Aetna 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

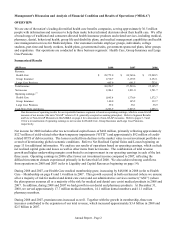

HEALTH CARE

Health Care consists of medical, pharmacy benefits management, dental, behavioral health and vision plans offered

on both an Insured basis and an ASC basis. Medical products include point-of-service (“POS”), preferred provider

organization (“PPO”), health maintenance organization (“HMO”) and indemnity benefit plans. Medical products

also include health savings accounts and Aetna HealthFund®, consumer-directed health plans that combine traditional

POS or PPO and/or dental coverage, subject to a deductible, with an accumulating benefit account. We also offer

Medicare and Medicaid products and services and specialty products, such as medical management and data

analytics services, and stop loss insurance, as well as products that provide access to our provider network in select

markets. We separately track premiums and health care costs for Medicare and Medicaid products. The grouping

referred to as Commercial includes all medical, dental and other insured products, except Medicare and Medicaid.

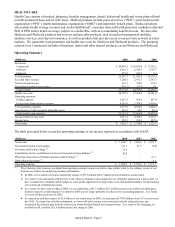

Operating Summary

(Millions) 2008 2007 2006

Premiums:

Commercial 20,096.2$ 18,656.8$ 17,356.5$

Medicare 4,816.1 2,598.3 1,787.7

Medicaid 595.0 245.0 9.3

Total premiums 25,507.3 21,500.1 19,153.5

Fees and other revenue 3,202.6 2,931.3 2,743.7

Net investment income 341.3 370.9 334.2

Net realized capital (losses) gains (276.2) (33.7) 9.1

Total revenue 28,775.0 24,768.6 22,240.5

Health care costs 20,785.5 17,294.8 15,301.0

Operating expenses:

Selling expenses 1,055.2 966.6 867.4

General and administrative expenses 4,281.8 3,708.3 3,618.6

Total operating expenses 5,337.0 4,674.9 4,486.0

Amortization of other acquired intangible assets 101.3 90.7 80.4

Total benefits and expenses 26,223.8 22,060.4 19,867.4

Income before income taxes 2,551.2 2,708.2 2,373.1

Income taxes 924.5 959.2 847.6

Net income 1,626.7$ 1,749.0$ 1,525.5$

The table presented below reconciles operating earnings to net income reported in accordance with GAAP:

(Millions) 2008 2007 2006

Net income 1,626.7$ 1,749.0$ 1,525.5$

Net realized capital losses (gains) 213.1 21.9 (8.0)

Severance and facility charge

(1)

35.6 - -

Contribution for the establishment of an out-of-network pricing database

(1)

20.0 - -

Physician class action settlement insurance-related charge

(1)

- - 47.1

Debt refinancing charge

(1)

- - 8.1

Operating earnings 1,895.4$ 1,770.9$ 1,572.7$

(1) The following other items are excluded from operating earnings because we believe they neither relate to the ordinary course of our

business nor reflect our underlying business performance:

• In 2008, we recorded a severance and facility charge of $35.6 million ($54.7 million pretax) related to actions taken.

• As a result of our agreement with the New York Attorney General to discontinue the use of Ingenix databases at a future date, we

have committed to contribute $20.0 million to a non-profit organization to help create a new independent database for determining

out-of-network reimbursement rates.

• As a result of a trial court’ s ruling in 2006, we concluded that a $47.1 million ($72.4 million pretax) receivable from third party

insurers related to certain litigation we settled in 2003 was no longer probable of collection for accounting purposes. As a result,

we wrote-off this receivable in 2006.

• In connection with the issuance of $2.0 billion of our senior notes in 2006, we redeemed all $700 million of our 8.5% senior notes

due 2041. In connection with this redemption, we wrote-off debt issuance costs associated with the redeemed notes and

recognized the deferred gain from the interest rate swaps that had hedged the redeemed notes. As a result of the foregoing, we

recorded an $8.1 million ($12.4 million pretax) net charge in 2006.

Annual Report - Page 5