Adidas 1997 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1997 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

ACQUISITION OF SALOMON IMPACTS

BALANCE SHEET: SUBSTANTIAL

INCREASE IN NON-CURRENT ASSETS

AND LIABILITIES

The acquisition of the Salomon family holding

company at the end of December had a sig-

nificant impact on the balance sheet for the

fiscal year ended 1997. In a first step, adidas

acquired 100% of the share capital of Sport

Développement S.C.A. (the former Salomon

family holding company, now re-named

adidas Salomon France S.A.), a French com-

pany registered in Annecy, France. This com-

pany held 56% of the voting rights and

39%

of the capital of Salomon S.A. and was

purchased for a total acquisition cost

of

DM 942 million. The growth

in non-current

assets, which rose by DM 1,001 million to

DM 1,467 million, is therefore almost solely

the result of the increase in investments,

which in turn resulted from the acquisition of

the Salomon family holding company.

These effects are correspondingly reflected in

the growth in liabilities. As the acquisition of

the family holding company was funded by

using and increasing the amounts available

under existing credit lines, there was also

a significant rise in short-term borrowings,

which increased by a total of DM 1,059 mil-

lion to DM 1,525 million.

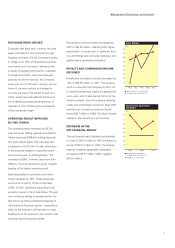

As a result of the 100% debt-financing of the

acquisition of the Salomon family holding

company, financial leverage increased from

38% in 1996 to 107% in 1997.

adidas has cash credit lines amounting to

DM 5.8 billion. As of December 31, 1997 un-

used cash credit lines amounted to DM 4.2

billion. An amount of approximately DM 1.5

billion was subsequently used to complete the

acquisition of Salomon S.A. through the public

tender offer in February. Remaining unused

cash credit lines will be sufficient to fund

increasing product purchase requirements.

DECREASE IN OPERATING

CASH FLOW –

AS A RESULT OF

HIGHER TAX PAYMENTS

Operating cash flow totalled DM 78 million,

which is DM 123 million below the previous

year’s level. This decrease is primarily the

result of a DM 92 million increase in tax pay-

ments and increased inventory levels to sup-

port expected growth in 1998.

OUTLOOK

BACKLOG INCREASED BY

MORE THAN 50%

Orders on hand at the end of 1997 amounted

to DM 3,172 million, which represents an

increase of 56% or DM 1,136 million com-

pared to the end of 1996. Order backlog is

an indication of sales development to be an-

ticipated for the first six months of 1998, as the

order volume covers the 1998 spring/summer

season. However, the order volume only

comprises the 13 largest subsidiaries of

adidas – excluding South Korea – which

account for approximately two thirds of

adidas’ total business. Variation in sales mix

as well as reorders and/or cancellations

could still change the order profile to some

extent going into the spring/summer season.

The increase in order volume was led by North

America, which showed growth of 101%,

followed by Europe with 35%. Due to the

uncertain economic development, figures for

Asia are less reliable. adidas expects, never-

theless, a modest growth in order volume for

the first six months of 1998.

In Region Europe, the strongest backlog

growth was seen in Spain with 121%. The

U.K., Italy, Switzerland, France and Norway

all showed backlog growth of more than 25%

compared to 1996.

1993 1994 1995 1996 1997

Financial Leverage

(%)

100

90

80

70

60

50

40

30

20

10

nNet borrowings divided by

shareholders’ equity

n

n

nn

n