Air Canada 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

Table of contents

-

Page 1

-

Page 2

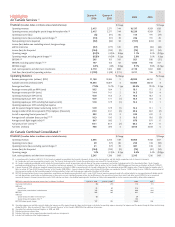

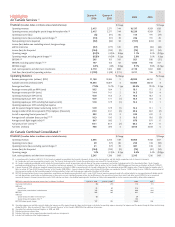

... fuel expense and the special charge for labour restructuring (cents) (3) (5) Average number of full-time equivalent (FTE) employees (thousands) Aircraft in operating fleet at period end (6) Average aircraft utilization (hours per day) (7) (8) Average aircraft flight length (miles) (8) Fuel price...

-

Page 3

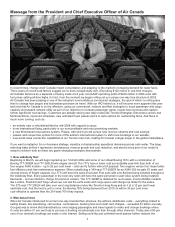

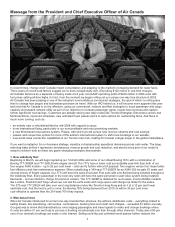

... CHIEF EXECUTIVE OFFICER, AIR CANADA ... MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS ... PREFACE ... GLOSSARY ... OVERVIEW AND GENERAL BUSINESS SUMMARY ... FUEL RISK MANAGEMENT ... EMPLOYEES AND LABOUR RELATIONS ... FLEET ... RESULTS OF OPERATIONS...

-

Page 4

...expand network utility as part of our objective to increase passenger yields, create new revenues and capture further significant cost savings. Customers are already seeing new daily routes like Toronto-Shanghai, Edmonton-London and Montreal-Rome, improved schedules, new unlimited travel passes and...

-

Page 5

... causing even more booking activity to shift to aircanada.com. Air Canada is shaking up the airline business. By using our new corporate passes, large customers like TELUS® not only save on fares but are slashing their administration costs. At our instigation, travel agent reservations systems are...

-

Page 6

... relating to these statements. For a detailed description of the risks affecting the business of Air Canada and its subsidiaries, see the "Risk Factors" section in this MD&A. Air Canada's combined consolidated financial statements include the financial position, results of operations and cash...

-

Page 7

...a number of factors, including without limitation, energy prices, general industry, market and economic conditions, war, terrorist attacks, changes in demand due to the seasonal nature of the business, the ability to reduce operating costs and employee counts, employee relations, labour negotiations...

-

Page 8

... Air Canada seats to be provided to Aeroplan members who choose to redeem their Aeroplan miles for air travel rewards. The Corporation also generates revenues from cargo services provided by Air Canada and Air Canada Cargo, tour operator services provided by Air Canada Vacations and ground handling...

-

Page 9

... market. Pass sales increased 148 percent in 2006. "À la carte" options provide customers with the ability to customize their purchase by selecting the items for which they would like to pay, or not. Examples of "à la carte" options include, checked baggage, advance seat assignment, Aeroplan miles...

-

Page 10

... efficient on a unit cost basis for fuel and maintenance. At the same time, POLARIS is expected to generate productivity improvements in call centers, airport check-in and revenue accounting. Maintaining Positive Employee and Labour Relations As part of its focus on employee relations, Air Canada...

-

Page 11

...impact of fuel surcharges and fuel hedging). In order to manage the airline's exposure to the volatility of jet fuel prices, the Corporation has hedged a portion of its 2007 anticipated jet fuel requirements using mostly swap and collar option structures. The swap structure allows the Corporation to...

-

Page 12

... that represent them.

Employee Group Management and Administrative Support Pilots Flight Attendants (3) Customer Sales and Service Agents (3) Technical Services, Ramp and Cargo United Kingdom Unionized Employees Other Unionized Air Canada Services Jazz Consolidated

(3)

Union(1) N/A ACPA CUPE CAW...

-

Page 13

... personal rewards. These Plans provide employees with financial rewards on a monthly basis when operational performance levels are achieved. The Air Canada Plans also permit employees to share in the fiscal year-end pre-tax profits and Jazz's Plans provide annual rewards where corporate, financial...

-

Page 14

... Consolidated under Operating (2) AcG-15 Lease

Total seats Air Canada Services Widebody Aircraft Airbus A340-500 Airbus A340-300 Airbus A330-300 Boeing 767-300 Boeing 767-200 Narrowbody Aircraft Airbus A321 Airbus A320 Airbus A319 Embraer 190 Embraer 175 Total Operating Aircraft Jazz Bombardier CRJ...

-

Page 15

...

Operating expenses Salaries, wages and benefits Aircraft fuel Aircraft rent Airport and navigation fees Aircraft maintenance, materials and supplies Communications and information technology Food, beverages and supplies Depreciation, amortization and obsolescence Commissions Capacity purchase fees...

-

Page 16

...

Operating expenses Salaries, wages and benefits Aircraft fuel Aircraft rent Airport and navigation fees Aircraft maintenance, materials and supplies Communications and information technology Food, beverages and supplies Depreciation, amortization and obsolescence Commissions Capacity purchase fees...

