Aetna 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

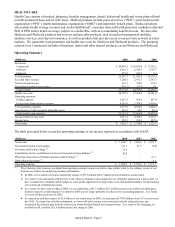

The operating summary for Large Case Pensions on page 10 includes revenues and expenses related to our

discontinued products with the exception of net realized capital gains and losses which are recorded as part of

current and future benefits. Since we established a reserve for future losses on discontinued products, as long as our

expected future losses remain consistent with prior projections, the operating results of our discontinued products are

applied against the reserve and do not impact operating earnings or net income for Large Case Pensions. However,

if actual or expected future losses are greater than we currently estimate, we may have to increase the reserve, which

could adversely impact net income. If actual or expected future losses are less than we currently estimate, we may

have to decrease the reserve, which could favorably impact net income. In those cases, we disclose such adjustment

separately in the operating summary.

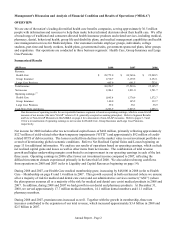

The activity in the reserve for anticipated future losses on discontinued products in 2008, 2007 and 2006 was as

follows:

(Millions) 2008 2007 2006

Reserve, beginning of period 1,052.3$ 1,061.1$ 1,052.2$

Operating (loss) income (93.4) 28.5 85.7

Net realized capital (losses) gains (124.7) 27.0 38.6

Reserve reduction (43.8) (64.3) (115.4)

Reserve, end of period 790.4$ 1,052.3$ 1,061.1$

During 2008, our discontinued products reflected an operating loss and net realized capital losses, both attributable

to the unfavorable investment conditions that existed in the latter half of 2008. The operating loss in 2008 reflects

lower net investment income than we experienced in 2007, primarily related to alternative investments. Net realized

capital losses in 2008 are comprised substantially of OTTI of debt securities, a majority of which are yield-related

and were caused by the widening of credit spreads relative to the interest rates on U.S. Treasury securities in 2008.

Accounting guidance requires us to recognize OTTI on these securities in order to maintain our flexibility in

managing this portfolio; however, these securities continue to perform and are generating investment income to

support the cash flows of our discontinued products. We have evaluated the operating losses and the yield-related

OTTI in 2008 against our expectations of future cash flows assumed in estimating the reserve and do not believe an

adjustment to the reserve is required at December 31, 2008.

Management reviews the adequacy of the discontinued products reserve quarterly and, as a result, $44 million ($29

million after tax), $64 million ($42 million after tax) and $115 million ($75 million after tax) was released in 2008,

2007 and 2006, respectively. The 2008 reserve reduction was primarily due to favorable mortality and retirement

experience compared to assumptions we previously made in estimating the reserve. The 2007 and 2006 reserve

reductions were primarily due to favorable investment performance and favorable mortality and retirement

experience compared to assumptions we previously made in estimating the reserve. The current reserve reflects

management’ s best estimate of anticipated future losses.

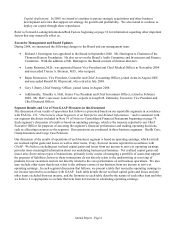

Assets Managed by Large Case Pensions

At December 31, 2008 and 2007, Large Case Pensions assets under management consisted of the following:

(Millions) 2008 2007

Assets under management:

(1)

Fully guaranteed discontinued products 3,840.2$ 4,225.1$

Experience-rated 4,226.8 4,554.3

Non-guaranteed

(2)

2,630.5 15,376.2

Total assets under management 10,697.5$ 24,155.6$

(1) Excludes net unrealized capital (losses) gains of ($111.2) million and $143.4 million at December 31, 2008 and 2007, respectively.

(2) In 2008, approximately $12.4 billion of our mortgage loan and real estate Separate Account assets transitioned out of our business.

Refer to Note 2 of Notes to Consolidated Financial Statements beginning on page 48 for additional information.

Annual Report - Page 11