’s subsidiaries as if they had been combined from September 30, 2004, the

date Air Canada and these entities emerged from creditor protection under the provisions of the Companies’

Creditors Arrangement Act (Canada) (“CCAA”). The assets and liabilities have been combined at their carrying

values in the respective entities. The shareholders’ equity reflects the shareholders’ equity of Air Canada

adjusted for the transactions related to the Air Canada IPO, as applicable.

For further information on Air Canada’s public disclosure file, including Air Canada’s Annual Information Form

which will be filed by March 31, 2007, consult SEDAR at www.sedar.com.

6