-

Page 17

... mile than short-haul flights. When measured on a per mile basis, the average fare paid on long-haul flights is relatively lower than on short-haul flights. At the same time, since the costs of ground handling, take-off and landing are similar for both short and long-haul flights, unit costs...

-

Page 18

... revenues from Air Canada Vacations, mainly due to increased passenger volumes, accounted for approximately $18 million of the increase. Other increases included flight cancellation and change fees, buy-on-board revenues and other miscellaneous revenues. Operating Expenses Operating expenses in...

-

Page 19

... 4 2006. Increases in ownership costs included a change in assumptions relating to the residual value of certain aircraft and the addition of 16 Embraer aircraft to Air Canada's operating fleet. Decreases in ownership costs included the impact of aircraft returns and lease terminations, the transfer...

-

Page 20

... was mainly due to a growth in fleet size consistent with Jazz's plan to increase its relative share of the North American ASM capacity, an increase in hours of contract flying under the Jazz CPA, as well as cost control. The Jazz CPA came into effect on January 1, 2006. The major changes from...

-

Page 21

...

Operating expenses Salaries, wages and benefits Aircraft fuel Aircraft rent Airport and navigation fees Aircraft maintenance, materials and supplies Communications and information technology Food, beverages and supplies Depreciation, amortization and obsolescence Commissions Capacity purchase fees...

-

Page 22

...non-unionized employees by 20 percent. As at February 14, 2007, approximately 75 percent of the planned reductions had been completed. A special charge of $28 million was recorded in the Air Canada Services segment in Quarter 1 2006 relating to this program. During Quarter 4 2006, the estimated cost...

-

Page 23

... the year ended December 31, 2005. The amounts in the table below include intersegment revenues and expenses.

Air Canada Services Change 2006 2005 $ Jazz % 2006 2005 Change $ %

($ millions, except per share figures) Operating revenues Passenger Cargo Other Special charge for Aeroplan miles

$ 8,887...

-

Page 24

...-related fare increases to offset higher fuel costs. Increased demand for the higher-priced Tango Plus product was also a factor in the passenger yield growth over 2005. For 2006, domestic RASM rose 3 percent as a result of the yield improvement partly offset by a decrease of 0.5 percentage points...

-

Page 25

...change fees, buy-on-board revenues and other miscellaneous revenues. Operating Expenses Operating expenses increased $705 million or 8 percent in 2006 largely reflecting a 4 percent growth in capacity in addition to a $347 million or 16 percent increase in fuel expense. For 2006, unit cost increased...

-

Page 26

... mainly due to a 6 percent increase in aircraft departures and increased rates for landing and general terminal fees primarily at Toronto's Pearson International Airport. At Pearson, general terminal charges rose 9 percent per seat for domestic and international arrivals. These increases were partly...

-

Page 27

... 2006 was mainly due to a growth in fleet size consistent with Jazz's plan to increase its relative share of the North American ASM capacity, an increase in hours of contract flying under the Jazz CPA, as well as cost control. The Jazz CPA came into effect on January 1, 2006. The major changes from...

-

Page 28

unit aircraft rental cost increase mainly reflected six CRJ-200 aircraft deliveries and the transfer of 10 CRJ-100 aircraft from Air Canada partly offset by a termination of two Dash 8 aircraft operating leases. Segment income of $140 million was recorded in 2006 compared to segment income of $118 ...

-

Page 29

... and Analysis of Results and Financial Condition

9. FINANCIAL AND CAPITAL MANAGEMENT

9.1

Financial Position

The Corporation's combined consolidated statement of financial position includes the accounts of certain entities which are not legally controlled by Air Canada, including Jazz and...

-

Page 30

... for the periods indicated.

Air Canada Services December 31, 2006 Inter-segment Jazz elimination Consolidated total Air Canada Services December 31, 2005 Inter-segment Jazz elimination Consolidated total

($ millions)

ASSETS Current Cash and cash equivalents Short-term investments $ $ $ $ 1,312...

-

Page 31

... Air Canada's innovative customer driven revenue model in conjunction with a redesigned network and a renewed fleet is expected to generate increased revenue and improved cost efficiencies going forward. This, in turn, is expected to improve cash generated from operations which will in part be used...

-

Page 32

...to net cash provided by operations Depreciation, amortization and obsolescence (Gain) loss on sale of assets Foreign exchange (gain) loss Future income taxes Employee future benefit funding more than expense Decrease (increase) in accounts receivable Decrease (increase) in spare parts, materials and...

-

Page 33

Management's Discussion and Analysis of Results and Financial Condition

As described in Note 1 to Air Canada's combined consolidated financial statements, inter-company accounts between ACE and Air Canada were settled at the time of the Air Canada IPO which resulted in an increase to cash and cash ...

