Aetna 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

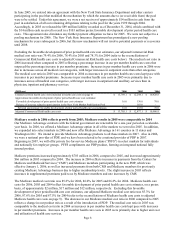

(Millions) 2006 2005 2004

Cash flows from operating activities

Health Care and Group Insurance

(1)

1,917.6$ 1,894.4$ 884.5$

Large Case Pensions (279.0) (242.9) (266.8)

Net cash provided by operating activities of continuing operations 1,638.6 1,651.5 617.7

Discontinued Operations 49.7 68.8 666.2

Net cash provided by operating activities 1,688.3 1,720.3 1,283.9

Cash flows from investing activities

Health Care and Group Insurance (931.3) (1,009.3) (546.1)

Large Case Pensions 378.0 299.2 613.5

Net cash (used for) provided by investing activities (553.3) (710.1) 67.4

Net cash used for financing activities (1,447.6) (1,213.6) (1,388.7)

Net decrease in cash and cash equivalents (312.6)$ (203.4)$ (37.4)$

(1) Includes corporate interest.

Cash flows provided by operating activities for Health Care and Group Insurance were approximately $1.9 billion

in 2006 and 2005, and $885 million in 2004. Included in these amounts were payments of approximately $245

million pretax in each of 2006 and 2005 and $555 million pretax in 2004 in voluntary contributions to our tax-

qualified pension plan. The cash flows from operating activities also reflect the receipt of approximately $50

million in 2006, $69 million in 2005 and $666 million in 2004 resulting from the completion of certain Internal

Revenue Service audits associated with businesses previously sold by our former parent company (refer to Note 21

of Notes to Consolidated Financial Statements on page 88 for additional information). The cash flows provided by

operating activities for 2005 also include payments of approximately $150 million pretax related to a prior year

class action lawsuit settlement.

As discussed in Note 3 of Notes to Consolidated Financial Statements beginning on page 57, during 2006 and 2005,

we spent $161 million and $1.2 billion ($1.1 billion after considering cash acquired) on acquisitions we expect to

enhance our existing product capabilities and future growth opportunities. This use of cash was reported as cash

flows used in investing activities.

We continually monitor existing and alternative financing sources to support our capital and liquidity needs,

including, but not limited to, debt issuance, preferred or common stock issuance and pledging or selling of assets.

During the period 2004 through 2006, we repurchased common stock under various repurchase programs

authorized by our Board. In 2006, we repurchased approximately 60 million shares of common stock at a cost of

$2.3 billion. In 2005, we repurchased approximately 42 million shares of common stock at a cost of $1.7 billion.

In 2004, we repurchased approximately 64 million shares of common stock at a cost of $1.5 billion. As of

December 31, 2006, we had authorization to repurchase up to $571 million of common stock under the remaining

Board authorization.

On September 29, 2006, our Board declared an annual cash dividend of $.04 per common share to shareholders of

record at the close of business on November 15, 2006. The dividend was paid on November 30, 2006. While our

Board reviews our common stock dividend annually, we currently intend to maintain an annual dividend of $.04 per

common share. Among the factors considered by our Board in determining the amount of the dividend are our

results of operations and the capital requirements, growth and other characteristics of our businesses.

In June 2006, we issued $2.0 billion of senior notes, comprised of $450 million of 5.75% senior notes due 2011,

$750 million of 6.0% senior notes due 2016 and $800 million of 6.625% senior notes due 2036. The proceeds from

these senior notes were used to redeem the entire $700 million aggregate principal amount of our 8.5% senior notes

due 2041 and to repay approximately $400 million of commercial paper borrowings, outstanding since the March 1,

2006 maturity of the entire $450 million aggregate principal amount of our 7.375% senior notes. The remainder of

the net proceeds raised were used for general corporate purposes, including share repurchases.

Page 18