Aetna 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report - Page 7

D.C. We have been a national provider of PDP since 2006. In 2007, we began offering Medicare Advantage PFFS

products in select markets for individuals and nationally for employer groups. Medicare Advantage PFFS

complements our PDP product, forming an integrated fully insured Medicare product nationwide. We intend to

continue providing each of our Medicare Advantage as well as our PDP products in 2009.

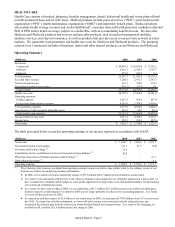

Medicare premiums increased approximately $2.2 billion in 2008, compared to 2007, and increased approximately

$811 million in 2007 compared to 2006. The increase in 2008 and 2007 primarily reflects the introduction of our

new PFFS product, which was effective January 1, 2007, including the conversion of a large customer’ s membership

from a Commercial ASC plan to a Medicare Insured plan in 2008. The increase in 2008 and 2007 was also due to

increases in premiums as a result of higher membership levels, rate increases from the Centers for Medicare &

Medicaid Services (“CMS”) and premium rate increases.

Our Medicare MBRs were 85.6% for 2008, 86.8% for 2007 and 85.2% for 2006. We had no significant development

of prior period health care cost estimates that affected results of operations in 2008, 2007 or 2006. The decrease in

our Medicare MBR in 2008 reflects a percentage increase in our per member premiums that outpaced the percentage

increase in per member health care costs. The increase in our Medicare MBR in 2007 compared to 2006 reflects a

change in our product mix as a result of the introduction of PFFS as well as a percentage increase in our per member

health care costs that outpaced the percentage increase in per member premiums. The increases in our per member

health care costs during 2007 were primarily due to increases in pharmaceutical costs.

Medicaid results for 2008 and 2007 reflect growth from the Schaller Anderson, Incorporated (“Schaller

Anderson”) acquisition.

Medicaid premiums increased approximately $350 million in 2008 compared to 2007 and increased approximately

$236 million in 2007 compared to 2006. These increases primarily reflect an increase in premiums as a result of our

acquisition of Schaller Anderson in July 2007. The Medicaid MBRs were 87.4% for 2008 and 88.4% for 2007 (the

2006 Medicaid MBR was not meaningful prior to the acquisition of Schaller Anderson). We had no significant

development of prior period health care cost estimates that affected results of operations in 2008 or 2007.

Other Sources of Revenue

Fees and other revenue for 2008 increased $271 million compared to 2007 and increased $188 million in 2007

compared to 2006, reflecting revenue from our recent acquisitions of Schaller Anderson and Goodhealth Worldwide

(Bermuda) Limited (“Goodhealth”) as well as growth in ASC membership.

Net investment income for 2008 decreased $30 million compared to 2007 primarily reflecting lower income from

alternative investments. Net investment income for 2007 increased $37 million compared to 2006, primarily

reflecting higher average asset levels and higher average yields on debt securities.

Net realized capital losses in 2008 and 2007 were due primarily to OTTI of debt securities (refer to our discussion of

Investments – Net Realized Capital Gains and Losses on page 13 for additional information).