-

Page 34

...to net cash provided by operations Depreciation, amortization and obsolescence (Gain) loss on sale of assets Foreign exchange (gain) loss Future income taxes Employee future benefit funding more than expense Decrease (increase) in accounts receivable Decrease (increase) in spare parts, materials and...

-

Page 35

... and Analysis of Results and Financial Condition

Cash Flows from Operating Activities For 2006, cash flows from operations for the Air Canada Services segment were $211 million, an increase of $15 million over 2005, primarily due to improved operating results partly offset by increased pension plan...

-

Page 36

... for the years 2007 through to 2011 and thereafter under existing operating leases as at December 31, 2006.

($ millions) Air Canada Services (1) Aircraft operating leases Other property Total Air Canada Services Jazz Aircraft operating leases Other property Total Jazz Consolidated total 2007 2008...

-

Page 37

... the term to maturity. On November 3, 2006, Air Canada made an application for loan guarantee support from the Export-Import Bank of the United States for the first seven Boeing 777 aircraft deliveries in 2007. The loan guarantee, if provided, would cover a 12-year loan term for 85 percent of the...

-

Page 38

...net of related financing, if applicable, for the years 2007 through to 2011. In addition to the firm aircraft orders, Air Canada's purchase agreements include options, cancelable orders and purchase rights, all of which are not included in these projections.

Air Canada Services Projected planned and...

-

Page 39

... benefit and defined contribution plans providing pension, other retirement and post-employee benefits to its employees, including those employees of the Corporation who are contractually assigned to ACTS and Aeroplan. Air Canada's combined consolidated financial statements include all of the assets...

-

Page 40

... Canadian. The issued and outstanding shares of Air Canada, along with shares potentially issuable, are as follows:

Number of shares (000) At January 31, 2007 Issued and outstanding shares Class A variable voting shares Class B voting shares Total issued and outstanding shares 17,572,543 82,427...

-

Page 41

...Operating expenses Operating income (loss) Total non-operating income (expense), non-controlling interest, foreign exchange gain (loss) and income tax Net income (loss) Earning (loss) per share - Basic - Diluted Revenue passenger miles (millions) Available seat miles (millions) Passenger load factor...

-

Page 42

... year. This demand pattern is principally a result of the high number of leisure travelers and their preference for travel during the spring and summer months. The cost structure of the Corporation is such that its fixed costs do not fluctuate proportionately with passenger demand in the short...

-

Page 43

... items Total non-operating income (expense), non-controlling interest, foreign exchange gain (loss) and income tax Net income (loss) EBITDAR (3) EBITDAR excluding special charges Earning (loss) per share - Basic - Diluted Cash, cash equivalents and short-term investments Total assets Total long-term...

-

Page 44

...changes in interest rates, foreign exchange rates and jet fuel prices through the use of various derivative financial instruments. The Corporation uses derivative financial instruments only for risk management purposes, not for generating trading profit. Interest Rate Risk Management The Corporation...

-

Page 45

... hedge accounting purposes. The unrealized changes in fair value have been recorded in "foreign exchange gain (loss)" on Air Canada's combined consolidated statement of operations. Fuel Price Risk Management The Corporation enters into contracts with financial intermediaries to manage its exposure...

-

Page 46

... trade balances relate mainly to the provision of services, the allocation of employee-related costs, the allocation of corporate expenses and centralized cash management activities. Refer to Notes 1, 6, 7 and 9 to Air Canada's combined consolidated financial statements for additional information...

-

Page 47

...") Air Canada provides ACTS with the services of a group of unionized and non-unionized employees for which is reimbursed by ACTS for all costs, including salary and benefits, on a fully allocated basis. The ACTS GSAs may be

terminated by either party at any time and without cause upon a 30 days...

-

Page 48

...information technology services Revenues from corporate services and other Cargo revenues from related parties Expenses Maintenance expense from ACTS Call centre management and marketing fees from Aeroplan Other expenses Recovery of salary, wages and benefit expense for employees assigned to related...

-

Page 49

... on a straight-line basis over the period during which the travel pass is valid. The Corporation has formed alliances with other airlines encompassing loyalty program participation, code sharing and coordination of services including reservations, baggage handling and flight schedules. Revenues are...

-

Page 50

...the asset allocation strategy adopted by the Corporation, including the longer duration in its bond portfolio in comparison to other pension plans. These factors are used to determine the average rate of expected return on the funds invested to provide for the pension plan benefits. While the review...

-

Page 51

...to discount rate and expected return on plan assets is as follows:

Impact on 2006 pension expense in $ millions Discount rate on obligation assumption Long-term rate of return on plan assets assumption 0.25 percentage point Decrease Increase 29 25 (19) (25)

Assumed health care cost trend rates have...

-

Page 52

...lease payments. On the application of fresh start accounting effective September 30, 2004, the cost of the Corporation's property and equipment was adjusted to fair value. In addition, the estimated useful lives of certain assets were adjusted, including buildings where useful lives were extended to...

