Adidas 1997 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1997 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

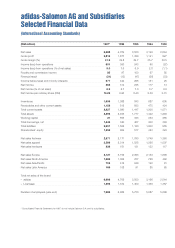

Change

year-over-

DM m year

Total net sales 169 +55.3%

of which

Footwear 136 +51.4%

Apparel 21 +179.6%

Gross margin 33.3% –1 PP

Change

year-over-

DM m year

Total net sales 703 +69.0%

of which

Footwear 320 +48.9%

Apparel 325 +84.8%

Gross margin 40.9% +2.8 PP

10

Further contributions to this success also

came from the tennis and soccer categories,

as well as the kids’ and women’s segments.

After an initially weak

sales performance at the

begin

ning of the year, the basketball category

picked up momentum, primarily driven by

Kobe Bryant’s signature shoe – the KB8.

Its launch in November was followed by

remarkably high sell-through rates at retailers.

Net sales of apparel increased by 91%, out-

performing growth in footwear sales. At

DM 834 million, apparel generated almost

50% of total sales. The stron

gest growth in

apparel was seen in the segments for women

and for kids aged 8 – 20, both of which in-

creased by around 150%.

Signings with the National Football League

(NFL), the New York Yankees, America’s

best-known baseball team, the Universities of

Notre Dame, Tennessee and Northwestern

in the college sport sector, as well as with a

number of young basketball players, will

make

adidas more visible in North America. This

huge commitment to promotion and the

associated media expenditure puts adidas in

a good position to increase brand visibility

and continue to expand market share in the

North American market.

ASIA/PACIFIC PERFORMED WELL

DESPITE CURRENCY CRISIS

Despite the Asian currency crisis triggered

by the floating of the Thai baht on July 2,

1997, net sales in the region increased by

69% to DM 703 million in 1997, with signifi-

cant contributions to the growth in net sales

coming from the inclusion of the first full-year

effect of the joint venture company in South

Korea and the subsidiary in Taiwan. Exclud-

ing the effects of new companies, net sales

in Asia increased by 38%.

Apparel was the major growth driver for

adidas, increasing by 85% to DM 325 mil-

lion. In footwear, net sales grew by 49% to

DM 320 million, primarily driven by the run-

ning and all-purpose categories.

Top performing countries included New Zea-

land (+79%), Australia (+53%) and the Philip-

pines (+46%), an indication of the success to

be achieved via the strategy of establish

ing

wholly or majority-owned subsidiaries, as

implemented in these countries in 1995 and

1996.

In Japan, one of Asia’s key markets, adidas

was still represented solely by licensees. Sales

under license in Japan in 1997 decreased

by 8%. Royalty income, however, remained

stable

. Upon expiry of the major license

agree-

ment at the end of 1998, adidas will have a

fully-controlled sales organization in Japan

from 1999 onward. This should enable adidas

to market the adidas products and pursue

brand objectives more effectively in Japan.

In 1998, adidas will make use of the new NBA

star Kobe Bryant and major international

sports events, such as the Olympic Winter

Games in Nagano/Japan, the Soccer World

Cup in France, the Commonwealth Games

and the Asian Games, in order to further

strengthen the brand image in the region. All

these events will be accompanied by the as-

sociated advertising and promotion activities.

Despite the anticipated negative impact on

sales figures as a result of the Asian currency

crisis and the related increasing pressure on

margins, in 1998 adidas management is

aiming to achieve the same level of net sales

as in 1997. This aim is supported by the fact

that the economic crisis is not showing any

appreciable effects in several of adidas’ key

countries in the Asia/Pacific region, such as

Australia, New Zealand or Hong Kong.

Asia/Pacific

Latin America