Air Canada 2006 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2006 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

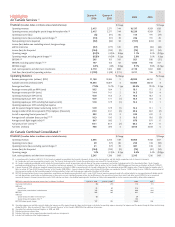

Highlights

Air Canada Services (1)

(1) In accordance with Canadian GAAP ACG-15, Air Canada is required to consolidate the financial statements of Jazz, certain leasing entities and fuel facility corporations into its financial statements.

Air Canada does not have any ownership interest in Jazz. The financial statements of Air Canada, the mainline airline, are termed "Air Canada Services".

(2) Air Canada's combined consolidated results include the financial position, results of operations and cash flows of the various components and entities (including Jazz Air LP) as described in Note 1 to Air Canada's

combined consolidated financial statements. Air Canada has two business segments: Air Canada Services and Jazz. Refer to section 1 of Air Canada's 2006 Management Discussion and Analysis of Results ("MD&A").

(3) A special charge of $102 million was recorded to operating revenues in Quarter 3 2006 in connection with Air Canada's obligations for the redemption of pre-2002 Aeroplan miles ("Special charge for Aeroplan miles")

Refer to section 20 "Non-GAAP Financial Measures" of Air Canada's 2006 MD&A. A special charge for labour restructuring of $28 million was recorded in Quarter 1 2006. During Quarter 4 2006, the estimated cost of

this plan was revised due to the favourable impact of attrition and other factors and the charge was reduced by $8 million to $20 million.

(4) EBITDAR (earnings before interest, taxes, depreciation, amortization and obsolescence and aircraft rent) is a non-GAAP financial measure commonly used in the airline industry to view operating results before aircraft

rent and depreciation, amortization and obsolescence as these costs can vary significantly among airlines due to differences in the way airlines finance their aircraft and other assets. EBITDAR is not a recognized

measure for financial statement presentation under GAAP and does not have a standardized meaning and is therefore not likely to be comparable to similar measures presented by other public companies.

(5) Operating expense per available seat mile, before fuel expense and the special charge for labour restructuring, is calculated as operating expense, removing fuel expense and the special charge for labour restructuring,

divided by ASMs. Refer to section 20 "Non-GAAP Financial Measures" of Air Canada's 2006 MD&A for additional information.

(6) Operating fleet excludes chartered freighters in 2006 and 2005.

(7) Excludes maintenance down-time.

(8) Excludes third party carriers operating under capacity purchase arrangements.

(9) Includes fuel handling and fuel hedging expenses.

Quarter 4 Quarter 4

2006 2005 2006 2005

Financial (Canadian dollars in millions unless stated otherwise) $ Change $ Change

Operating revenues

2,415

2,271 144

10,137

9,509 628

Operating revenues, excluding the special charge for Aeroplan miles

(3)

2,415

2,271 144

10,239

9,509 730

Operating income (loss)

(5 )

(91 ) 86

114

191 (77 )

Operating income (loss), excluding special charges

(3)

(13 )

(91 ) 78

236

191 45

Non-operating income (expense)

(52 )

(86 ) 34

(191 )

(224 ) 33

Income (loss) before non-controlling interest, foreign exchange

and for income tax

(57 )

(177 ) 120

(77 )

(33 ) (44 )

Income (loss) for the period

(144 )

(135 ) (9 )

(74 )

(20 ) (54 )

Operating margin

(0.2 )%

(4.0 )% 3.8 pp

1.1 %

2.0 % (0.9 )pp

Operating margin, excluding special charges

(3)

(0.5 )%

(4.0 )% 3.5 pp

2.3 %

2.0 % 0.3 pp

EBITDAR

(4)

205

105 100

921

936 (15 )

EBITDAR, excluding special charges

(3)

(4)

197

105 92

1,043

936 107

EBITDAR margin

8.5 %

4.6 % 3.9 pp

9.1 %

9.8 % (0.7 )pp

Cash, cash equivalents and short-term investments

2,110

1,302 808

2,110

1,302 808

Cash flows from (used for) operating activities

$ (159 )

$ (48 ) $ (111 )

$ 211

196 15

Operating Statistics % Change % Change

Revenue passenger miles (millions) (RPM)

11,160

10,584 5

48,993

46,762 5

Available seat miles (millions) (ASM)

14,343

13,807

4

61,083

58,818

4

Passenger load factor

77.8 %

76.7 % 1.1 pp

80.2 %

79.5 % 0.7

pp

Passenger revenue yield per RPM (cents)

18.5

18.4 1

18.1

17.5 3

Passenger revenue per ASM (cents)

14.4

14.1 2

14.5

13.9 4

Operating revenue per ASM (cents)

16.8

16.5 2

16.6

16.2 3

Operating expense per ASM (cents)

16.9

17.1 (1 )

16.4

15.8 4

Operating expense per ASM, excluding fuel expense (cents)

12.8

12.9 (1 )

12.2

12.1 1

Operating expense per ASM, excluding fuel expense

and the special charge for labour restructuring (cents)

(3)

(5)

12.9

12.9 (1 )

12.2

12.1 1

Average number of full-time equivalent (FTE) employees (thousands)

23.3

24.1 (3 )

23.6

24.0 (2 )

Aircraft in operating fleet at period end

(6)

332

322 3

332

322 3

Average aircraft utilization (hours per day)

(7) (8)

10.3

10.0 3

10.5

10.6 (1 )

Average aircraft flight length (miles)

(8)

847

842 1

873

871 0

Fuel price per litre (cents)

(9)

64.1

65.7 (2 )

66.2

59.7 11

Fuel litres (millions)

906

874 4

3,813

3,643 5

Air Canada Combined Consolidated (2)

Financial (Canadian dollars in millions unless stated otherwise) $ Change $ Change

Operating revenues

2,395

2,256 139

10,065

9,458 607

Operating income (loss)

29

(57 ) 86

259

318 (59 )

Operating income (loss), excluding special charges

(3)

21

(57 ) 78

381

318 63

Income (loss) for the period

(144 )

(135 ) (9 )

(74 )

(20 ) (54 )

Operating margin

1.2 %

(2.5 )% 3.7 pp

2.6 %

3.4 % (0.8 )pp

Cash, cash equivalents and short-term investments

2,245

1,336 909

2,245

1,336 909

EBITDAR is reconciled to operating income (loss) as follows ($ millions) Quarter 4, 2006 Quarter 4, 2005 2006 2005

Operating income (loss) (5 ) (91 ) 114 191

Add back:

Aircraft rent 75 90 314 341

Depreciation, amortization & obsolescence 135 106 493 404

EBITDAR 205 105 921 936

Add back:

Special charge for labour restructuring (3) (8 ) - 20 -

Special charge for Aeroplan miles (3) - - 102 -

EBITDAR before special charges 197 105 1,043 936