-

Page 53

Management's Discussion and Analysis of Results and Financial Condition

15. FUTURE ACCOUNTING STANDARD CHANGES

The Accounting Standards Board has issued three new standards dealing with financial instruments that the Corporation will be required to adopt in future years: (i) (ii) (iii) Financial ...

-

Page 54

...Canada System System

18.1 23.7 48,993 15,465 80.2 14.5

1% change in yield

84 35 76 31 95 80

Traffic (RPMs) (millions)

1% change in traffic

Passenger load factor RASM (cents) Cost Measures Labour and benefits expenses ($ millions) Fuel - WTI price (US$/barrel)

(1) (1)

1 percentage point change...

-

Page 55

... cash from its operations to pay its debts and lease obligations. Need for Additional Capital The Corporation faces a number of challenges in its current business operations, including high fuel prices and increased competition from international, transborder and low-cost domestic carriers. In order...

-

Page 56

... levels, fuel costs could have a material adverse effect on the Corporation's business, results from operations and financial condition. Due to the competitive nature of the airline industry, the Corporation may not be able to pass on increases in fuel prices to its customers by increasing its fares...

-

Page 57

... lower fare alternatives by providing them with access to more pricing information. The increased price awareness of both business and leisure travelers as well as the growth in new distribution channels have further motivated airlines to price aggressively to gain fare and market share advantages...

-

Page 58

...with Aeroplan, the Corporation is able to offer its customers who are Aeroplan members the opportunity to earn Aeroplan miles. Based on customer surveys, Management believes that rewarding customers with Aeroplan miles is a significant factor in customers' decision to travel with Air Canada and Jazz...

-

Page 59

... and Air Canada's business, results from operations and financial condition could be materially adversely affected. Star Alliance® The strategic and commercial arrangements with Star Alliance® members provide the Corporation with important benefits, including codesharing, efficient connections...

-

Page 60

... has appealed the order dismissing its claim. In addition, see above Risk Factor entitled "Equal Pay Litigation". Key Personnel The Corporation is dependent on the experience and industry knowledge of its executive officers and other key employees to execute its business plan. If Air Canada were to...

-

Page 61

...profit margins and high fixed costs. The costs of operating any particular flight do not vary significantly with the number of passengers carried and, therefore, a relatively small change in the number of passengers or in fare pricing or traffic mix could have a significant effect on the Corporation...

-

Page 62

...could have a material adverse effect on the Corporation's business, results from operations and financial condition. The availability of international routes to Canadian air carriers is regulated by agreements between Canada and foreign governments. Changes in Canadian or foreign government aviation...

-

Page 63

... with these regulatory regimes is expected to result in additional operating costs and could have a material adverse effect on the Corporation's business, results from operations and financial condition. Increased Insurance Costs Since September 11, 2001 the aviation insurance industry has been...

-

Page 64

... additional shares. Any sale by ACE or Air Canada of shares in the public market, or the perception that sales could occur could adversely affect prevailing market prices of the shares. Refer to Note 18 to Air Canada's combined consolidated financial statements for additional information on related...

-

Page 65

...required. Management has commenced remedial action to add additional qualified income tax professionals with the appropriate knowledge and experience which addresses this design area. There were no changes to the Corporation's internal controls over financial reporting during the year ended December...

-

Page 66

...

A fundamental building block of the airline industry is to match capacity with demand. Air Canada has successfully pursued this strategy as evidenced by its annual record load factors over the last three years. In 2006, Air Canada Services flew 61.1 billion available seat miles, an increase of...

-

Page 67

...$ Change $ Change

2006

2005

Air Canada Services GAAP operating income (loss) Add back: Aircraft rent Depreciation, amortization and obsolescence EBITDAR Add back: Special charge for labour restructuring Special charge for Aeroplan miles EBITDAR excluding special charges Jazz GAAP operating income...

-

Page 68

... is the total cost of the 20 percent non-unionized workforce reduction plan announced in February 2006. The special charges for Aeroplan miles and labour restructuring are not reflective of the underlying financial performance of the Air Canada Services segment from ongoing operations. The following...

-

Page 69

Management's Discussion and Analysis of Results and Financial Condition

Operating Expense excluding Fuel Expense and the Special Charge for Labour Restructuring The Air Canada Services segment uses operating expense excluding fuel expense and the special charge for labour restructuring to assess ...

-

Page 70

...'s responsibilities as to the adequacy of the supporting systems of internal controls; provides oversight of the independence, qualifications and appointment of the external auditor; and, pre-approves audit and audit-related fees and expenses. The Board of Directors approves the Corporation...

-

Page 71

... of financial position of Air Canada as at December 31, 2006 and December 31, 2005 and the combined consolidated statements of operations, deficit and cash flows for the years then ended. These combined consolidated financial statements are the responsibility of the company's management. Our...

