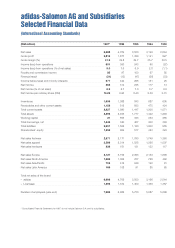

Adidas 1997 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1997 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Currency erosion in several Asian countries

during the last quarter of 1997

had virtually

no impact on the improvement of

gross

margin. Although adidas sources about 95%

of footwear and around 60% of apparel in

countries in South-East Asia and most prod-

ucts are purchased from suppliers in US

dollar, there are a number of reasons why the

effect of the currency crisis has not been

experienced in 1997:

(1) FOB prices for products purchased in the

fourth quarter are typically negotiated in

the second quarter;

(2) most of the suppliers’ raw materials costs

are priced in US dollar or other major cur-

rencies and

(3) a significant portion of adidas production

is carried out in countries which did not

experience major devaluations e.g. China.

It should also be remembered that, apart

from price, adidas’ sourcing policy includes

other selection parameters for factories such

as product quality, adherence to delivery

deadlines and acceptable transportation dis-

tances. In order to find the best possible

compromise between the different require-

ments, adidas pursues a long-term sourcing

strategy. One of the key aspects of this strat-

egy is to establish long-term ties

with manu-

facturers which have a track record

of deliver-

ing the high quality required by adidas. Such

a policy therefore also involves not always

taking advantage of every short-term price

spread offered by countries with strongly

depreciated currencies. However, Manage-

ment expects to see some positive effect on

FOB prices in 1998 as a result of both the

Asian currency position and adidas’ strength-

ening order book.

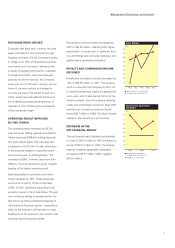

EXCELLENT SALES LEVELS

REACHED WITH APPAREL

In 1997, adidas again achieved higher growth

rates with apparel than with footwear. Net

sales of apparel grew by 55%, reaching

DM 3,586 million and increasing this divi-

sion’s share of total company sales to 54%,

almost five percentage points up on 1996.

The all-purpose category remained the largest

product category in apparel, representing

around two thirds of total apparel sales. The

lifestyle and workout categories made an

even more substantial contribution to sales

growth in relative terms, with above-average

growth rates. Sales of soccer apparel re-

mained at the previous year’s high level.

GROWTH ALSO ACHIEVED

IN HARDWARE AND OTHER SALES

Hardware and other sales, which consist

mainly of

bags, balls and accessories, in-

creased

by 7% to DM 241 million in 1997,

resulting in a slight decrease in this division’s

share of total sales to 3.6% (1996: 4.8%).

GROSS PROFIT IMPROVED,

SOURCING COSTS UNDER CONTROL

Gross profit improved by 49.7%, growing

at a faster rate than sales and reaching

DM 2,810 million. As a result, gross margin

as a percentage of net sales increased by

over two percentage points to 41.9% in 1997.

This success was due to careful choice of

manufacturers, cost-oriented negotiations with

suppliers and continuing tight control of other

sourcing costs. Additionally, this development

was positively influenced by the fact that ap-

parel sales generated higher growth rates,

thus increasing its share of total company

sales. The appar

el business traditionally

has

higher margins than the footwear business.

Shares of Net Sales Apparel

(Categories in % of net sales apparel)

Others 6.6

Workout 5.8

Lifestyle 7.7

Soccer 14.0

All-purpose 65.9

n

n

n

n

n

1993 1994 1995 1996 1997

Net Sales Apparel

(Change year-over-year in %)

60

50

40

30

20

10

0

– 10

n

n

n

n

n