Aetna 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report - Page 14

Risk Management and Market-Sensitive Instruments

We manage interest rate risk by seeking to maintain a tight match between the durations of our assets and liabilities

where appropriate. We manage credit risk by seeking to maintain high average quality ratings and diversified sector

exposure within our debt securities portfolio. In connection with our investment and risk management objectives, we

also use derivative financial instruments whose market value is at least partially determined by, among other things,

levels of or changes in interest rates (short-term or long-term), duration, prepayment rates, equity markets or credit

ratings/spreads. Our use of these derivatives is generally limited to hedging purposes and has principally consisted of

using interest rate swap agreements, warrants, forward contracts, futures contracts and credit default swaps. These

instruments, viewed separately, subject us to varying degrees of interest rate, equity price and credit risk. However,

when used for hedging, we expect these instruments to reduce overall risk.

We regularly evaluate our risk from market-sensitive instruments by examining, among other things, levels of or

changes in interest rates (short-term or long-term), duration, prepayment rates, equity markets or credit

ratings/spreads. We also regularly evaluate the appropriateness of investments relative to our management-approved

investment guidelines (and operate within those guidelines) and the business objectives of our portfolios.

On a quarterly basis, we review the impact of hypothetical net losses in our investment portfolio on our consolidated

near-term financial position, results of operations and cash flows assuming the occurrence of certain reasonably

possible changes in near-term market rates and prices. We determine the potential effect of interest rate risk on near-

term net income, cash flow and fair value based on commonly used models. The models project the impact of

interest rate changes on a wide range of factors, including duration, prepayment, put options and call options. We

also estimate the impact on fair value based on the net present value of cash flows using a representative set of likely

future interest rate scenarios. The assumptions used were as follows: an immediate increase of 100 basis points in

interest rates (which we believe represents a moderately adverse scenario and is approximately equal to the historical

annual volatility of interest rate movements for our intermediate-term available-for-sale debt securities) and an

immediate decrease of 25% in prices for domestic equity securities.

Based on our overall exposure to interest rate risk and equity price risk, we believe that these changes in market rates

and prices would not materially affect our consolidated near-term financial position, results of operations or cash

flows as of December 31, 2008.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flows

Generally, we meet our operating cash requirements by maintaining appropriate levels of liquidity in our investment

portfolio and using overall cash flows from premiums, deposits and income received on investments. We monitor

the duration of our portfolio of debt securities (which is highly marketable) and mortgage loans, and execute

purchases and sales of these investments with the objective of having adequate funds available to satisfy our

maturing liabilities. Overall cash flows are used primarily for claim and benefit payments, operating expenses and

share repurchases.

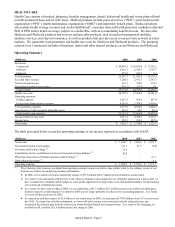

Presented in the following table is a condensed statement of cash flows for the years ended December 31, 2008, 2007

and 2006. We present net cash flows used for operating activities of continuing operations and net cash flows

provided by investing activities separately for our Large Case Pensions segment because changes in the insurance

reserves for the Large Case Pensions segment (which are reported as cash used for operating activities) are funded

from the sale of investments (which are reported as cash provided by investing activities). Refer to the Consolidated

Statements of Cash Flows on page 47 for additional information.