-

Page 72

...(21)

Operating expenses Salaries, wages and benefits Aircraft fuel Aircraft rent Airport and navigation fees Aircraft maintenance, materials and supplies Communications and information technology Food, beverages and supplies Depreciation, amortization and obsolescence Commissions Special charge for...

-

Page 73

... debt and capital leases Notes payable to ACE subsidiary Future income taxes Pension and other benefit liabilities Other long-term liabilities Preferred shares

note 7 note 1 note 8 note 9 note 10 note 12

Non-controlling interest SHAREHOLDERS' EQUITY Share capital Contributed surplus Deficit note...

-

Page 74

...restricted cash Increase (decrease) in Aeroplan Miles obligation Non-controlling interest Special charge for Aeroplan Miles Allocation of corporate expenses Aircraft lease payments (in excess of) less than rent expense Other Financing Issue by Air Canada of share capital Issue of Jazz units Transfer...

-

Page 75

...consolidated statement of financial position and combined consolidated statements of operations and cash flows are of Air Canada (the "Corporation"), a subsidiary of ACE Aviation Holdings Inc. ("ACE"). In conjunction with the initial public offering of Air Canada (the "Air Canada IPO"), which closed...

-

Page 76

... active business. Air Canada has two business segments: Air Canada Services and Jazz. Air Canada Services is the passenger and cargo transportation services business operated by Air Canada and related ancillary services. Jazz operates under the capacity purchase agreement with Air Canada that came...

-

Page 77

... investments in Aeroplan). During 2006, Jazz settled a Note payable outstanding to a subsidiary of ACE of $200 in connection with the initial public offering of Jazz Air Income Fund (Note 19). C) NATURE OF OPERATIONS Air Canada is Canada's largest domestic and international full-service airline and...

-

Page 78

...United States. Jazz focuses on flight operations and customer service and Air Canada is responsible for scheduling, marketing, pricing and related commercial activities of the regional operations. Under the Jazz CPA, Jazz records revenues from Air Canada based upon fees relating to flight operations...

-

Page 79

... in the aircraft fuel, airport and navigation fees and other operating expense categories. F) AEROPLAN LOYALTY PROGRAM Air Canada is an Aeroplan partner providing certain of Air Canada's customers with Aeroplan Miles, which can be redeemed by customers for air travel or other rewards acquired by...

-

Page 80

...related to these passenger tickets is recorded in passenger revenues when transportation is provided. For Aeroplan Miles earned by Air Canada customers, Air Canada purchases Miles from Aeroplan in accordance with the terms of the CPSA. The cost of purchasing Aeroplan Miles from Aeroplan is accounted...

-

Page 81

... in other operating expenses are expenses related to building rent and maintenance, terminal handling, professional fees and services, crew meals and hotels, advertising and promotion, insurance costs, credit card fees, ground costs for Air Canada Vacations packages, and other expenses. Expenses are...

-

Page 82

... statement of financial position in Other assets and recognized in Fuel expense at the same time as the hedged jet fuel is consumed. Similarly, the value of the derivatives previously measured at fair value where the Corporation did not apply hedge accounting is also treated as a cost of the...

-

Page 83

... estimated useful lives. Estimated Useful Life Indefinite Indefinite Indefinite 25 years 10 to 15 years 1 to 5 years

International route rights and slots Air Canada trade name Other marketing based trade names Star Alliance membership Other contract and customer based intangible assets Technology...

-

Page 84

...of fair value can be made. The associated asset retirement costs are capitalized as part of the carrying amount of the long-lived asset and then amortized over its estimated useful life. In subsequent periods, the asset retirement obligation is adjusted for the passage of time and any changes in the...

-

Page 85

... to Jazz, pays certain variable costs of operating Jazz aircraft and is obligated to cover the costs of certain aircraft return obligations related to Jazz aircraft covered under the Jazz CPA. Air Canada does not hold any partners units of Jazz. Due to the terms of the Jazz CPA, Air Canada is...

-

Page 86

... buildings with a carrying value of $35, for proceeds of $40 resulting in a gain on sale of $5. The Corporation recorded an impairment loss of $7 on one of its buildings being held for sale, which is to be sold to an affiliate in early 2007, within non-operating expenses of the Air Canada Services...

-

Page 87

Combined Consolidated Financial Statements 2006

4. DEFERRED CHARGES

2006

2005

Aircraft lease payments in excess of rent expense - Air Canada Services Financing costs - Air Canada Services Aircraft lease payments in excess of rent expense - Jazz Financing costs - Jazz

$

$

55 18 28 2 103

$

$...

-

Page 88

... 2005

Indefinite life assets International route rights and slots Air Canada trade name Other marketing based trade names Finite life assets Star Alliance membership Other contract and customer based Technology based Accumulated depreciation and amortization Star Alliance membership Other contract...

