Aetna 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

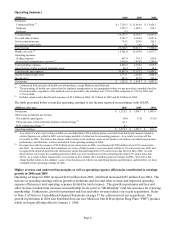

Operating Summary

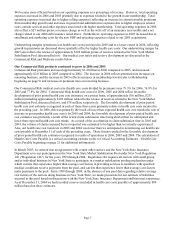

(Millions) 2006 2005 2004

Premiums 194.1$ 199.3$ 189.0$

Net investment income 536.4 514.9 526.3

Other revenue 11.0 11.5 11.9

Net realized capital gains 11.6 8.3 16.2

Total revenue 753.1 734.0 743.4

Current and future benefits 672.2 656.5 660.4

General and administrative expenses

(1)

17.0 18.1 19.9

Reduction of reserve for anticipated future losses on discontinued products (115.4) (66.7) -

Total benefits and expenses 573.8 607.9 680.3

Income before income taxes 179.3 126.1 63.1

Income taxes 56.7 44.1 21.3

Net income 122.6$ 82.0$ 41.8$

Assets under management:

(2)

Fully guaranteed discontinued products 4,352.3$ 4,466.9$ 4,584.2$

Experience-rated

(3)

4,752.7 4,268.1 4,509.4

Non-guaranteed

(4)

14,857.0 12,229.6 10,632.9

Total assets under management 23,962.0$ 20,964.6$ 19,726.5$

(1) Includes salaries and related benefit expenses of $13.7 million in 2006, $14.6 million in 2005 and $14.3 million in 2004.

(2) Excludes net unrealized capital gains of $200.2 million, $362.6 million and $558.8 million at December 31, 2006, 2005 and 2004,

respectively. Refer to Note 2 of Notes to Consolidated Financial Statements beginning on page 48 for information on expected future

reductions in these assets.

(3) The increase in experience-rated assets under management in 2006 primarily reflects additional deposits to fund guaranteed benefits.

(4) The increases in non-guaranteed assets under management in 2006 and 2005 primarily reflect additional deposits and investment

appreciation.

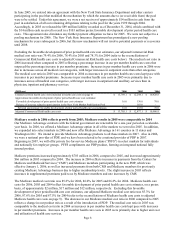

The table presented below reconciles operating earnings to net income reported in accordance with GAAP:

(Millions) 2006 2005 2004

Net income 122.6$ 82.0$ 41.8$

Other items included in net income:

Net realized capital gains (8.7) (5.4) (10.5)

Reduction of reserve for anticipated future losses on discontinued products

(1)

(75.0) (43.4) -

Operating earnings 38.9$ 33.2$ 31.3$

(1) In 1993, we discontinued the sale of our fully guaranteed large case pension products and established a reserve for anticipated future

losses on these products, which we review quarterly. Changes in this reserve are recognized when deemed appropriate. We reduced the

reserve for anticipated future losses on discontinued products by $75.0 million ($115.4 million pretax) in 2006 and $43.4 million ($66.7

million pretax) in 2005. There was no reserve release or charge in 2004. We believe excluding any changes to the reserve for anticipated

future losses on discontinued products provides more useful information as to our continuing products and is consistent with the

treatment of the results of operations of these discontinued products, which are credited/charged to the reserve and do not affect our

results of operations.

Operating earnings in 2006 increased $6 million compared to 2005, and increased $2 million in 2005 compared to

2004. The increase in operating earnings in 2006 reflects an increase in net investment income in continuing

products primarily due to higher income from the receipt of mortgage loan equity participation income, higher

yields and higher limited partnership income. The increase in operating earnings in 2005 reflects favorable

experience related to a run-off product. Large Case Pensions’ operating earnings are expected to decline in the

future in keeping with the run-off nature of the business.

The reductions of the reserve for anticipated future losses on discontinued products in 2006 and 2005 were

primarily due to favorable investment performance and favorable mortality and retirement experience compared to

assumptions we previously made in estimating the reserve.

Page 12