Aetna 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net realized capital gains for 2006 were due primarily to gains on sales of debt securities, real estate and equity

securities partially offset by losses on the write-down of other investments and losses on futures contracts. Net

realized capital gains for 2005 reflect gains on sales of debt and equity securities as well as gains on futures

contracts. Net realized capital gains for 2004 reflect gains on sales of debt securities in a low interest rate

environment, receipt of mortgage loan equity participations, gain on the sale of a real estate investment and gains

from futures contracts.

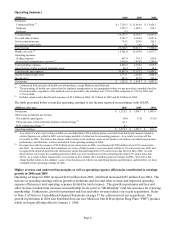

The activity in the reserve for anticipated future losses on discontinued products in 2006, 2005, and 2004

was as follows (pretax):

(Millions) 2006 2005 2004

Reserve for anticipated future losses on discontinued products, beginning of period 1,052.2$ 1,079.8$ 1,035.8$

Operating income (loss) 38.6 12.4 (6.6)

Net realized capital gains 38.6 22.0 37.5

Mortality and other 3.4 4.7 13.1

Tax benefits (1) 43.7 - -

Reserve reduction (115.4) (66.7) -

Reserve for anticipated future losses on discontinued products, end of period 1,061.1$ 1,052.2$ 1,079.8$

(1) Amount represents tax credits primarily from tax advantaged investments which were reclassified from deferred tax liabilities

within the liabilities supporting discontinued products.

Management reviews the adequacy of the discontinued products reserve quarterly and, as a result, $115 million ($75

million after tax) of the reserve was released in 2006 and $67 million ($43 million after tax) was released in 2005.

The 2006 and 2005 reserve releases were primarily due to favorable investment performance and favorable

mortality and retirement experience compared to assumptions we previously made in estimating the reserve. The

reserve was found to be adequate, and no release or charge was required during 2004. The current reserve reflects

management’ s best estimate of anticipated future losses.

Refer to Note 20 of Notes to Consolidated Financial Statements beginning on page 84 for additional information on the

assets and liabilities supporting discontinued products at December 31, 2006 and 2005 as well as a discussion of the

reserve for anticipated future losses on discontinued products.

CORPORATE INTEREST

Corporate interest expense represents interest incurred on our debt and is not recorded in our business segments.

After-tax interest expense was $96 million for 2006, $80 million for 2005 and $68 million for 2004. The increase in

interest expense for 2006 compared to 2005 was related to higher overall average long-term debt levels as a result of

our issuance of $2.0 billion in senior notes in 2006 and the sale of interest rate swap agreements in 2005. The

increase in interest expense for 2005 compared to 2004 was related to higher interest rates and the sale of the

interest rate swap agreements. Refer to Notes 13 and 15 of Notes to Consolidated Financial Statements beginning

on pages 75 and 76, respectively, for additional information.

INVESTMENTS

Investments disclosed in this section relate to our total portfolio (including assets supporting discontinued products

and experience-rated products). Refer to Note 8 of Notes to Consolidated Financial Statements beginning on page

60 for additional information on our investments.

Page 14