-

Page 89

Combined Consolidated Financial Statements 2006

6. DEPOSITS AND OTHER ASSETS

2006

2005

Aircraft related deposits and derivative instruments Collateral under letters of credit and other deposits Advances to ACE Other

$ note 1 $

172 133 7 312

$

$

167 127 186 10 490

89

-

Page 90

... that Air Canada drew relating to the Embraer aircraft financing (7.81% - weighted average rate of the fixed and floating interest rate loans outstanding as at December 31, 2005). (b) US$158 principal outstanding on purchases of two A340-500 aircraft financed through conditional sales agreements...

-

Page 91

... to the six month LIBOR rate plus 5.75% pre-payable on any interest payment date after December 23, 2007 secured by certain flight training equipment with a current carrying value of $55. (e) Upon closing of the Air Canada IPO and satisfaction of certain customary conditions, the revolving credit...

-

Page 92

... and to the extent the Corporation has obtained residual value support on lease expiry. The maximum amount payable on July 1, 2009, assuming the related aircraft are worth nil, is US$871. This amount declines over time to nil upon lease expiry. Interest paid on long-term debt and capital lease...

-

Page 93

... Current Taxes Payable As part of a tax loss utilization strategy that was planned in conjunction with the initial public offering of Air Canada and corporate restructuring, a current tax payable of $345 was created. This tax payable arose upon a transaction to transfer tax assets from Air Canada to...

-

Page 94

...) based on combined federal and provincial rates Non-taxable portion of capital gains Large corporations tax Non-deductible expenses Effect of tax rate changes on future income taxes Effect of statutory tax rates substantially enacted during the year Other Valuation allowance (Recovery of) provision...

-

Page 95

... Japan plan are international plans covering employees in those countries. In addition, the Corporation maintains a number of supplementary pension plans, which are not registered. The defined benefit pension plans provide benefits upon retirement, termination or death based on the member's years of...

-

Page 96

... Plan Assets The following tables present financial information related to the change in the pension and other postemployment benefits plans:

Pension Benefits 2006 2005 Other Employee Future Benefits 2006 2005

Change in benefit obligation Benefit obligation at beginning of year Current service cost...

-

Page 97

...of Pension Benefits related to Jazz (2005 - $5), which is consolidated under AcG-15. (b) A rate of compensation increase of 0% in 2005 and 2% in 2006 was used in determining the net benefit pension expense and 4% for the remaining years. Other Benefits - Sensitivity Analysis Assumed health care cost...

-

Page 98

increase in assumed health care trend rates would have increased the service and interest costs by $1 and the obligation by $17. A one percentage point decrease in assumed health care trend rates would have decreased the service and interest costs by $1 and the obligation by $16. Pension Plan Cash ...

-

Page 99

...the asset allocation strategy adopted by the Corporation, including the longer duration in its bond portfolio in comparison to other pension plans. These factors are used to determine the average rate of expected return on the funds invested to provide for the pension plan benefits. While the review...

-

Page 100

... in excess of lease payments (c) Long-term employee liabilities (d) Workplace safety and insurance board liability Other

$

$

105 77 121 54 45 70 472

$

$

80 107 126 86 53 44 496

(a) Air Canada has a liability related to Aeroplan Miles which were issued by Air Canada prior to January 1, 2002...

-

Page 101

...reduce non-unionized employee levels by 20 percent. A special charge of $28 was recorded in the Air Canada Services segment in Quarter 1 2006 relating to this program. During Quarter 4 2006, the estimated cost of this plan was revised due to the favourable impact of attrition and other factors which...

-

Page 102

...activity related to Corporation employees participating in the ACE stock options' plan is as follows:

2006 Options (000) Weighted Average Exercise Price/Share Options (000) 2005 Weighted Average Exercise Price/Share

Beginning of year Granted Exercised Forfeited Outstanding options, prior to special...

-

Page 103

... Corporation's employees participate in the Air Canada Long-term Incentive Plan (the "Long-term Incentive Plan") administered by the Board of Directors of Air Canada. The Long-term Incentive Plan provides for the grant of options and performance share units to senior management and officers of Air...

-

Page 104

...to 6% of their base salary for the purchase of shares or units on the secondary market. Air Canada and Jazz will match 33.3% of the investments made by the employee. During 2006, the Corporation recorded compensation expense of $2 in the Air Canada Services segment and $2 in the Jazz segment for the...

-

Page 105

... (a) Special common shares Adjustment to shareholders' equity (b)

$

$

562 562 (288) 274

$

$

325 325 (303) 22

(a) The net proceeds from the Treasury offering by Air Canada in 2006 resulted in an increase to shareholders' equity of $187 (after $13 of expenses). The carrying value of outstanding...

-

Page 106

...and outstanding Class A variable voting shares Class B voting shares Total issued and outstanding Potential common shares Stock options

18 82 100 2

During 2005, a nominal number of common shares were issued to ACE in consideration for the acquisition of the assets of Destina. Special Common Shares...

-

Page 107

... 2005

Contributed surplus, beginning of year Allocation of corporate expenses (Note 1) Fair value of stock options issued to Corporation employees recognized as compensation expense (Note 11) ACE plan Air Canada plan Allocation of reduction to intangible assets (Note 8) Utilization of future income...

