Air Canada 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

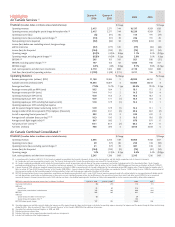

4. FUEL RISK MANAGEMENT

Aircraft fuel is a major expense in the airline industry. During the period from January 1, 2006 to December 31,

2006, the price of Western Texas Intermediate ("WTI") crude oil ranged from a low of US$55.86 to a high of

US$76.95. Fuel prices continue to be susceptible to factors such as political unrest in various parts of the world,

Organization of Petroleum Exporting Countries (OPEC) policy, the level of demand from emerging economies

such as China, the level of inventory carried by the industry, the level of fuel reserves maintained by

governments, disruptions to production and refining facilities, alternative fuels and the weather. Based on 2006

volumes and US exchange rates, Management estimated that a US$1 per barrel movement in the price of WTI

crude oil or in the refining spread between WTI and jet fuel impacted 2006 fuel expense by approximately C$27

million or US$24 million (excluding the impact of fuel surcharges and fuel hedging).

In order to manage the airline’s exposure to the volatility of jet fuel prices, the Corporation has hedged a portion

of its 2007 anticipated jet fuel requirements using mostly swap and collar option structures. The swap structure

allows the Corporation to fix jet fuel price at a specific level, whereas the collar option structure creates a ceiling

and a floor price, allowing the Corporation to protect itself against prices above the ceiling but exposing the

Corporation to the floor if the price falls below the floor. As at December 31, 2006, the Corporation had 39

percent of its fuel requirement for 2007 hedged at prices that can fluctuate between an average of US$74 to

US$85 per barrel for its heating oil-based contracts, an average of US$58 to US$69 per barrel for its WTI crude

oil-based contracts and an average of US$81 to US$85 for jet-fuel based contracts. Since December 31, 2006,

the Corporation has entered into new hedging positions, using collar option structures, which have added 5

percent coverage to 2007 increasing the total hedged volume for 2007 to 44 percent, as well as an additional 1

percent coverage to 2008. As at February 14, 2007, for 2007, the Corporation has hedged its projected fuel

requirements as follows: 57 percent for Quarter 1, 44 percent for Quarter 2, 36 percent for Quarter 3 and 39

percent for Quarter 4.

For information on fuel hedging gains and losses recognized in fuel expense in 2006 and gains and losses

recognized in “other” non-operating expense for derivative instruments that do not qualify for fuel hedging

accounting, refer to section 12 of this MD&A.

11

Management's Discussion and Analysis of Results and Financial Condition