-

Page 108

... securities are assumed to be used to purchase Class B Voting Shares. Excluded from the calculation of diluted earnings per share were 1,699,678 outstanding options as the option's exercise price was greater than the average market price of the common shares for the year (2005 - nil). At December 31...

-

Page 109

...:

2006 Air Canada Services Jazz Elimination Consolidated Total

Passenger revenue Cargo revenue Other revenue External revenue Inter-segment revenue Special charge for Aeroplan Miles Total revenues Salaries, wages, and benefits Aircraft fuel Aircraft rent Airport user fees Aircraft maintenance...

-

Page 110

2005 Air Canada Services Jazz Elimination Consolidated Total

Passenger revenue Cargo revenue Other revenue External revenue Inter-segment revenue Total revenues Salaries, wages, and benefits Aircraft fuel Aircraft rent Airport user fees Aircraft maintenance materials and supplies Depreciation of ...

-

Page 111

... and cargo transportation services business operated by Air Canada and related ancillary services. The Jazz segment is Jazz Air LP operating under the capacity purchase agreement ("Jazz CPA") with Air Canada as described in Note 1C. Under the Jazz CPA, Jazz is reimbursed for all pass-through costs...

-

Page 112

... over the term to maturity. In November 2006, Air Canada made an application for loan guarantee support from the Export-Import Bank of the United States for the first seven Boeing 777 aircraft deliveries in 2007. The loan guarantee, if provided, would cover a 12-year loan term for 85% of the capital...

-

Page 113

... Consolidated Financial Statements 2006

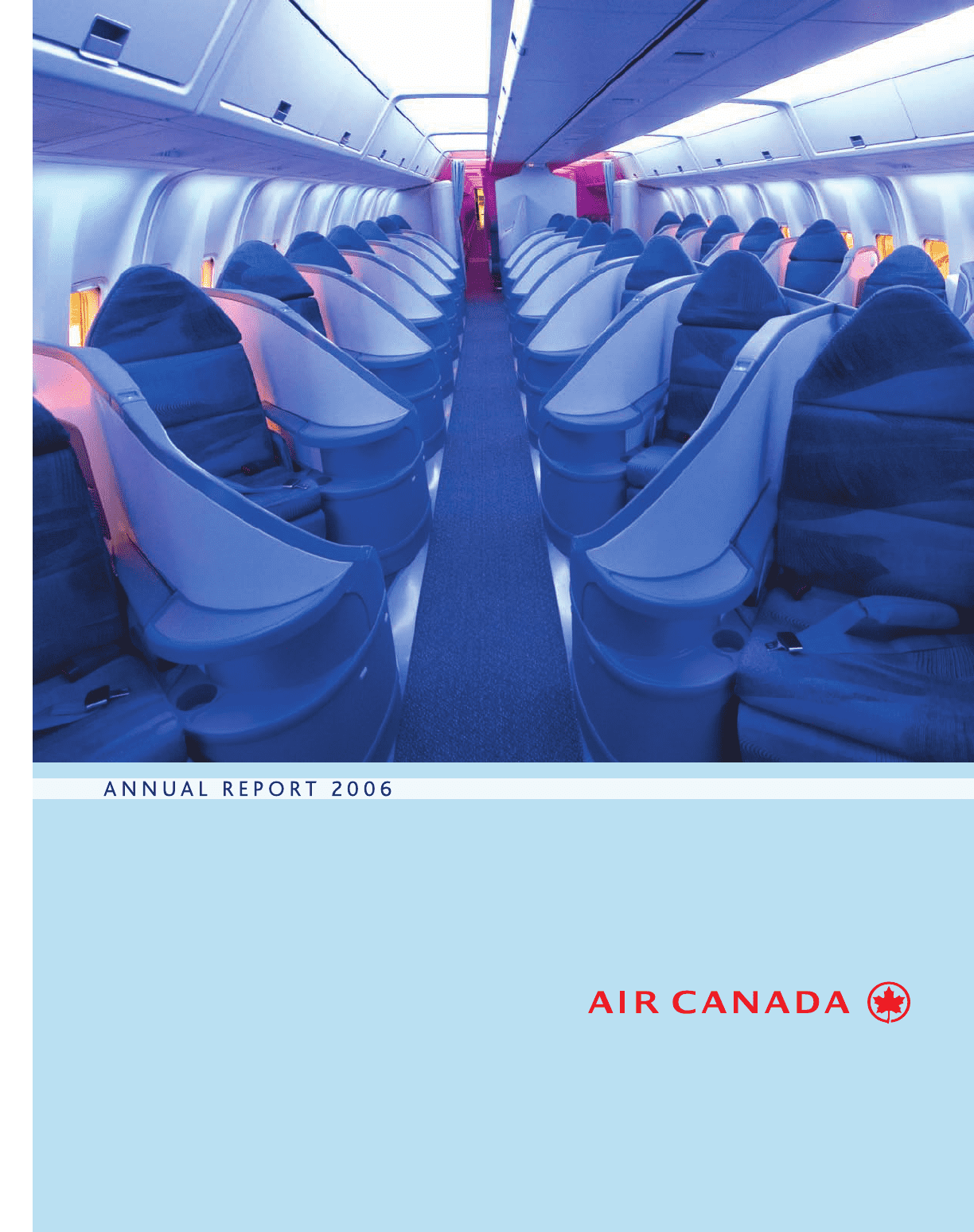

Air Canada has signed a 10-year lease for one Boeing 777-300ER from International Lease Finance Corporation ("ILFC"), which is scheduled to be delivered in May 2007. Aircraft Interior Refurbishment Program In addition to acquiring new aircraft, Air Canada...

-

Page 114

...changes in interest rates, foreign exchange rates and jet fuel prices through the use of various derivative financial instruments. The Corporation uses derivative financial instruments only for risk management purposes, not for generating trading profit. Interest Rate Risk Management The Corporation...

-

Page 115

... the combined consolidated statement of financial position for cash and shortterm investments, accounts receivable and accounts payable approximate fair values due to the immediate or short-term maturities of these financial instruments. The fair value of long-term debt and capital lease obligations...

-

Page 116

...' equity called other comprehensive income will be presented. The new section will include gains and losses related to the mark-to-market of investment securities and cash flow hedges. The impact of measuring fuel hedging derivatives at fair value on January 1, 2007 will be recognized in opening...

-

Page 117

... is the Corporation's policy to conduct its business in full compliance with all applicable competition laws. Pay Equity Complaints filed in 1991 and 1992 with the Canadian Human Rights Commission against Air Canada and the former Canadian Airlines International on behalf of flight attendants at the...

-

Page 118

...consequences. When the Corporation, as a customer, enters into technical service agreements with service providers, primarily service providers who operate an airline as their main business, the Corporation has from time to time agreed to indemnify the service provider against liabilities that arise...

-

Page 119

... 2006

arise out of or relate to the negligence of the service provider, but excluding liabilities that arise from the service provider's gross negligence or willful misconduct. Under its general by-laws, the Corporation has indemnification obligations to its directors and officers. Pursuant to such...

-

Page 120

...information technology services to related parties Revenues from corporate services and other Cargo revenues from related parties Expenses Maintenance expenses from ACTS Call centre management and marketing fees from Aeroplan Other expenses Recovery of salary, wages and benefit expense for employees...

-

Page 121

... purchase of Aeroplan Miles. The Aeroplan CPSA also provides that Aeroplan shall, in return for a service fee, manage Air Canada's frequent flyer tier membership program for Air Canada Super Elite(TM), Elite(TM) and Prestige(TM) customers, as well as perform certain marketing and promotion services...

-

Page 122

...years to compensate Air Canada for call centre employees' share of the unfunded Air Canada pension liability. Amounts related to GSA are recorded in the above table summarizing related party revenues and expenses under Recovery of salary, wages, and benefit expense for employees assigned to Aeroplan...

-

Page 123

... Corporation and ACE Master Services Agreement Air Canada provides certain administrative services to ACE in return for a fee. Such services relate to finance and accounting, information technology, human resources and other administrative services. Cash Management System Air Canada manages the cash...

-

Page 124

... of the outstanding limited partnership units of Jazz. ACE holds the remaining 79.7% of the outstanding limited partnership units of Jazz. In connection with the initial public offering, Jazz Air Limited Partnership transferred substantially all of its assets and liabilities to the new Jazz Air LP...

-

Page 125

..., by amendment, Air Canada has assumed responsibility for the redemption of up to 112 billion Miles and, as a result, recorded a special charge of $102 for the incremental 9 billion Miles against Operating revenues in the year ended December 31, 2006 and increased Aeroplan deferred revenues. This...

-

Page 126

..., Network Planning Susan Welscheid Vice President, Customer Experience - In-Flight Service Carolyn Hadrovic Corporate Secretary Chris Isford Controller Chantal Baril President and Chief Executive Officer, ACGHS Claude Morin President and Chief Executive Officer, Air Canada Cargo Benjamin...

-

Page 127

...: (514) 205-7859

Investor Relations

Director, Investor Relations Telephone: (514) 422-7849 Facsimile: (514) 422-7877

Price Range and Trading Volume of Air Canada Voting Shares (AC.B)

2006 4th Quarter High $ 21.05 Low $ 15.63 Volume Traded 8,976,738

Head Office

Air Canada Centre 7373 Côte-Vertu...

-

Page 128

...Corporation's primary hubs are located in Toronto, Montreal, Vancouver and Calgary. Air Canada also operates an extensive global network in conjunction with its international partners. Air Canada is a founding member of the Star Alliance, the world's largest airline alliance group. The Star Alliance...